Fintech is disrupting the financial services industry by creating a digital alternative to traditional institutions. Fintech companies use innovative technologies and data analytics to facilitate access to banking and financial services, including payments, loans, and insurance. There is still a significant percentage of the world's population that is excluded from the financial ecosystem and does not have access to platforms that allow them to track their spending, save money, or use other banking services. The percentage of adults making digital payments increased globally from 26% to 51% between 2014 and 2021, but in Latin America and the Caribbean, this number increased from 5% to 20% over the same period. The increase in account ownership in LAC is largely due to greater access to mobile money accounts, which has made financial products more accessible to women, low-income groups, and other excluded sectors. Financial inclusion in Mexico In Mexico, in 2021, over 40% of the population was considered financially excluded, according to the ENIF survey. This means that they do not have access to formal financial services such as banking, saving, credit, and insurance. However, fintech has been playing a critical role in improving financial inclusion in the country by bringing financial services to the previously unbanked. This has forced large financial institutions to reevaluate their business practices, resulting in 16.8 million adults in Mexico having access to banking services through fintech platforms in 2020. According to the Mexican Banking and Securities Commission (CNBV), financial inclusion in Mexico has four fundamental components: Access: Infrastructure available to offer financial services and products. Use: Acquisition or contracting by the population of one or more financial products or services. Consumer protection: New or existing financial products and services are under a framework that guarantees transparency of information, fair treatment, and good practices. Financial education: Aptitudes, skills, and knowledge that the population acquires in order to be able to correctly manage and plan their personal finances. The World Bank reports that financial inclusion in Mexico has advanced due to the National Financial Inclusion Strategy, whose main policy goal is to allow 77% of the Mexican population to hold at least one financial product by 2024, compared to 68% in 2018. More than $200 million in loans have been given out in the last five years, primarily to residents in rural and marginalized communities. However, there is still a significant percentage of the population that doesn’t have access to essential financial products and services like savings accounts, credit, insurance, and pensions. This leaves a large portion of the population vulnerable to financial shocks, such as job loss or illness, and unable to save for important life events like education or retirement. Fintech is playing an important role in transforming financial inclusion in Mexico and bridging this gap. Fintech Solutions Fintech companies use specialized software and algorithms to bridge the gap between those with access to financial services and those without. As more people access the Internet through their mobile devices, fintech companies are able to reach a wider audience and offer their services through user-friendly mobile apps, making digital banking more accessible and affordable for people living in rural areas, low-income households, the elderly, or those working in the informal sector. In March 2018, Mexico published the Fintech Law after the number of financial technology companies grew by 50% in the previous two years. The Secretariat of Finance and Public Credit (Secretaría de Hacienda y Crédito Público or SHCP), the Mexican Banking and Securities Commission (CNBV), and the Central Bank (BANXICO) are the main regulators of this sector. The law aims to foster financial inclusion, provide greater legal certainty for users of fintech services, and generate more competition in the market. Fintech regulation has placed Mexico at the forefront of regulatory issues and consolidated its position as a pioneer in the field. By 2021, there were around 512 fintech startups in Mexico, making it the second largest fintech ecosystem in Latin America after Brazil. Their competitive advantage is the specialization in some products to meet different sectors, segments, and market needs, such as payments and remittances, loans, corporate financial management, among others. As we can see in Figure 1, Business and Consumer Lending is the subsector with the highest market share, coinciding with credit cards, which are the products for which fintechs are best known today. [caption id="attachment_10139" align="aligncenter" width="473"] Figure 1. Fintech Subsectors and Market Share 2021 Source: Fintech Radar Mexico 2021[/caption] The sectors with the highest market share are Loans (21%) and Payments and Remittances (18%). A good example of those with a presence in Mexico are Nubank and Clip. Clip, as one of the leading companies, was the first terminal in the country (mobile and non-mobile) to accept all payment methods, pioneering innovation in business payment methods in Mexico. This helps SMEs increase their sales and have better control of their finances without paying high rates and commissions. Nubank, the largest neobank (which operates exclusively online) in Latin America, has a presence in Mexico, offering their first product: a credit card without annuities, acceptable in all businesses, and without long waiting times for approval. Nu Mexico is a company that has made a special effort to bridge the financial inclusion gap, as reported in 2022; 46% of its clients report a monthly income of less than 10,000 pesos; 1 in 3 customers over the age of 65 did not have a credit card before Nu card; its clients are located in 80% of the priority rural municipalities for the federal government. Future Prospects for Financial Inclusion with Fintech Financial inclusion has been a hot topic in Mexico, and fintech has played a key role in driving change. As more of the population gains access to internet connections and financial services, it is important to take a look at the future prospects of financial inclusion with fintech in Mexico. Offering individuals financial products like bank accounts and credit cards through their current smartphone service is one method of increasing financial inclusion. In Mexico, 67% of people over the age of 15 had smartphones in 2020, and that number is expected to rise to 74% by 2025. However, only 32% have made or received digital payments. This presents a significant opportunity to improve accessibility through digitized services. It is also important that both traditional financial institutions and fintechs continue to work together to re-educate people on the benefits of using electronic money; this not only expands access to financial services but also helps boost economic growth and reduce inequality. In conclusion, the outlook for fintech and financial inclusion in Mexico is positive. The industry has grown rapidly in recent years, driven by favorable regulatory policies, increasing smartphone penetration, growing demand for digital financial services, and a focus on reaching underserved populations. With continued innovation and expansion, the fintech industry is expected to play a key role in promoting financial inclusion and economic growth in Mexico in the years to come. Author: Meliza Rivas Sources: https://www.inegi.org.mx/programas/enif/2021/ https://www.inegi.org.mx/contenidos/saladeprensa/boletines/2021/EstSociodemo/ResultCenso2020_Nal.pdf