An overview of commercial aviation in the Russian Far East

Rossyia Airlines, a subsidiary of Aeroflot, maintains the vital long-haul links between Moscow and several cities in the Russian Far East with a mix of Boeing 777s and Boeing 747s

Aviation in the Russian Far East gears up for an upgrade

Rather than a clearly defined administrative entity, when Russians talk of their country’s Far East they usually refer to a loosely defined area that stretches from the Bering Straits, barely a few miles off Alaska’s coast, all the way to the Eastern shores of Lake Baikal.

This is a vast, sparsely populated region, teeming with wildlife and rich in natural resources, but where transportation options are few and far between.

Just as it happens in Alaska or in the Canadian North, aviation plays an essential role here, connecting isolated settlements to a handful of regional hubs such as Khabarovsk, Vladivostok, Yuzhno-Sakhalinsk, Petropavlovsk-Kamchatsky.

These regional centers are, in turn, linked to Moscow by daily nonstop flights, a vital lifeline to the country’s far-flung capital.

A Rossiya Airlines Boeing 777 at Yuzhno-Sakhalinsk airport (UUS)

Although domestic traffic is still the bread and butter Russia’s Far East airports, these are also turning their attention towards the buzzing metropolises of Japan, Korea and China.

The recent introduction to a simplified e-visa scheme for citizens of eighteen (mostly) Asian countries entering Russia through its Far Eastern gateways is but the latest of the initiatives aimed at drawing tourism and investment to the region.

Whether these schemes are going to succeed in breaking the traditional isolation of this part of the World remains to be seen. What is hardly in doubt is that, one way or another, the economic prosperity of Russia’s Far East is inextricably linked to the fortunes of the commercial aviation industry. But what are the prospects?

Build it and they will come?

Have a look at any flight tracking site and you will see how the skies above Russia’s Far East are busy with traffic. Two major air corridors go over it, one in a Northwesterly direction, channeling flights from Japan and Korea onto Europe and the other North-Eastwards, the main trunk route between East Asia and North America.

Yet, very few international flights call at the regions’ airports.

In fact, its four top airports show rather modest traffic flows, only two of them are above the 2M annual passenger mark, Vladivostok (VVO) with 2.1M pax per year and Khabarovsk (KHV) which is just above 2M. Lesser local hubs are below one million: Yuzhno-Sakhalinsk (UUS), 985k and Petropavlovsk-Kamchatsky (PKC) 620k (all figures are end of year 2017).

Window view of Yuzhno-Sakhalinsk airport, with the new terminal, under construction, clearly visible

Yet, a wave of investment is sweeping through the regions’ airports with the aim of bringing these numbers up.

Singaporean investment

Two years ago Vladivostok International, an airport that had already seen significant renovation work, including a new terminal, ahead of the 2012 APEC Russia Summit, was purchased by a three-member consortium made of Singapore Changi Airport, Basel Aero (an airport management firm controlled by Russian oligarch Deripaska), and the Russian Direct Investment Fund.

The stated aim of these investors is to turn VVO into the Eastern gateway to Russia.

Has this goal met with success? Perhaps it is a bit too early to tell.

The first signs are encouraging, though, with VVO experiencing a solid 17.5% passenger numbers growth in 2017, an increase that took it above the 2 million passengers mark for the first time ever and a first step towards the long term 5 million passengers per year goal.

The vision, outlined on a pre-acquisition strategy document available on the airport’s website, of a route network that stretches as far as the US West Coast, Singapore, Indonesia and Australia hasn’t materialized, though, and nothing indicated that it will happen in the short term.

But Vladivostok is far from being the only airport with ambitious growth plans, other airports in the region are also playing catch up and significant infrastructure upgrades are either under way or at an advanced planning stage.

Island hub in the making

A recent trip to the Sakhalin, Russia’s largest island, whose Southern tip is barely 30 miles off the coast of Japan, gave us the chance to observe how at Yuzhno-Sakhalinsk airport (UUS), a brand new airport terminal is already taking shape next to the current one.

This US$117M greenfield facility, that is due to enter service later this year, will be a much welcome improvement, since the current terminal at UUS is nothing to write home about.

Arrivals area at Yuzhno-Sakhalinsk airport. The new terminal is taking shape next door.

The arrivals hall is a rather basic affair, a little room that gets incredibly crowded right after the arrival of a full Boeing 777. Taxi drivers and relatives of the recently arrived passengers crowd the outside the entrance, separated from the baggage belts by a simple ordinary door.

