- India

- International

ExplainSpeaking: Understanding Javier Milei and dollarisation, his radical policy to save Argentina’s economy

Javier Milei’s spectacular rise to the presidency of Argentina shows the voter is completely fed up with the conventional set of policies and politicians. Milei has suggested 'dollarisation' for the battered economy. What is it, and could it work?

A 100-dollar bill cut-out with Argentine presidential candidate Javier Milei's face printed on it is pictured during the closing event of his electoral campaign ahead of the November 19 runoff election, in Cordoba, Argentina, November 16, 2023. (REUTERS/Matias Baglietto/File Photo)

A 100-dollar bill cut-out with Argentine presidential candidate Javier Milei's face printed on it is pictured during the closing event of his electoral campaign ahead of the November 19 runoff election, in Cordoba, Argentina, November 16, 2023. (REUTERS/Matias Baglietto/File Photo) Dear Readers,

Last week something quite remarkable happened in the history of global politics: For the first time, a self-proclaimed “libertarian” and “anarcho-capitalist” became the head of one of the world’s biggest economies. Javier Milei, the leader of the Freedom Advances party, registered a stunning electoral victory to become the President-elect of Argentina.

Libertarian and Anarcho-capitalist

The chief import of those two expressions is that he is someone who believes that the government has either little or no role in the functioning of a country and an economy.

Libertarianism is a political philosophy that gives primacy to individual liberty over everything else. A libertarian believes that individuals have certain God-given rights — such as the right to life and liberty, freedom of speech, right to property, freedom of worship, moral autonomy etc. — and seeks to define the powers of a government in this context.

“The purpose of government, according to liberals, is to protect these and other individual rights, and in general liberals have contended that government power should be limited to that which is necessary to accomplish this task,” states Britannica Encyclopaedia.

Anarcho-capitalism seems to take the libertarian view to what would appear like an extreme. According to Britannica Encyclopaedia, anarcho-capitalism is a political philosophy that advocates the voluntary exchange of goods and services in a society broadly regulated by the market rather than by the state.

“The term anarcho-capitalism was coined by Murray Rothbard, a leading figure in the American libertarian movement from the 1950s until his death in 1995. Rothbard envisioned a ‘contractual society’ in which the production and exchange of all goods and services, including those usually assigned to the state (such as law enforcement, education, and environmental protection) would be conducted through voluntary agreements (contracts) between individuals,” states Brittanica.

Simply put, imagine a society where even law & order as well as justice delivery is privatised. In such a society, the government has no monopoly on police like it has at present. Almost every sector of the economy is run on free market principles with the belief that people, as consumers, will choose the best option among the available ones and that demand for better quality goods and services (say policing) will incentivise entrepreneurs to come up with the most efficient solutions.

That a person — Milei — who subscribes to these beliefs has ended up winning the highest office of government is a surprising result, to say the least. Equally, now that he is going to head the government, it is anyone’s guess how drastic his changes will be to the way Argentina is run and governed.

Not Donald Trump

For the most part since his election, the focus has been on Milei’s personality, particularly his eccentricities. For instance, the well-regarded English newspaper The Economist states the following: “Even by the standards of Argentine politics, he can sound eccentric: he is said to have hired a medium to consult Conan, his dead mastiff.”

Thanks to his antics, many have seen him as a Latin American version of Donald Trump. But the truth is that in terms of actual policy prescription, Milei could not be more different from Trump.

While the former US President gained popularity by turning to economic nationalism and trade protectionism, Milei wants to disband Argentina’s currency and central bank, adopt the US dollar as its currency and open trade unilaterally.

Milei believes that free trade between individuals across countries will be beneficial overall. Presumably, Milei is not scared of a possible spike in trade deficit — which may happen if goods from other countries flood Argentina’s market — because such an event would also mean cheaper foreign goods will be available to the Argentine public.

Similarly, unlike Trump who wanted to leverage the government machinery to achieve certain policy goals such as imposing trade tariffs or announcing unfunded tax cuts etc., Milei wants to prune down the government’s influence. A striking example is Milei wanting to disband the state-run media.

The problem with Argentina

Almost a year ago, when Lionel Messi-led Argentina beat the then defending champions France to lift the football World Cup, ExplainSpeaking discussed the problems in detail.

Here’s a quick recap.

Depending on what data one looks at, Argentina’s inflation rate is anywhere between 110% to 150%. For context, India’s inflation rate is around 5%. In other words, in Argentina, the general price level is more than double what it was a year ago. Another way to understand this is that no two visits to the grocery store are the same — the prices change that frequently.

Look at CHART 1. It shows inflation in Argentina as compared to the global average. It is noteworthy that the contrast is despite inflation shooting up to historic highs across the world thanks first to the pandemic and then to the war between Russia and Ukraine. It is also noteworthy that high inflation has been there in Argentina for years on end.

CHART 1.