https://microvestfund.com/fintech-a-bright-spot-in-mexicos-road-to-financial-inclusion/#:~:text=Despite%20medium%2Dterm%20liquidity%20issues,they%20have%20a%20bank%20account. https://www.afi-global.org/wp-content/uploads/2020/07/EN_Summary_National_Financial_Inclusion_Strategy.pdf https://mexicobusiness.news/entrepreneurs/news/role-fintech-financial-inclusion-mexico https://www.oecd-ilibrary.org/deliver/73e9341b-en.pdf?itemId=%2Fcontent%2Fpaper%2F73e9341b-en&mimeType=pdf https://www.gob.mx/cnbv/acciones-y-programas/inclusion-financiera-25319 https://www.gsma.com/mobileeconomy/wp-content/uploads/2021/11/GSMA_ME_LATAM_2021.pdf https://www.worldbank.org/en/results/2021/04/09/expanding-financial-access-for-mexico-s-poor-and-supporting-economic-sustainability#:~:text=Mexico%20lags%20in%20terms%20of,with%20similar%20levels%20of%20development. https://diafintech.com.mx/noticia/fintech-radar-mexico-2021-principales-hallazgos/ https://labsnews.com/en/news/business/the-13-latin-american-rockets-among-cb-insights-250-top-fintech-companies-of-2021/ https://interesante.com/2022/06/top-10-strongest-fintech-startups-in-mexico/ https://blog.clip.mx/clip-fortalece-la-economia-emergente https://www.endeavor.org.mx/clip_una_revolucion_a_la_inclusion_financiera.html https://blog.nu.com.mx/nu-pieza-clave-de-la-inclusion-financiera/ https://www.bbva.com/es/las-fintech-invaden-mexico/ https://es.statista.com/grafico/27329/paises-latinoamericanos-con-mas-empresas-fintech/#:~:text=Brasil%20es%20claramente%20el%20pa%C3%ADs,del%2030%25%20del%20total%20regional. https://financer.com/mx/wiki/ley-fintech/#:~:text=El%20principal%20prop%C3%B3sito%20de%20esta,Los%20pagos%20electr%C3%B3nicos. https://fintechradar.finnovista.com/mexico/2021/en/ https://www.caf.com/en/knowledge/views/2022/12/financial-inclusion-in-latin-america-how-far-we-have-come/

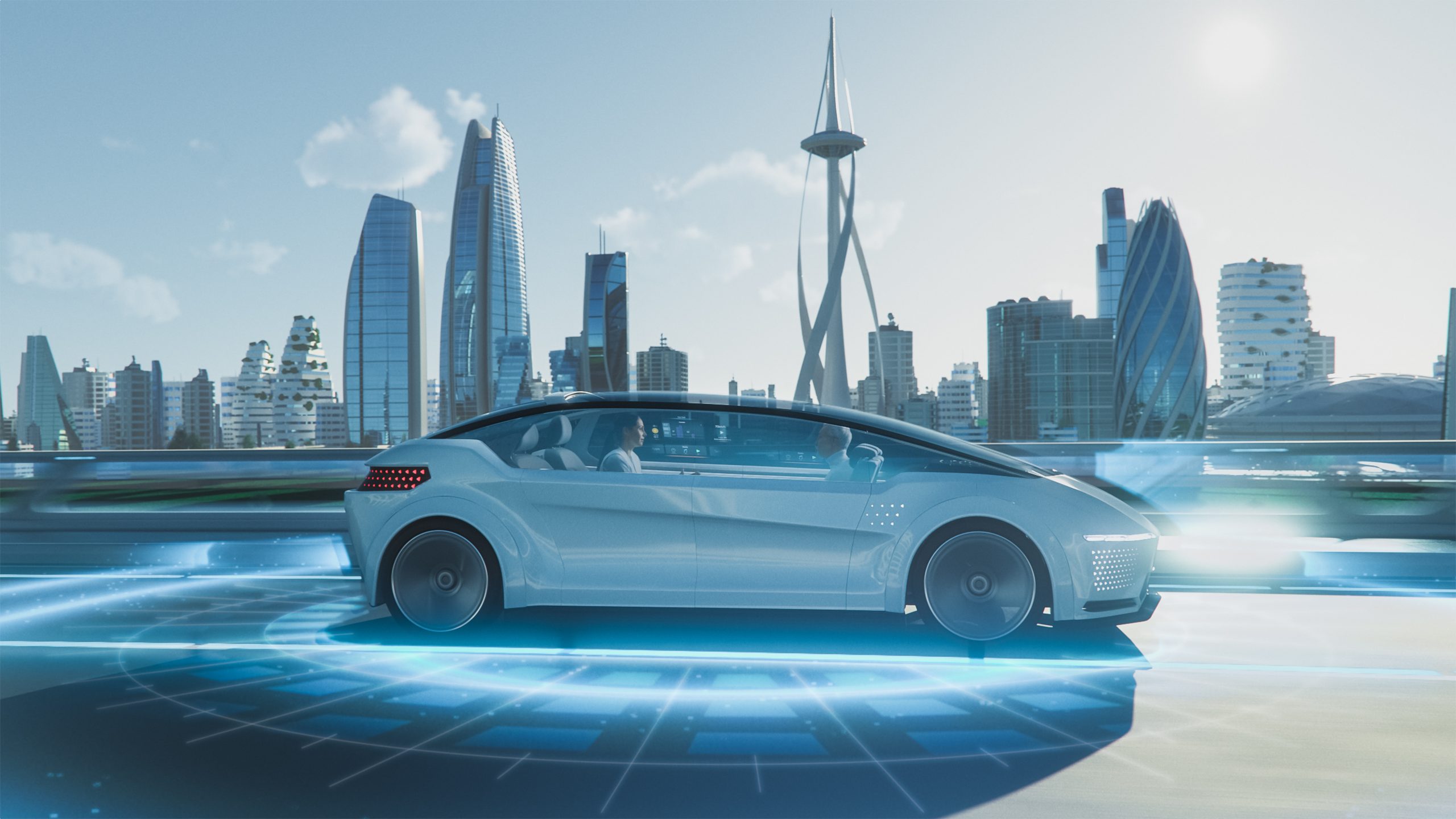

Autonomous vehicles (AVs), also known as self-driving or driverless cars, are becoming increasingly common on city streets around the world. The developers of these vehicles are striving to provide drivers with a safe, comfortable, and hands-free experience, pushing the boundaries of comfort and safety in road travel. A driverless car relies on sensors, cameras, radar, and artificial intelligence (AI) to travel between destinations without a human driver. Its technology developers use vast amounts of data from image recognition systems, machine learning, and neural networks to build systems that can drive autonomously. This data includes images from cameras mounted on the AV that can identify any driving environment’s components, such as traffic lights, trees, curbs, walkers, street signs, etc. Automakers and technology companies are still far behind in releasing fully autonomous cars. Although there are no commercially available self-driving cars for individual buyers today, some vehicles currently offer advanced driver assistance features. There is some confusion about what today’s cars are capable of and whether today’s active driving assistance (ADA) systems, which automatically steer, brake, and accelerate under certain conditions, are considered self-driving. Levels and types of AVs The Society of Automotive Engineers (SAE) defines six vehicle driving automation system levels according to the degree of automation, ranging from Level 0, where vehicles have no automation, to Level 5, which represents full automation. Most vehicles on the road are at Level 1 equipped with driver assistance or Level 2 with partial automation, while some prototypes are at Level 3 or Level 4 with conditional and high automation, respectively. Right now, we are at Level 2, with cars that can control steering, acceleration, and braking while still requiring the driver to remain engaged. In the future, Level 5 autonomy would mean fully driverless vehicles. According to McKinsey & Company, the first Level 3 traffic-jam pilots or prototypes, in which autonomous systems control driving and monitoring in some situations, have already received regulatory approval in 2021. [caption id="attachment_8808" align="aligncenter" width="641"] Figure 1. Levels of driving Automation (Synopsys, 2023)[/caption] Which vehicle segments could be autonomous? New modes of transportation will emerge, primarily driven by factors such as what is being transported, the type of vehicle ownership, and where the vehicle operates. As of today, the strongest candidates to become fully automated are passenger cars, including private cars and shared autonomous vehicles, also known as robo-taxis or shuttles; the second segment is autonomous truck platooning. It is forecast that by 2040, there will be over 33 million driverless vehicles on the road. When it comes to the cost of shared autonomous vehicles, the cost per mile of a robo-taxi trip could be just 20% higher than that of a private nonautonomous car in specific contexts, depending on the segment, geography, and local conditions such as the city archetype. A robo-shuttle could be 10 to 40% cheaper than private, non-autonomous cars, though less convenient. Another segment where full automation is close to becoming a reality is truck platooning, where a group of vehicles equipped with advanced technology travel together in a line at high speed. In a truck platoon, a lead vehicle is followed by the other vehicles at the same speed and maneuvers as the lead vehicle. Each vehicle communicates with the lead vehicle, which is in control. These new transportation means, especially robo-taxis and shuttle mobility, can potentially disrupt our future mobility behavior and cannibalize the many miles people travel daily. Global Autonomous vehicles Market size According to an autonomous vehicle market forecast by Next Move Strategy Consulting, the global market for L1 and L2 autonomous vehicles reached nearly USD 106 billion in 2021 and is projected to reach over USD 2.2 trillion in 2030, growing at a CAGR of 35.6% from 2021 to 2030. [caption id="attachment_8814" align="aligncenter" width="555"] Figure 2. Global Autonomous Vehicles Market Size (Statista, 2023)[/caption] Asia Pacific is expected to account for the largest market share by 2030, followed by Europe and North America. The main factors driving the growth of the autonomous / self-driven car market are: Increasing demand for a safe, efficient, and convenient driving experience Rising disposable income in emerging economies; and Stringent safety regulations across the globe Autonomous Vehicles market players in 2023 Many companies are already conducting extensive testing of private AV cars, fleets of shared AVs, and AV trucks. The companies involved range from original equipment manufacturers (OEMs) and suppliers to tech players and start-ups. [caption id="attachment_8815" align="aligncenter" width="535"] Figure 3. OEMs and suppliers to tech players and start-ups (AI Time Journal, 2023)[/caption] Autonomous Vehicles in the Middle East UAE becomes the first in the Middle East and the second globally to test self-driving cars on the streets with the approval of a temporary license to test self-driving vehicles on the roads. According to the Dubai Autonomous Transportation Strategy, launched by His Highness Sheikh Mohammad Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, 25% of all trips on various self-driving transport means in Dubai will be driverless by 2030. In April 2021, the Roads Transportation Authority signed an agreement with Cruise, a General Motors-backed company, to operate Cruise autonomous vehicles to offer taxi and e-Hail services until 2029. It is planned to reach 4,000 Cruise AVs in Dubai by 2030 as part of its efforts to enhance Dubai’s pioneering role in self-driving transport and transform it into the smartest city in the world. [caption