Peak hour at Yuzhno-Sakhalinsk airport: shortly after the arrival of the Rossiya daily Moscow flight, the outside of the terminal filled with cars of people coming to pick up their friends and relatives

The departure can also be quite an experience, with an interior that still feels quite Soviet in design and appearance, more reminiscent of a 1980s bus station than to the glass and steel airport terminals most travelers are used to today.

Little has changed since Soviet times inside the departures hall at Yuzhno-Sakhalinsk airport. This building will soon be replaced by a state-of-theart new terminal, though.

The tiled columns that interspersed its interior, however, hold a surprise for the aviation enthusiast: a collection of pictures with all sorts of Russian-made aircraft. The overall aesthetic is a quite dated, but I don’t think any self-respecting avgeek would object!

An airport with a view

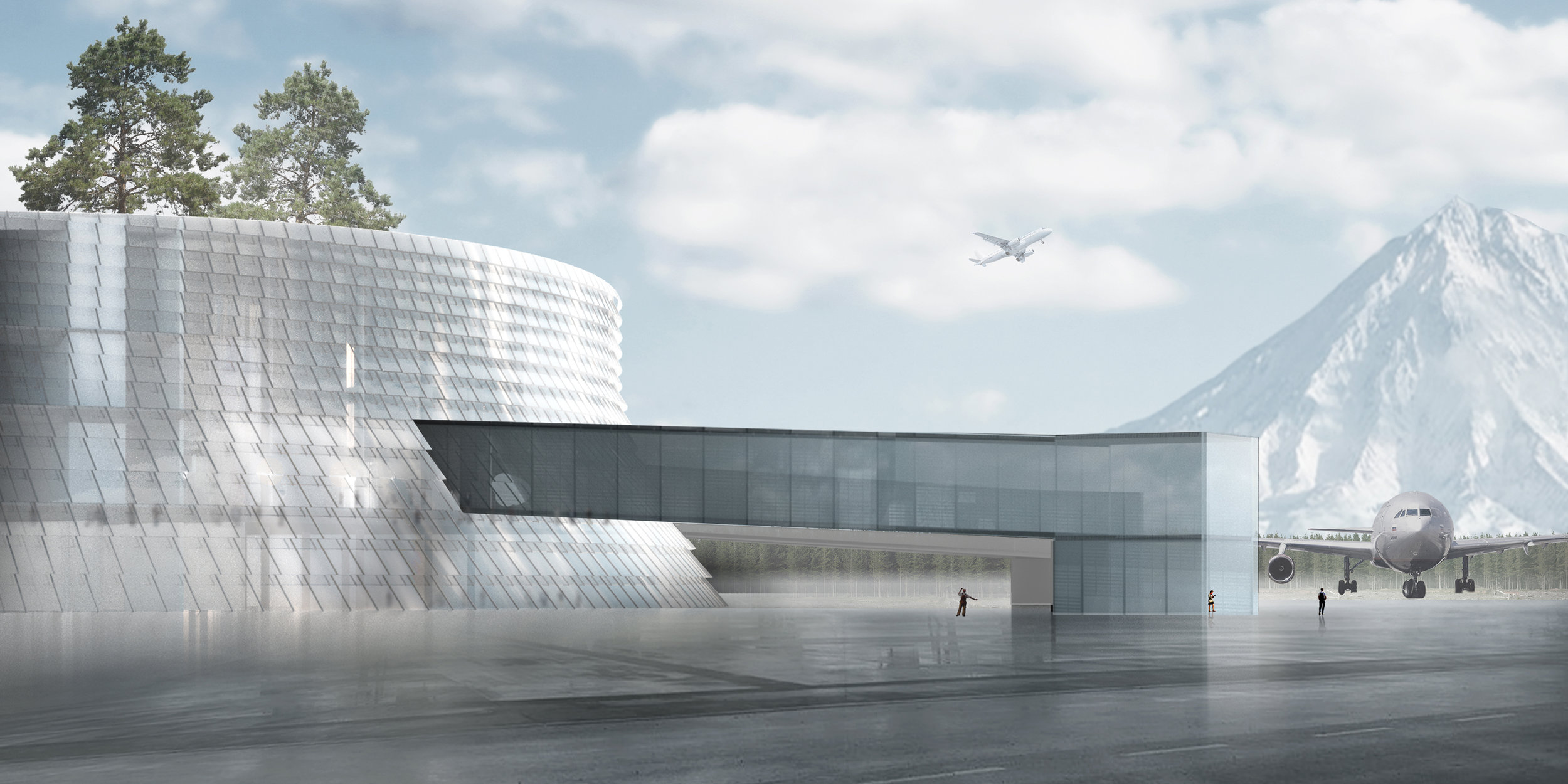

The projected new terminal at Elizovo airport, Petropavlovsk-Kamchatsky. Picture: Airport of the Regions

