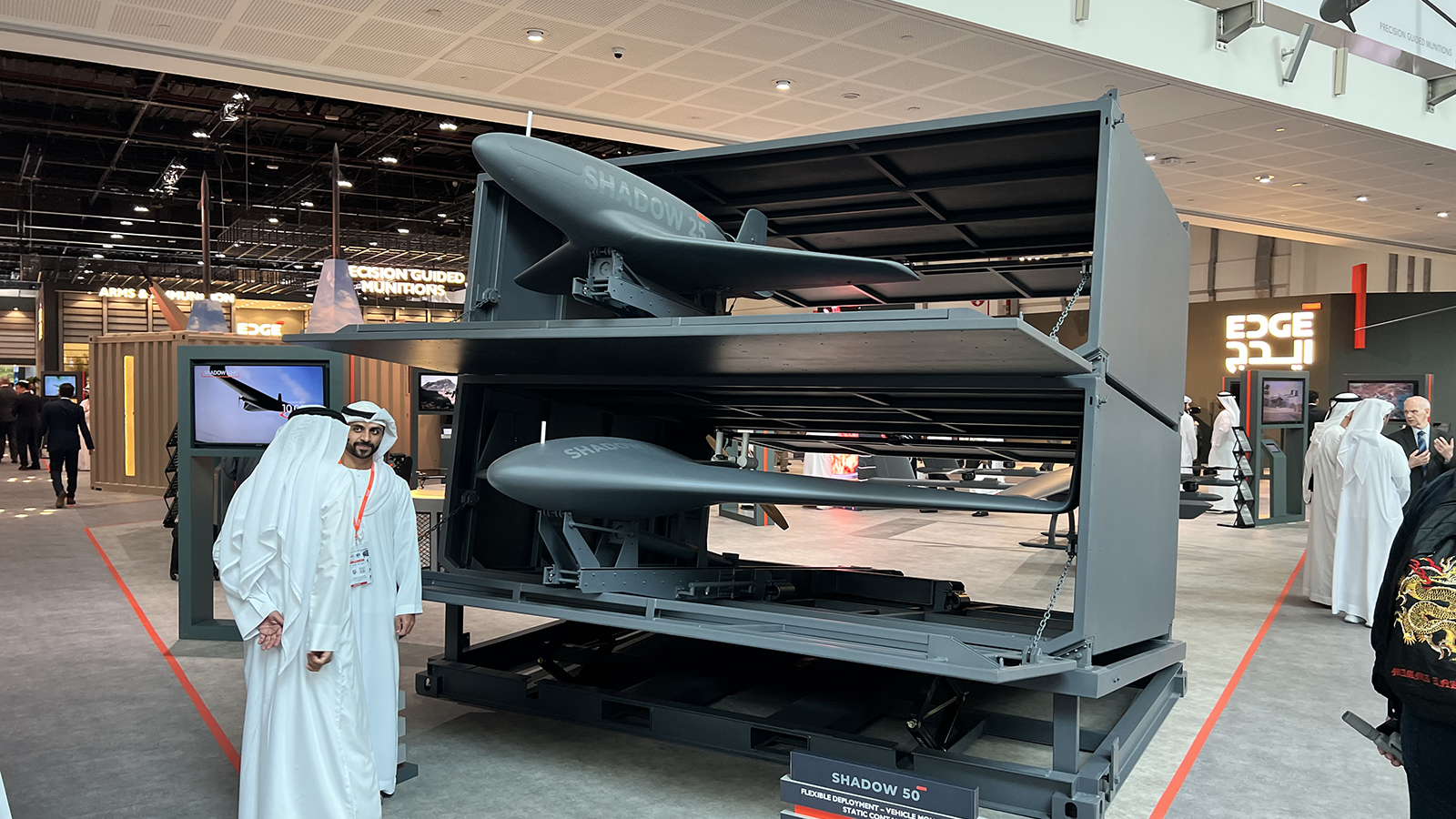

EDGE Group shows off some unmanned aerial vehicles at the IDEX defense expo in Abu Dhabi in 2023. (Breaking Defense)

BEIRUT — For a relatively small nation in a region that’s not yet known for its military industry, the United Arab Emirates lately has been making a name for itself on the global stage, with Emirati companies and organizations inking defense deals and partnerships half a world away.

And though some of those arrangements are in their infancy, analysts told Breaking Defense that Emirati firms so far have managed to expand their reach well beyond the Gulf by choosing their spots — geographically and technologically.

“Where there is a gap, it appears the UAE is trying to fill the requirement by looking at market dynamics. To be sure, the regions and countries targeted for investment are long-term partners in the UAE’s strategic vision,” Theodore Karasik, a senior advisor at the Gulf State Analytics think tank, told Breaking Defense.

And though Emirati firms have signed deals in recent years from Eastern Europe to southern Africa, there’s one distant country that appears to hold much of the focus of the UAE’s largest defense conglomerate known as the EDGE Group: Brazil.

There, analyst Ryan Bohl said, EDGE has found an entry into a “niche region that has the ambitions to build up their militaries but don’t face pressing military threats.” That means it’s a relatively low-risk environment for defense initiatives, both for the UAE firms and for their Latin American customers.

And though the UAE generally has kept tight control over homegrown intellectual property for defense products, the partnerships allow information sharing and faster technological development in a country with its own mature industrial base.

For this report, Breaking Defense examined publicly announced defense sales, partnerships and other corporate moves, and spoke with expert analysts. EDGE officials declined to be interviewed for the story, as did those from the Tawazun Council, the UAE’s acquisition authority and another major player in the Gulf nation’s global expansion.