id="attachment_8817" align="aligncenter" width="578"] Figure 4. Dubai Self-Driving Transportation Strategy 2030 (Road and Transport Authority UAE, 2023)[/caption] Can we see driverless taxis on UAE streets in 2023? According to Dubai’s Roads and Transport Authority, Cruise has sent two of its autonomous Chevrolet Bolt electric vehicles to Dubai to begin mapping the streets in the Jumeirah area, driven by specialist drivers using two Chevrolet Bolt electric vehicles equipped with sensors and cameras in preparation for a planned launch in 2023. The technology uses a high-resolution map of the physical environment using several sensors, including LiDAR, cameras, and others. The cars were driven around the city to collect data, which can then be used to create a navigable map for Cruise’s driverless vehicles to follow. Dubai is aggressively integrating self-driving transport across all modes of public transport, from taxis and metros to buses and shuttles, and wants to set a global example for policy and legislation regarding self-driving transport. Challenges and future of Autonomous Vehicles Regulations and safety According to a McKinsey survey conducted on 75 executives from automotive, transportation, and software companies working on autonomous driving in North America, Europe, and Asia-Pacific in December 2021, 60% of respondents viewed the need for regulatory support as the greatest requirement for autonomous driving; those in Europe were most likely to voice this sentiment. Notably, several European countries have launched independent efforts to create regulations. Different regulations have also emerged in China at the municipal level. [caption id="attachment_8821" align="aligncenter" width="536"] Figure 5. Main challenges to the adoption of Autonomous Vehicles (McKinsey & Company, 2021)[/caption] Technology barriers The technology must be tested for many millions of kilometers before it can be fully commercialized. To achieve a 95% equivalency to a human driver, an autonomous automobile needs to travel around 291 million miles without causing any fatalities. For instance, the first fatal accident happened in March 2018, when a Level-4 Uber prototype collided with a person crossing the street. Lack of required infrastructure In emerging countries, the development of IT infrastructure on highways is slow as compared to developed economies. 3G and 4G-LTE communication networks, which are required for connectivity, are limited to urban and semi-urban areas. Autonomous/ Self-driving cars require basic infrastructure such as well-organized roads, lane markings, and GPS connectivity for effective functioning. We can conclude that the market size of autonomous vehicles is expected to grow rapidly in the next decade, reaching trillions of U.S. dollars by 2030 due to the expected expansion of autonomous vehicle levels. More than half of the new vehicles sold globally will be at least at level 3, while about 10% will be at level 4 or higher. North America and Europe may lead the adoption of higher-level AVs for personal use, while China and Asia-Pacific may dominate the market for robo-taxis and shared mobility services. Highway driving or parking may be more suitable for higher-level AVs than others, such as urban driving or off-road driving. This will be driven by technological improvements, regulatory support, consumer demand, safety benefits, and environmental concerns. Do you think autonomous vehicles will be a reliable and safe option for everyday transportation without the need for a human driver? Author: Eman Abdelmohsen Sources: https://www.theguardian.com/technology/2023/feb/17/taking-ride-self-driving-car-nissan-servcity-autonomous-vehicles https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/whats-next-for-autonomous-vehicles https://www.techtarget.com/searchenterpriseai/definition/driverless-car https://www.marketsandmarkets.com/Market-Reports/near-autonomous-passenger-car-market-1220.html#:~:text=The%20global%20autonomous%20%2F%20self%2Ddriving,automotive%20customers%20across%20the%20world. https://www.statista.com/statistics/1224515/av-market-size-worldwide-forecast/ https://www.esquireme.com/gear/cars/dubai-cruise-driverless-taxis-2023 https://www.telecomreview.com/articles/reports-and-coverage/5651-uae-drives-the-future-of-mobility-and-autonomous-technology https://www.rta.ae/links/sdt/sdt-final.pdf https://techcrunch.com/2022/07/24/cruise-starts-mapping-dubais-streets-in-prep-for-2023-robotaxi-launch/?guccounter=1 https://ai4beginners.com/top-10-self-driving-car-companies-in-2020/ https://www.aitimejournal.com/autonomous-vehicles-companies-to-watch/ https://www.neusoft.com/Products/Automotive/2286/ https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/the-road-to-affordable-autonomous-mobility https://techcrunch.com/2022/07/24/cruise-starts-mapping-dubais-streets-in-prep-for-2023-robotaxi-launch/ https://www.telecomreview.com/articles/reports-and-coverage/5651-uae-drives-the-future-of-mobility-and-autonomous-technology https://builtin.com/transportation-tech/self-driving-car-companies https://www.theguardian.com/technology/2023/feb/14/amazon-tests-robotaxis-zoox-california https://www.theguardian.com/technology/2023/feb/20/self-driving-vehicles-from-overseas-face-ban-in-england-and-wales https://www.researchgate.net/publication/366986201_Autonomous_Car_Current_Issues_Challenges_and_Solution_A_Review https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/autonomous-drivings-future-convenient-and-connected https://www.mckinsey.com/features/mckinsey-center-for-future-mobility/our-insights/whats-next-for-autonomous-vehicles https://www.bbc.com/news/technology-60126014 https://www.forbes.com/sites/naveenjoshi/2022/07/22/5-ways-autonomous-cars-will-reshape-our-world/?sh=7b32995b589b https://www.synopsys.com/automotive/autonomous-driving-levels.html

Robots are not what we once thought. They are more than those humanoid creations with odd speech patterns, and they are definitely not as evil as depicted in science-fiction movies like The Terminator (1984) or in novels like Frankenstein’s artificial lifeform monster. Although the now real “killer robots” are making us question whether our subconsciously learned stereotype is really a misconception or rather a prediction of the future, it is safe to say that robots do have many useful applications that benefit society on multiple levels, which is why companies around the world are increasingly opting for them. So, what exactly are robots? There are two main types of robots: industrial robots and service robots. Industrial robots are mainly used in manufacturing industries and factories, and they are programmed to handle dangerous tasks that require precision, consistency, and heavy lifting. They represent an important component of process automation, and they are increasingly being integrated with artificial intelligence and the cloud. On the other hand, service robots are often intended for more “soft” tasks in offices, homes, or similar environments to assist people. They can either be human-operated or fully autonomous, and they are safer to interact with since they are designed to be human-facing devices that mimic human abilities. If we look at the numbers, industrial robots generate higher revenues compared to service ones, with USD 24.18 billion for industrial robots compared to USD 8.23 billion for service ones in 2022. Together, both types generated a total of USD 32.41 billion in revenue in 2022 and are expected to reach USD 43.32 billion in 2027, per the below chart. [caption id="attachment_8789" align="aligncenter" width="549"] Notes: Data shown is using current exchange rates and reflects market impacts of the Russia-Ukraine war. Most recent update: Aug2022; Source Statista[/caption] When it comes to industrial robots and the manufacturing industry, Asian countries are dominating the market, with 74% of the 517,385 newly deployed robots in 2021 installed in Asia. In fact, the highest densities of robots can be found in Asian countries, with 932 robots per 10,000 employees in South Korea, compared to 605 in Singapore and 390 in Japan, as shown in the below graph Manufacturing industry-related robot density in selected countries worldwide in 2020 While the Singapore Government is actively seeking to develop national capabilities in robotics through its National Robotics Programme, it has also unexpectedly caused a ramp-up of automation in the country after enacting the “Serious Disasters Punishment Act” in 2021. The new law imposed criminal liability on CEOs and high-ranking managers in the case of injuries and deaths on job sites to encourage them to invest in making workplaces safer; however, in reality, it has pushed companies to avoid the entire problem by replacing workers with machines. Why the race for robots? Are they really that useful? Technology has come a long way since the first mechanical invention, an automated water clock, was created in early 270 B.C. While robots were later developed as machines that handle repetitive tasks that do not require precision, they are now deployed across a broad spectrum of industries, with many benefits. In the healthcare sector, assistive robot arms are opening doors to independence for people with disabilities or advanced muscular problems. Robots are also assisting in hospitals, such as in Mongkutwattana General Hospital in Bangkok, where three robotic nurses helped face the surge in the number of patients in 2017 by traveling between desks and delivering important paperwork and medicine to doctors. In the retail industry, automation is increasingly incorporated in different stages of the value chain, including logistics and supply chains, back-offices and in-store operations, and sales and marketing, with the aim of optimizing customer experiences and driving revenue. While the global retail automation market was valued at USD 11.3 billion in 2020, it is estimated to reach USD 33 billion in 2030. AI-powered robots such as Effective Retail Intelligent Scanners can take over time-intensive tasks by scanning shelves and alerting staff of any misplaced items and price tag inconsistencies, in addition to issuing stock warnings. In terms of customer support, sensor-based robots can also bring customers the products they are looking for, while AI-powered ones can offer personalized product recommendations. Moving on to the leisure and travel sectors, we can find that the world’s first AI news anchor joined China’s state-run Xinhua News Agency in 2018 with the ability to mimic facial expressions, speak in both English and Chinese, read texts, and report on social media and on the Xinhua website. Moreover, robots are making life easier and more convenient for humans. For example, during the Tokyo 2020 Games, two Toyota human support robots assisted spectators in wheelchairs by carrying their belongings and guiding them to their seats, while at the Lyon Saint-Exupéry Airport, robot valets are parking cars in a robot-lot, fitting 50 percent more cars in the same area by parking them closer together. Not to mention that a three-armed robot, can now prepare, cut, and serve a pizza in less than five minutes while creating 500,000 unique recipes at the Pazzi restaurant in Paris. [caption id="attachment_8755" align="aligncenter" width="369"] The world’s first AI news anchor adopted by China’s state news agency Xinhua in 2018; Source: The Guardian[/caption] Robots are also extremely helpful in addressing climate change. Advanced technologies are now used to create profitable solutions that positively impact the environment and help achieve net zero goals, in what we call “technology eco-advantage”. PwC UK estimated in 2019 that using environmental applications of AI in four sectors—agriculture, transport, energy, and water—could reduce worldwide greenhouse gas (GHG) emissions by 4% in 2030, the equivalent of 2.4 Gt CO2e. This represents the 2030 annual emissions of Australia, Canada, and Japan combined. Real-life applications that back up this estimation include the tree-planting robot “Growbot”, created by SkyGrow with a mission to plant trees faster than the rate of deforestation. The robot is 10 times faster than trained individuals and helps cut costs in half compared to traditional techniques. Researchers at Sichuan University have also invented a 13-mm-long flexible and self-healing nacre robot fish that is programmed to absorb microplastics from seas and oceans up to 5kg in weight just by swimming around. If robots are helpful, then why all the controversy? The truth is, robotic applications are useful for humanity on many different levels, but they rarely come without any serious downsides. Whether it is the displacement effects of robots performing tasks previously done by humans, injuries caused by over-automation, or ethical concerns about killer robots and algorithmic bias, many questions are being raised about what the future holds and how much we can control. Displacement effects and the concept of “Reshoring” A study on the US labor market found that for every robot added per 1,000 workers in the U.S., wages would decline by 0.42%, and one robot would decrease employment by 3.3 workers. This displacement effect varies based on the gender, age, and country of the worker. In fact, the World Economic Forum found in 2019 that women are more likely to lose their jobs due to automation in comparison to men because the positions that have more than a 90% chance of becoming automated, such as cashiers, administrative assistants, and bookkeepers, are mostly dominated by women. Accordingly, for every seven men employed in occupations with a 90 percent likelihood of automation, there are 10 women. The IMF also estimated in 2018 that 26 million women in 30 countries face a high risk of being displaced by technology within the next 20 years. When it comes to age, young people aged 16-24 face the highest vulnerability to losing their jobs compared to other age groups, as shown in the below graph. As for country-level effects, the ILO has also raised the idea of “reshoring”, where labor-intensive tasks previously outsourced to developing countries can be reshored to developed ones to be performed by robots, resulting in a shift in the global division of labor. Injuries and inefficiencies It is true that robots are more efficient than humans in certain aspects, but overusing them can be dangerous. For example, after Amazon began employing robots in its warehouses in 2014 to take on repetitive tasks, the Center for Investigative Reporting revealed in 2020 that during the period 2016-2019, the rate of serious injuries endured by Amazon employees at automated warehouses was 50 percent higher than at facilities that didn’t use robots. This was due to robots increasing workers’ quotas from scanning 100 items per hour to scanning 400, which was far beyond their human capacity. While over-automation might not always lead to injuries, it can often be inefficient. In Japan, after the Henn na Hotel opened in 2015 as the first hotel in the world to be entirely staffed by robots, it had to replace more than half of its 243 robotic workforce with traditional human service providers in 2019. Robots were found to annoy guests and break down many times; they were incapable of answering some basic questions at the front desk, and robot room assistants woke up guests in the middle of the night as they mistook snoring sounds for commands. Despite these