A bit further North, Elizovo airport in Petropavlovsk-Kamchatsky (PKC), is the gateway to the Kamchatka Peninsula, famous for its volcanoes, bears and abundant salmon fishing.

This remote corner of Russia may not have the busiest of airports, but its majestic views of snowy volcanoes are hard to beat.

Kamchatka is emerging as a popular destination for all sort of outdoor activities and nature-related tourism and although arrival numbers are still low in absolute numbers (it received nearly 200,000 visitors overall in 2017), it has been experiencing double digit growth, with the number of foreign visitors doubling over the course of 2017.

Some of these certainly arriving in the rather unique nonstop flight from Anchorage, Alaska, the shortest scheduled air link between the US and Russia. This highly seasonal service, runs weekly between mid-July and September. Tickets are commercialized by a Seattle-based tour operator under the brand “Air Russia”, however the flight itself is operated by Russian airline Yakutia Airlines, with a Boeing 737-800. The same company operates also a seasonal flight between Petropavlovsk and Japan, although with less frequencies.

Airport renovation at Elizovo, Kamchatka, will be accompanied by some tourism infrastructure, such as a new hotel next to the airport. Picture: Airports of the Regions

Come 2021, the growing number of tourists arriving to Kamchatka will be able to use a new terminal of contemporary design, complete with its own hotel complex.

How the projected new hotel at Petropavlovsk-Kamchatsky airport is going to look like. Picture: Airports of the Regions

Work on the new facility was started in 2018 by Airport of the Regions, a company that already manages a handful of other airports throughout Russia.

A hub on the Amur river

For a big chunk of its length, the Amur river demarcates the border between Russia and China. Located right on its banks, Khabarovsk, the historical capital of the Russian Far East (it lost this distinction to Vladivostok in late 2018) is also hurrying with its plans to provide its airport with an entirely new terminal.

The project has not been without some issues, as the Japanese company that was expected to participate in the project suddenly withdrew in early 2018 due to disagreements with the Russian side.

However, construction has gone ahead with the participation of Turkish construction companies. And the project is now well under way.

Foreign airlines have increased their presence

It remains to be seen whether all this amount of investment in the region’s airports will be enough to entice more foreign airlines to launch new routes to the Russian Far East.

At the moment it is Korean airlines that are the most active foreign players across Russia’s Far East.

In particular Asiana links nonstop Vladivostok, Khabarovsk and Yuzhno-Sakhalinsk to Seoul-Incheon.

But other Korean operators have also a presence throughout the region, particularly at Vladivostok, with Korean Airlines, Air Busan, Eastar, Jeju Air and T’Way operating regular scheduled flights to the port city, with T’Way also flying to Khabarovsk.

And, the air links are not constrained to South Korea...as a curiosity, Vladivostok is one of the few airports in the World to feature on the route network of Air Koryo, North Korea’s national airline.

Spot the only foreign airline? Departures board at Yuzhno-Sakhalinsk airport

Russian airlines dominate the market

The larger driver of traffic in the region, though, both on domestic and international markets, will continue to be Russian airlines.

The demise, in 2015, of Transaero, back then Russia’s second largest airline and one that had a strong presence in these markets, proved to be just a momentary lull.

Fast forward to today, though, and the gap left by Transaero has been filled by Aeroflot and its subsidiaries, as well as several other private Russian carriers.

Rossiya, an airline that is 100% owned by Aeroflot, took over some of Transaero’s Boeing 747s and Boeing 777s, to become the primary operator on routes linking the Far East with Moscow and St. Petersburg.

Not content with that, but Rossiya continued also some of Transaero’s non-aeronautical activities in the region, such as its sponsorship of preservation efforts to save the Amur tiger and leopard, two extremely endangered feline species that are endemic of the Russian Far East. Just as Transaero did back in its day, the front of one of Rossiya’s Boeing 747s was painted like the face of an Amur tiger, while a Boeing 777 was later painted the same way, but on this occasion with a leopard face.