CHART 1.

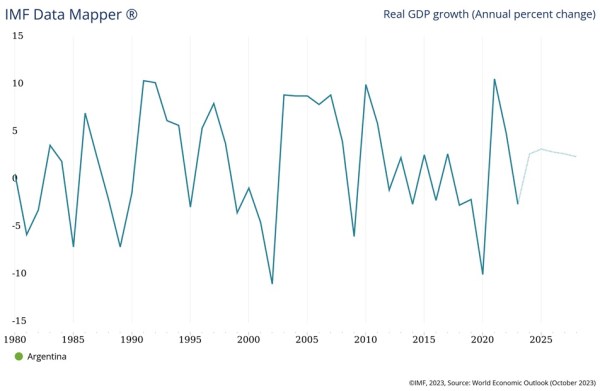

High inflation hasn’t come with the comfort of fast growth. CHART 2 shows the wildly fluctuating fortunes of Argentina’s GDP growth rate. Often the spikes in growth rate are nothing but the effect of a low base thanks to a sharp contraction in the preceding year or years.

CHART 2.

CHART 2.

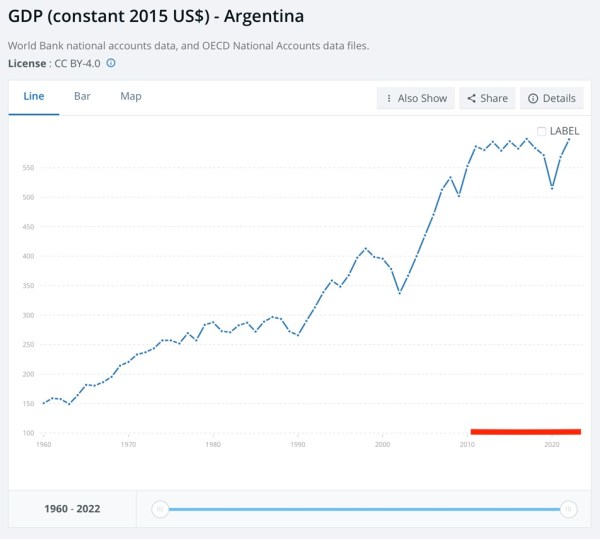

As a result, in absolute terms, the size of the Argentine economy (GDP) has stagnated over the past decade (See CHART 3) as have per capita incomes (SEE CHART 4).

CHART 3.

CHART 3.

CHART 4.

CHART 4.

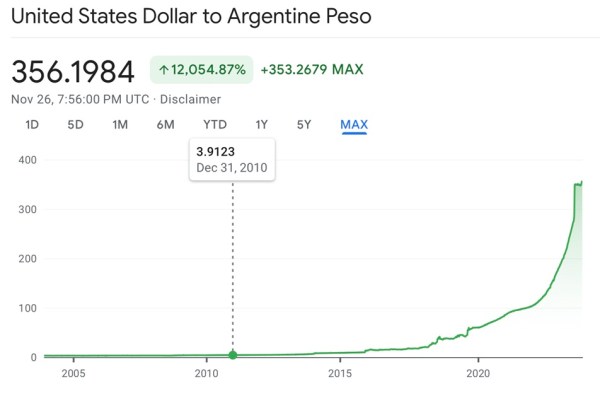

High inflation essentially means that the domestic currency is fast losing its value. If two pieces of bread cost 100 pesos last year, then a doubling of prices implies that last year’s 100 pesos are only worth 50 today.

Having any kind of economic activity in such an economy becomes not only more and more difficult but also unpredictable. Predictably, much like the domestic economic activity, trade suffers as well. This shows up in a sharp worsening of a country’s exchange rate.

CHART 5 shows how a dollar could be exchanged or bought for less than 4 pesos at the end of 2010. But since then, as the economy stagnated and inflation worsened, the exchange rate has plummeted. Today it stands at almost 360 pesos to a dollar. What is worse is that this is just the official rate — the actual free market rate is close to 470 pesos.

CHART 5.

CHART 5.

Reasons for Argentina’s economic woes

It is sky-high inflation that is the main problem. Unless that is addressed nothing will move forward in Argentina. But the solution crucially depends on why inflation spiked over the past decade.

Data suggests that even though Argentina’s economic output stagnated, its money supply continued to grow rapidly. This happened because the government continued to spend more than its revenues in a bid to continue its welfare programmes. To get financing, the government asked the country’s central bank to print new currency. But in the absence of increased economic output, more currency in the economy only served to spike prices.

Milei’s solution: Dollarisation

Since it was the excessive and irresponsible spending by the government and the facilitation of that by Argentina’s central bank, Milei proposes to:

1. Severely cut government spending starting with disbanding several departments. These correspond to those sectors where he doesn’t believe the government should be to begin with.