risks, robot hotels are increasingly becoming popular worldwide, with NEOM’s first robot-powered Yotel Hotel opening in the Oxagon district in 2025, in Saudi Arabia. Algorithmic bias and toxic stereotypes Another major concern that shakes our trust in robots is their programming, which is based on biased artificial intelligence algorithms. In 2022, in a collaboration between Johns Hopkins University and other educational institutions, scientists asked programmed robots to scan blocks with people’s faces on them and choose a block based on their command. When asked to select a “criminal block”, the robot chose the block with the black man’s face 10% more often than when asked to select a “person block”. Also, when asked to select a “janitor block” the robot selected Latino men 10% more often while selecting men more often than women when asked for a “doctor block” and choosing black and Latina women when asked for a "homemaker block”. On another note, in May 2016, the investigative journalism organization ProPublica claimed that the Correctional Offender Management Profiling for Alternative Sanctions (COMPAS), a computer program used by a US court for risk assessment, was found to mistakenly label black defendants as more likely to re-offend at almost twice the rate as white people. Similar COMPAS and programs are used in hundreds of courts across the US, making us question if robots are being racialized as “white” and programmed with toxic stereotypes. Legal autonomous weapons and killer robots Ethical concerns take a much bigger turn when it comes to lethal autonomous weapons and military robots that use artificial intelligence to identify and kill human targets without human intervention. These are no longer limited to movies but are becoming a reality on the battlefield. A military combat robot experiment developed by the U.S. military’s research labs Source: Teslarati While some see it as more ethical to employ robots in wars rather than human fighters, others think that “killer robots” can cause more collateral damage than human soldiers. They have been designed to be unpredictable to be one step ahead of the enemy, but their unpredictability combined with their speed, lack of situational awareness, risk of inaccurate target identification, and programming based on biometric information can rapidly escalate the conflict and result in selective killing based on age, gender, and race. Once these weapons start being mass-produced, they can be sold on the black market and fall into the wrong hands, leading to human disasters. How are organizations, companies, and employees reacting? The United Nations Convention on Certain Conventional Weapons (CCW) in Geneva started discussing lethal autonomous weapons in 2013 and set up in 2016 a Group of Governmental Experts (GGE) to develop a new ‘normative and operational framework’ for member states. In July 2015, during a joint conference on artificial intelligence, an open letter calling for a ban on autonomous weapons was released and signed by significant figures such as Elon Musk, inventor and founder of Tesla, Steve Wozniak, co-founder of Apple, and Stephen Hawking, physicist at the University of Columbia. Also, the Stop Killer Robots Coalition, formed by Human Rights Watch, Amnesty International, and other NGOs, was launched in 2013 to call for new international law on autonomy in weapons systems, and in October 2022, 70 states delivered a joint statement on autonomous weapons systems in what became the largest cross-regional group statement ever made throughout UN discussions on the issue so far. When it comes to industrial and service robots, many employees perceive robots as the new “digital workforce” that is stealing their jobs. While denying the truth is pointless, companies should try to openly communicate with their workers their vision for the future in terms of automation and technology and invest in training and upskilling their employees to be able to fit in an automated workplace where robots complement employees’ work rather than replace them. So… Are we for or against robots? Robots might be able to perform some of the same tasks as humans with higher speed and accuracy, but they still have a long way to go when it comes to emotional and cultural sensitivity, opening doors to questions, concerns, and fears. It is almost like a love-hate relationship, but it is also one with which we eventually need to make peace if we want to stay ahead of the game. New robotic technologies, or even bots and chatbots like ChatGPT, will never stop breaking new ground, and it is up to us to determine how we perceive them. Allies or enemies? The choice is yours. Author: Mané Djizmedjian Sources: https://www.sciencefriday.com/segments/the-origin-of-the-word-robot/ https://www.bcg.com/publications/2014/business-unit-strategy-innovation-rise-of-robotics https://www.thoughtco.com/timeline-of-robots-1992363 https://www.robotlab.com/group/blog/whats-the-difference-between-industrial-robots-and-service-robots https://www.geeksforgeeks.org/differences-between-industrial-robots-and-service-robots/ https://www.statista.com/outlook/tmo/robotics/worldwide#revenue https://www.statista.com/statistics/911938/industrial-robot-density-by-country/#:~:text=In%202020%2C%20South%20Korea%20had,rounded%20off%20the%20top%20five. https://www.automation.com/en-us/articles/october-2022/ifr-presents-world-robotics-report-2022 https://restofworld.org/2022/korea-factories-replace-humans-with-robots/ https://www.nrp.gov.sg/ https://www.cnbc.com/2018/11/09/the-worlds-first-ai-news-anchor-has-gone-live-in-china.html https://olympics.com/en/news/tokyo-2020-robot-project-dr-hirukawa-hirohisa-to-showcase-future-of-sporti https://news.yahoo.com/hospital-uses-robots-instead-nurses-130000636.html https://sg.news.yahoo.com/2019-03-15-stanley-robotics-robot-valets-airport-france.html https://worldcrunch.com/tech-science/how-five-countries-are-integrating-robots-into-daily-life https://exchange.telstra.com.au/skygrow-muru-d-climate-change/ https://eandt.theiet.org/content/articles/2017/07/the-plantoid-project-how-artificial-plants-could-help-save-the-environment/ https://www.bcg.com/publications/2021/how-technology-helps-sustainability-initiatives https://www.pwc.com/gx/en/news-room/press-releases/2019/ai-realise-gains-environment.html https://www.theguardian.com/environment/2022/jun/22/scientists-unveil-bionic-robo-fish-to-remove-microplastics-from-seas https://www.statista.com/statistics/1257213/retail-automation-market-size/ https://www.engadget.com/amazon-robot-arm-picker-warehouse-sparrow-ai-computer-vision-210545438.html#:~:text=Amazon%20has%20unveiled%20its%20latest,of%20items%2C%20according%20to%20Amazon https://www.wired.com/story/amazons-worker-injury-problem/ https://www.adaptarobotics.com/robots/eris/ https://www.wevolver.com/article/how-ai-powered-robots-are-transforming-the-retail-industry https://www.wns.com/perspectives/articles/articledetail/627/robots-in-retail-driving-innovation-one-aisle-at-a-time https://www.hotelmanagement.net/tech/japan-s-henn-na-hotel-fires-half-its-robot-workforce https://www.revfine.com/robots-hospitality-industry/ https://mitsloan.mit.edu/ideas-made-to-matter/a-new-study-measures-actual-impact-robots-jobs-its-significant https://tcf.org/content/report/robots-beginning-affect-workers-wages/?agreed=1https://projectuntangled.eu/wp-content/uploads/2022/01/Untangled_The_Impact_of_Robots_on-Labour_Market_Transitions_in-Europe_11.01.pdf https://www.weforum.org/agenda/2019/03/women-face-greater-threat-from-job-automation-than-men https://www.imf.org/en/Blogs/Articles/2018/11/16/blog-Women-Technology-the-Future-of-Work#:~:text=On%20average%2C%20women%20face%20an,within%20the%20next%2020%20years