Routes between the Far East and Moscow and St. Petersburg are considered of national interest, therefore certain categories of passengers can benefit from subsidised fares. These fares are, in principle, restricted to Russian citizens that meet certain conditions, but, in parallel, Aeroflot runs its own “flat fare” programme on these routes, that is open to all travelers. This means that, at least in the low season, it is possible to fly the 8,000nm return trip from Moscow for less than $300. These fares, though, apply only to return trips, so they do not really help those that wish to set out on an itinerary through the region.

Aeroflot is, thus, the main player in the region, not only with its long haul flights from the European part of Russia, but also through its 51% ownership of Aurora, the main intra-regional operator.

Aurora was formed in 2014 out of the merger of Vladivostok Avia (one of the “Baby Flots” that emerged after the demise of the Soviet Union, subsequently reunited with Aeroflot) and SAT (controlled by the regional government of Sakhalin).

Just outside Yuzhno-Sakhalinsk airport, an Antonov An-24 in the livery of local airline SAT, now part of Aurora (Aeroflot Group)

The airline links several destinations throughout the region from its 3 bases (Yuzhno-Sakhalinsk, Vladivostok and Khabarovsk) operating a fleet of 10 Airbus A319 and an equal number of turboprops (Bombardier Dash 8 Q200, Q300, Q400 and de Havilland Canada DHC-6).

Aurora has also a notable international network, connecting its three hubs to a number of destinations in Japan (Tokyo-Narita, Sapporo, Osaka), Korea (Seoul-Incheon, Busan), China (Beijing, Harbin, Mudanjiang) and Hong Kong.

Aurora uses Bombardier Dash turboprops to link Yuzhno-Sakhalinsk to several smaller outlying islands

But, as dominant as it may be, the Aeroflot Group is far from being the only player in this market. The Far East features also in the expansion plans of a bunch of other Russian airlines.

In the case of S7, currently Russia’s second airline by size and its largest private carrier, has also a noticeable presence in Vladivostok, connecting it not only to the other major regional centers and also to destinations in Asia such as Shanghai, Beijing, Hong Kong, Bangkok, Tokyo and Seoul.

Passengers at Yuzhno-Sakhalinsk can enjoy the majestic landscapes this island has to offer. In the foreground an S7 A320 preparing to depart for Vladivostok, in the mainland

In addition to this, the Far Eastern destinations provide an additional vector of expansion for its developing Siberian hub in Novosibirsk. The rationale for this hub is that it provides a mid-way stopover point between Europe and, both, East and Central Asia.

Ural Airlines, Russia’s third largest airline provides another way to reach the Far East via its own hub in Ekaterinburg, in the Urals and also links Vladivostok to destinations such as Beijing, Sapporo and Bangkok.

At this point it is still unclear whether the announcement made by Aeroflot that it will start opening a new regional bases in Novosibirsk, Ekaterinburg will mean adding capacity from these airports to and from the Far East and how this may affect S7 and Ural Airlines.

Other airlines have also shown an interest in potential of Russia’s Far East.

Yakutia Airlines, a regional airline based in Yakutsk, in the Republic of Sakha (also known as Yakutia) deep in Eastern Siberia has announced that, as a reaction to increased competition in its Westward markets, it will focus its growth Eastwards, although no specific plans in this direction have been announced yet.

Another Siberian regional carrier attempting to set a foothold in the region is irAero, that was operating between Vladivostok and Moscow and between Vladivostok and several leisure destinations in South-East Asia. However, this airline, which is based in Irkutsk, near the shores of Lake Baikal, has ended up folding its scheduled Boeing 777 operation, due to disagreements and issues with its Chinese partners.

Leisure market: a two-way street?

The leisure market is likely to continue being one of the main drivers for international traffic to and from the region.

For the time being, though, this is mostly of Russian passengers traveling to warm destinations such as Thailand and Sanya (Hainan).

This is a market that has been traditionally serviced by Russian airlines, often through charter and seasonal flights.

Although some foreign carrier, such as Philippine Airlines, have also made some incursions, for example, by operating, at times, seasonal services to both Vladivostok and Khabarovsk.

And there is, of course, the Chinese market, whose huge potential as a source of tourists for the Russian Far East has hardly been tapped...

Tourist flows are hardly a one way lane, though, and there is a chance that the combination of better infrastructure, easier access and a growing middle class in Asian countries eager to explore new tourist destinations will stimulate a Northward tourist traffic in the coming years.