Breaking Into Brazil

Perhaps nowhere outside their own region is EDGE, a conglomerate of more than 25 defense firms, making more of a splash than in Brazil, which has South America’s largest defense budget and is home to the multinational aerospace firm Embraer.

In April, EDGE chose Brazil as the location for its first international office, and just today the conglomerate announced a new strategic agreement with the Brazilian Marine Corps to “showcase its advanced portfolio of multi-domain solutions, with a focus on autonomous vehicles, electronic warfare and secure communications.”

That announcement followed one last month in which EDGE said it was working with Brazilian military organizations to co-develop defense systems. Specifically, the Emitari firm said it will join forces with the Brazilian Air Force’s Department of Aerospace Science and Technology (DCTA) to jointly develop unmanned and autonomous systems, smart weapons and air and space projects.

Before that, on Aug. 11, EDGE signed an agreement with Brazilian engineering firm Turbomachine to co-develop engines, including turbofan and propellant fan, for the Emirati conglomerate’s UAVs and missiles. Earlier in July, EDGE signed a major agreement to develop long-range anti-ship missiles for the Brazilian navy.

During the LAAD defense and security expo in Brazil last April, Edge signed a number of agreements with defense firms, including agreement with Brazil’s Kryptus to cooperate on cyber capabilities, another with SIATT for smart weapons and high-tech system integration, and with AKAER to “combine expertise and deliver critical capabilities to support end users,” according to the firm’s statement.

“Abu Dhabi defense companies are looking for other regional markets to build business ties. Entering the Latin American market, and Brazil specifically, helps to build Emirati product attraction for various hypothetical scenarios in the region,” Karasik told Breaking Defense. “Brazil is a target country because of the Emirati ability to partner with Brazilian institutions,” in partnerships Karasik said are more likely to get support from the Brazilian government than standalone foreign firms.

Retired Brazilian armed forces Col. Paulo Roberto da Silva Gomes Filho told Breaking Defense Brazil is an attractive market because “the country has a strong defense industry base, a well-trained technical and scientific workforce, and several centers of excellence.”

“A notable example is the aeronautical sector, where the aircraft maker Embraer is well known worldwide. The country has abundant energy and a significant supply of raw materials (minerals) for industrial manufacturing,” he added.

Filho said the strategy is “advantageous for both parties because it is not limited to only the two nations; each one may also act as a doorway to markets in Latin America, in the case of the UAE, and the Arab Gulf, in the case of Brazil, respectively.”

He added that the partnership benefits both countries by allowing them to gain technological autonomy and procure defensive systems at lower costs and in less time. “This is because expenses and technologies can be pooled to accelerate both countries’ essential undertakings,” he said.

Brazil is also a nice partner to have diplomatically, Filho said.

“It is a country that maintains strong relations with both the East and the West, actively participating in both the G20, where it currently holds the presidency, and the BRICS, where it will assume the presidency in 2024,” he said. “It also has natural leadership in Latin America and solid links with African countries.”

And while Brazil spends a significant amount on defense — some $19 billion in 2022, according to Stockholm International Peace Research Institute data — Bohl, senior Middle East and North Africa Analyst at RANE Network, emphasized that it doesn’t face significant military threats in the region.

Brazil, and other countries in South America, he said, want “to become more independent and [are] looking for new defense partners, but they aren’t in a position where they’re facing imminent threats, whereby they can’t take a risk on an organization like EDGE.”

EDGE isn’t the only Emirati firm taking notice of the potential for business in Latin America. Paramount Group, which was founded in South Africa but is headquartered in Abu Dhabi, announced this month that its 6X6 Infantry Combat Vehicle (ICV) had been ordered by a Latin American military.

Beyond South America

In the same announcement, Paramount said its infantry vehicles had also been ordered by the Indian government, just a recent example of the global customer base Emirati firms are attempting to reach far outside the confines of the Gulf or South America.

The existing industrial partnership between Paramount and India-based engineering and technology conglomerate Bharat Forge Ltd and its subsidiary, Kalyani Strategic Systems, has, to date, resulted in the successful development and production of large volumes of the locally-made KM4 armored vehicles for the Indian Army. (A decade ago Paramount won a contract to supply tactical vehicles to police in Brazil.)

Elsewhere, EDGE is reaching in every direction. Last week the conglomerate announced two new agreements with Bulgarian companies: the first for knowledge and research transfer relating to everything from space tech to land vehicles, and the second to “jointly identify business opportunities within the multiple electronic development domain,” according to EDGE statement.

In the announcement, Omar Al Zaabi, President of Trading & Mission Support at EDGE, highlighted that these agreements will expand the firm’s footprint in Eastern Europe.

Already EDGE has a toehold in Eastern Europe since it acquired a majority stake in Estonian Milrem Robotics earlier this year. (Milrem and an EDGE subsidiary recently merged technologies to put a loitering munition launcher on a ground combat vehicle.)

Other than Latin America and Eastern Europe, EDGE Group also has customers in sub-Saharan Africa, where the firm signed a $1 billion deal to equip the Angolan navy with three BR71 MKII 71-meter corvettes.

Elsewhere, the Tawazun Council, the Emirati acquisition organization, is looking east to join a South Korean fighter jet program, according to a local news report — a development Karasik said would make sense for Abu Dhabi.

“The UAE and South Korea have excellent defense relations as represented by Seoul’s previous deals with Abu Dhabi including sophisticated anti-missile systems such as the Cheongung II KM-SAM,” Karasik told Breaking Defense. He added that it is only natural for Abu Dhabi to want to join the KF-21 fighter program as part of the expanding nature of defense and energy relationships between the two states.

Taking aim: Army leaders ponder mix of precision munitions vs conventional

Three four-star US Army generals this week weighed in with their opinions about finding the right balance between conventional and high-tech munitions – but the answers aren’t easy.