https://www.imf.org/en/Publications/fandd/issues/2018/06/japan-labor-force-artificial-intelligence-and-robots-schneider https://hbr.org/2017/04/the-countries-most-and-least-likely-to-be-affected-by-automation https://www.ilo.org/wcmsp5/groups/public/---ed_emp/documents/publication/wcms_751599.pdf https://www.abilities.com/community/buzz/64b-jaco.html https://www.bcg.com/publications/2014/business-unit-strategy-innovation-rise-of-robotics https://www.arabianbusiness.com/industries/travel-hospitality/neom-will-open-futuristic-yotel-hotel-with-robot-concierge-in-2025 https://www.armyupress.army.mil/Journals/Military-Review/English-Edition-Archives/May-June-2017/Pros-and-Cons-of-Autonomous-Weapons-Systems/ https://autonomousweapons.org/ https://www.washingtonpost.com/technology/2022/07/16/racist-robots-ai/ https://dl.acm.org/doi/pdf/10.1145/3531146.3533138 https://www.fastcompany.com/90212508/even-black-robots-are-impacted-by-racism https://www.theguardian.com/inequality/2017/aug/08/rise-of-the-racist-robots-how-ai-is-learning-all-our-worst-impulses https://www.teslarati.com/ai-weapons-darpa-kaist-south-korea-boycott/ https://nexxis.com/overcoming-staff-resistance-to-working-with-robots/ https://www.stopkillerrobots.org/

Artificial intelligence is an integrative discipline that simulates human aptitudes and cognitive behavior. In other words, intelligent systems imitate human aptitudes in order to execute complicated tasks that are outside the limits of human cognitive competence while removing errors and reducing risks of bias that are commonly linked to human beings. There are several established AI applications available nowadays, such as expert systems, neural computing, genetic algorithms, artificial neural networks, etc. Artificial Intelligence’s use in the HR context Artificial intelligence is increasingly being used to enhance managerial decision-making and assist managers in speeding up their day-to-day tasks. Human Resource Management refers to a set of HR policies and related management practices in organizations. The application of AI technology to HRM can increase a company’s profits. The development and refinement of HRM efficiency through the use of AI tools has become an essential trend for the future development of HRM as a field. Artificial Intelligence in recruitment and talent selection AI is becoming more prominent in the HR field, particularly in recruitment and selection. It is crucial for companies to identify, attract, retain, and manage the right talents. Having a talented team and the appropriate tools within a company’s HR department will directly lead to increased profits, but making a rationally perfect decision when it comes to candidate selection is challenging. Traditional recruitment strategies and techniques are built on psychometric doctrines. In addition to that, there are objectivity issues and human biases during the planning and execution of the recruitment process. To avoid this potential problem, organizations have considerably increased their use of screening programs in the past years—smart software programs that offer companies the chance to minimize human bias during the whole screening process of profiles. Below are some examples of AI techniques leveraged by the HR industry: The “Knowledge-based search engine” is considered one of the most frequently adopted AI techniques when it comes to recruitment. The search engines identify the connotation of the search subject and search content on the web for suitable applicants´ profiles based on the keywords or grammatical tags of job advertisements and candidates’ profiles. This includes desired experience, credentials and qualifications, position title, etc. Another popular AI technique is Expert systems, which is considered relevant in Human Resource Information Systems (HRIS) and corporate decision-making and helps propose actions instead of developing opinions. An alternative technique that is widely employed in the recruitment field is “Data Mining” which is the process of searching and evaluating very large arrays of data and then pulling out the information from it. This specific technique is usually employed to identify keywords while screening a large volume of applicants´ resumes. A smart text-treating method employing text mining aimed at emotion analysis could be very useful when recruitment specialists are evaluating the applicants since it can give them a better idea of the candidates´ profiles by analyzing their emotions in a word-based context. HR leaders are also increasingly considering and adopting "Chatbots". Chatbots employ neural language to communicate with candidates via aural or textual approaches; they are intelligent solutions that systematize tasks that are time-consuming, such as sourcing, screening, and evaluating profiles. Chatbots will start an instantaneous interaction with the applicants as soon as they send their job applications. After evaluating the application, the software will conduct different evaluation tests and reply to questions raised by applicants. Studies have demonstrated that most job applicants would develop negative reactions if they did not obtain feedback from firms. Thus, chatbots can significantly enhance candidates´ experiences by eliminating the communication breach that commonly exists between recruitment specialists and candidates. Some of the contemporary chatbots employed in recruitment are Wendy, Mya, and HireVue. The use of AI technologies and machine learning in the recruitment and selection process is becoming more popular. In fact, recruitment specialists have started to use AI techniques and technologies while interviewing face-to-face potential candidates. Specific AI solutions that are accessible in the market target evaluating the performance of candidates through analyzing their video interviews. Some examples of such AI solutions are Hire Vue, Affectiva, or HireIQ. These smart technologies are used to study the facial expressions of candidates, the specific words they choose to use, the voice tone employed when answering specific questions, and even the communication style. They help recruitment professionals assess candidates´ emotional intelligence, trustworthiness, and reliability, as well as get a better interpretation of their personalities. With such AI solutions, recruiters can make more accurate decisions and rank candidates based on their suitability for the job proposed as well as their fit with regard to the company´s culture, thus avoiding the risk of a costly recruitment error for the organization. Recruitment function in danger? With so many promising benefits, there is no doubt that the use of artificial intelligence in recruitment and selection will grow significantly over time. However, substituting a large group of analytical managerial positions is quite a challenge. The use of artificial intelligence technologies and tools in the recruitment and selection process is likely to increase at both the intuitive and empathetic levels/stages. Intuitive intelligence tools such as chatbots are currently used to conduct first interviews and evaluate candidates´ potential. In the near future, organizations are very likely to start using expressive, sensitive, talkative, and extremely interactive machines with face and sound identification technology to perform face-to-face interviews. However, it is unlikely that artificial intelligence will be able to entirely substitute the recruiter´s occupation since the human touch will continue to be indispensable. That being said, regular dependence on artificial intelligence tools will considerably impact recruitment-related occupations within the HR fields, lowering the costs of employing several people to take care of different functions within the recruitment and selection process. Author: Kenza Abadi References https://lumenpublishing.com/journals/index.php/brain/article/view/2011 https://link.springer.com/book/10.1007/978-3-319-63820-1 https://www.sciencedirect.com/science/article/abs/pii/S0957417406002776 https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/four-fundamentals-of-workplace-automation https://econpapers.repec.org/article/idsijbisy/v_3a6_3ay_3a2010_3ai_3a4_3ap_3a444-462.htm https://www.researchgate.net/publication/337931190_WILL_ARTIFICIAL_INTELLIGENCE_TAKE_OVER_HUMANRESOURCES_RECRUITMENT_AND_SELECTION https://www.intechopen.com/chapters/10951 https://aisel.aisnet.org/cgi/viewcontent.cgi?article=1011&context=iceb2018 https://psycnet.apa.org/record/2002-04710-003 https://terrorgum.com/tfox/books/artificialintelligenceinthe21stcentury.pdf https://iajit.org/PDF/January%202018,%20No.