2. Disband the domestic currency and the central bank and shift to the US dollar as the official currency. This is called Dollarisation. In doing so, Argentina will give up its ability to control its monetary policy — its monetary sovereignty.

In other words, there would be no authority in Argentina (neither the government nor the central bank) that can either print money or decide the price of parting with it (also referred to as the interest rate in the economy).

The basic idea behind Milei’s plan to dollarise is two-fold:

To bring price stability to the economy in a quick manner. Since the US dollar is the default currency of the world — in that it is recognised and trusted across the world, even in countries where people may not like the US — its value is not easily altered. Since Argentina’s GDP is barely over $630 billion while the US GDP is over $25 trillion, the dollar will not be affected by Argentina’s shift to using the dollar.

However, shifting to dollars will mean that it will be easier and more predictable for Argentinians to trade among themselves or with the rest of the world. They can plan their production and consumption with much greater clarity and certainty. This will allow Argentina to get off the inflation treadmill that is enervating its productive potential.

To ensure that the government and the central bank are in no position to influence monetary policy.

Since there is no domestic currency to print — and the US central bank, the Fed will not alter its policy stance based on Argentina’s demands — Milei hopes to completely remove the possibility of any kind of populism fuelling inflation.

Why Dollarisation may fail

The expert opinion is divided.

At a political level, many claim that Milei may not be able to achieve dollarisation to begin with. It has to do with Milei’s relative inexperience as a politician (not to mention his eccentricities) and the weakness of his mandate: His party has only a few seats in the two houses of the National Congress.

But if one supposes Milei is successful in achieving dollarisation and shutting down the central bank, then also some claim that it may not work.

For one, just because there isn’t a central bank to print money doesn’t necessarily mean that governments will not spend beyond their means. They may indeed do so at the cost of the private sector’s access to the same pool of financial resources. As such, it is not certain that fiscal excesses, and as a result inflation, can be ruled out completely.

Two, many others point out that for a country’s system to shift to dollars, its banks and its government should have the dollars to begin with. If they don’t have the dollars then how can the economy shift to dollars?

By most estimates, Argentina’s government needs $40 billion to make the shift. It is also reported that at present Argentina is struggling to pay back the IMF’s debt of $44 billion.

As such, among detractors of Milei, Argentina should default on its debt instead of dollarising. That’s because once Argentina shifts to the dollar as its currency, its government and banks will have little ability to deal with an economic crisis.

Think for a moment: If there is a money crunch in one of India’s banks or even in large sections of the non-bank financial companies sectors or indeed one of the state governments, the RBI can either print money or soak it up from the market and lend it to the beleaguered entity. This is all possible because everyone is dealing in the domestic currency — the Indian rupee. None of this would be possible if India was dependent on the Chinese yuan, the European Union’s euro or the US dollar.

Why Dollarisation may work

Yet those who identify with Milei’s libertarian beliefs point out why dollarisation will work. In a policy brief, titled “Argentina Should Dollarize, Pronto”, the Cato Institute, a leading libertarian think tank based out of Washington DC, states the following:

“Whether on the right or the left, the monetary sovereigntists miss the essential point behind dollarization, which is to protect ordinary people’s purchasing power from the excesses of chronically profligate politicians and often subservient—or simply incompetent—central bankers. It should come as no surprise, in fact, that, along with semidollarized Peru, Latin America’s three fully dollarized countries—Panama, Ecuador, and El Salvador—have had the region’s lowest inflation levels during the past 20 years (and for much longer in the case of Panama). “

As far as the government not having the requisite dollars to make the shift, it has been shown that Argentina’s central bank’s total liabilities stand at around 18.8 trillion pesos. Central bank liabilities refer to all the money it prints; its assets are things like gold and hard currencies (such as US dollars). If these liabilities are exchanged at the free market rate of 470 pesos to a dollar, Argentina will have the $40 billion it needs.

Cato Institute’s analysis also points out that since most Argentines in any case hoarded US dollars, whatever scarcity there is, is only limited to the government. “At the end of 2022, Argentines held over $246 billion in foreign bank accounts, safe deposit boxes, and mostly undeclared cash, according to Argentina’s National Institute of Statistics and Census. This amounts to over 50 per cent of Argentina’s GDP in current dollars for 2021 ($487 billion),” a Cato analysis.

In other words, when Argentina shifts to the US dollar, Argentinians, who had been hoarding US dollars under the carpet until now, will come forward with billions of US dollars. As the system receives these dollars, it can restart its economy.

Upshot

Javier Milei’s spectacular rise to the presidency of Argentina shows the voter is completely fed up with the conventional set of policies and politicians.

One should not disregard the possibility that dollarisation may help Argentinians even though it is a rather counterintuitive policy choice — especially not just based on emotional arguments such as Milei’s personality traits.

Until next time,

Udit

More Explained

EXPRESS OPINION

May 05: Latest News

- 01

- 02

- 03

- 04

- 05