%201/9605.pdf https://www.mheducation.com/highered/product/human-resource-management-gaining-competitive-advantage-noe-hollenbeck/M9781264188895.html https://psycnet.apa.org/record/1983-24691-001 https://www.springerprofessional.de/en/artificial-intelligence-techniques-in-human-resource-management-/2429550 https://www.atlantis-press.com/proceedings/jcis-06/46 https://www.researchgate.net/publication/334897991_Artificial_Intelligence_in_Human_Resources_Management_C_hallenges_and_a_Path_Forward

"The observation that patients with the same clinical diagnosis or symptoms respond differently to the same treatment has led to the development of Precision Medicine (PM), a novel therapeutic approach that relies on biological information and health data from patient tiers to develop tier-specific treatments that lead to better health outcomes." PM is the evolution of healthcare from a “one-cure-fits-all” strategy to the tailored development of precise medications targeted at specific individuals. It is a holistic approach to diagnosis and treatment in which traditional healthcare plays only a minor role in a patient's health, treating each patient as an individual and using his or her unique clinical data, genomic profile, family history, environmental factors, and lifestyle to more efficiently guide diagnosis, treatment, and prognosis Advancements in PM have been driven by the growing understanding of the biological pathways of diseases at the molecular level and the identification of novel biomarkers (a signature component detected in the blood, body fluids, or tissues, such as genes, proteins, etc.) that signal a normal or abnormal cascade of biological processes within the body. These biomarkers act as specific targets for more accurate diagnosis or more efficient treatment. The concept of PM is not new; oncology has been the main early adopter of this approach in treatment, such as with Xalkori from Pfizer. Wider adoption of PM in other therapeutic areas was limited, owing to the high associated costs and technological limitations in data access and utilization. However, the picture is changing due to rising demands to reduce escalating healthcare costs by reducing reliance on: Unnecessary, non-effective medications, especially for diseases (e.g., psychiatry, oncology, and rheumatology) that are commonly associated with high costs of prescription drugs and low response rates. Traditional diagnostic tools, which are characterized by low accuracy and limited detection of biomarkers, increasing the likelihood of subsequent medical interventions to treat complications. On the other hand, advanced diagnostics can screen millions of circulating biomarkers and detect early signs of diseases. A paradigm shift in the way drugs are developed and manufactured Pharmaceutical companies are under increasing pressure to justify the return on their R&D investments. A few years ago, they were reluctant to invest in R&D for PM due to the compromised commercial values associated with targeting limited populations. Nowadays, pharmaceutical companies are shifting their profit focus to price, not volume, as new drugs targeting niche populations can achieve higher selling prices with much lower marketing expenditures and more guaranteed sales. Big pharma companies can technically rely on their in-house manufacturing capabilities to produce precision therapies, but this is not economically viable because small batches of precision therapies will result in underutilized time, machinery, and resources. The traditional pharmaceutical manufacturing process relies on the production of several batches of high volumes of products to control costs and benefit from economies of scale. This cannot meet the complex needs of PM to produce a wider variety of batches of temperature-sensitive, complex products at lower volumes to serve a wider variety of patient populations. Flexible manufacturing and single-use technologies are emerging to provide companies and CDMOs (Contract Development and Manufacturing Organizations) with greater flexibility to manage the production of a variety of products in smaller batches by allowing companies to replace disposable single-use reactors for each medication. This not only reduces cross-contamination but also improves operational efficiency by significantly reducing the time needed to clean the reactors between different product lines. Advances in digital technology are key enablers for realizing the potential of PM For healthcare organizations to realize the full potential of PM, they must be able to collect enormous amounts of genomic, social, and physical data. They must also leverage modern technologies to transform this complex data into structured datasets that generate accurate insights regarding the best treatments while reducing time and errors. The following are key examples of high-potential technologies. Data analytics and AI: Advances in computational power enable the processing of huge amounts of data from various sources and provide valuable insights about the human body’s interactions with drugs. NLP technology: NLP created new opportunities for hospitals to leverage their data, an opportunity that was unattainable with humans alone. NLP can learn and understand the human language within the healthcare context more effectively and rapidly than humans. NLP then extracts valuable information from this vast unstructured data and translates it into more structured data sets ready for analysis. Digital biomarkers: They are physiological and behavioral data collected via digital devices such as wearables and portables. The widespread use of smartphones, along with the rapid development of sensor technologies, has enabled the accurate collection of health and wellness data in real-time. Digital biomarkers can disrupt traditional clinical assessments because objective and specific data is collected in real-life settings without any external bias. This increases the statistical power and increases the accuracy and sensitivity of the clinical results. A huge promise with challenges ahead Despite the unique potential PM can bring to public health, and how technology is making it more feasible than before, PM is not yet broadly integrated within healthcare systems due to some challenges such as: Quality of data: An average hospital produces around 50 petabytes of data annually (1 petabyte is equivalent to 11,000 4K movies). Most of this data is non-standardized and comes from multiple EHRs (Electronic Health Records) and disparate data repositories, making it very challenging and time-consuming to process and use. Economic value: Building an economic case for PM is not an easy task because advanced diagnostics and screening tests have much higher costs than traditional tests. Still, PM has strong potential to increase the efficiency of treatments, produce better outcomes, and thus reduce the overall costs of care. This is because PM eliminates the need for repeated diagnostic tests and the traditional trial-and-error approaches, which are more costly and less accurate. Capacity building: Physicians lack technological expertise and need to be trained and qualified to be able to interpret the data models built from genetic and biological markers via modern data analytics tools and technologies. Data privacy: PM involves the flow of enormous amounts of data among different stakeholders, and it is very critical to ensure the protection of such sensitive data and maintain patients’ privacy. Over the past decade, at least 14 countries have launched genomics-based medicine initiatives According to GlobeNewswire, the global PM market size was estimated at USD 65.89 billion in 2021 and is forecast to increase by a CAGR of 12.1% during 2022-2028, reaching USD 146.57 billion in 2028. Governments and insurance companies are strong advocates of PM to bring healthcare costs down and improve the quality of care, which are the essences of value-based healthcare models. In that sense, they have an important role in developing policies, regulatory reforms, and novel reimbursement plans to accelerate the transition of PM from research to clinical application. Over the past decade, at least 14 countries (Australia, Japan, the USA, the UK, Qatar, KSA, etc.) have collectively invested billions of dollars in large-scale projects to collect genomic and demographic data from thousands or even millions of citizens. These initiatives have great potential to accelerate the integration of genomics within healthcare systems and support the development of PM. Also, big pharma and technology companies are fostering strategic collaborations with strong investments to support the development of precision therapies, for example, in 2022: Google participated in a USD 65 million series A investment round for Vicinitas Therapeutics, which is a precision medicine startup for cancer and genetic disorders. Sanofi has entered into a research collaboration with Exscientia to leverage its AI-based capabilities and personalized medicine platform to develop a pipeline of precision-engineered therapies. Like any new disruptive technology, PM still has many hurdles to overcome, and the key to its success is to get all the ecosystem stakeholders (governments, insurers, pharma and biotech companies, technology providers, etc.) working in silos to collaborate, share resources, and establish standardization frameworks for the diverse data out there. Collaboration is also crucial to reducing costs and driving the development of a sustainable PM-based ecosystem. Author: Ghada Selim Sources: https://persmed.elpub.ru/jour/article/download/3/4 https://www.startus-insights.com/innovators-guide/top-10-pharma-industry-trends-innovations-in-2021/#precision-medicine https://www.thermofisher.com/eg/en/home/clinical/precision-medicine/precision-medicine-learning-center/precision-medicine-resource-library/precision-medicine-articles/overview-precision-medicine.html https://www.efpia.eu/about-medicines/development-of-medicines/precision-medicine/#/ https://www.iqvia.com/-/media/iqvia/pdfs/institute-reports/upholding-the-clinical-promise-of-precision-medicine.pdf https://www.iqvia.com/-/media/iqvia/pdfs/library/white-papers/linguamatics-nlp---precision-medicine-and-population-health.pdf https://www.forbes.com/sites/johnlamattina/2019/04/24/rare-disease-rd-investments-likely-to-grow-in-biopharma/?sh=32117c2274ba https://www.cancer.gov/publications/dictionaries/cancer-terms/def/biomarker https://www.mckinsey.com/industries/life-sciences/our-insights/what-are-the-biotech-investment-themes-that-will-shape-the-industry https://www.technologynetworks.com/biopharma/blog/downstream-processing-in-the-age-of-precision-medicine-trends-and-challenges-365452 https://www.linguamatics.com/solutions/precision-medicine https://www.infosys.com/about/knowledge-institute/insights/documents/precision-medicine.pdf https://www.mckinsey.com/~/media/mckinsey/dotcom/client_service/pharma%20and%20medical%20products/pmp%20new/pdfs/mckinsey%20on%20personalized%20medicine%20march%202013.pdf https://translational-medicine.biomedcentral.com/articles/10.1186/s12967-021-02910-6 https://www.globenewswire.com/news-release/2022/08/23/2503224/0/en/Global-Precision-Medicine-Market-Generate-Revenue-of-146-57-billion-2-68-Billion-Invested-in-R-D-Activities-in-2021-and-is-Projected-to-Expand-to-5-Billion-by-2028-SkyQuest.html https://techfundingnews.com/google-backs-65m-investment-in-precision-medicine-startup-for-cancer-and-genetic-disorders/ https://www.beckershospitalreview.com/healthcare-information-technology/google-backs-65m-funding-for-precision-medicine-startup.html https://www.sanofi.com/en/media-room/press-releases/2022/2022-01-07-06-00-00-2362917

Food production, specifically meat production, is responsible for nearly 60% of the planet-heating gases emitted by humans. In this article, we will explore the significant growth that the plant-based foods market has witnessed in the past few years, as well as its projected expansion over the next decade, highlighting major consumer trends that are driving this growth. How does meat consumption contribute to climate change? Greenhouse gases are gases that affect the earth’s temperature. The most known greenhouse gas is carbon dioxide (CO2). But there are other gases responsible for the greenhouse effect, such as methane, which is up to 34 times more damaging to the environment than CO2 if measured over 100 years; this ratio increases to 86 times more damaging if measured over 20 years. Livestock produces significant amounts of methane as part of their normal digestive processes, and when there is an overconsumption of cattle, there is a strong increase in gas emissions. According to recent studies, by 2050, global meat consumption is projected to reach between 460 million and 570 million tons, which is twice as high as in 2008. And clearly, the processing and transportation of this livestock generate further emissions. Emissions from livestock account for about 14.5 percent of total greenhouse gas emissions globally, and roughly 2/3 of those emissions come from cattle. Meat production is responsible for 57% of all food production emissions; 1 kilo of beef generates around 70 kg of greenhouse gas emissions. Meat production also contributes to the exhaustion of water resources. According to the UN, one quarter-pound burger requires around 1,500 liters of water. In addition to the gas emissions, raising meat requires a large quantity of feed, and cattle ranching requires millions of acres of land and monoculture crop fields to feed this livestock. Cattle ranching drives deforestation 5 times more than any other sector and is responsible for a great majority of the Amazon forests; estimates show that about 70% of its deforested land is used for cattle. Converting natural habitats to agricultural fields releases greenhouse gases that contribute to climate change. As a result of these facts, the plant-based movement has been growing as people understand the relationship between their food choices and the planet's health. From the planet’s perspective, plant-based foods would require 37% less water, and their production would generate significantly lower gas emissions. This is where the race for market share begins. Plant-based foods: the future? 2021 Bloomberg report: The plant-based food market globally is expected to reach $162 billion by 2030, up from $29.4 billion in 2020. A report published by Bloomberg in 2021 stated that global retail sales of plant-based food alternatives (meaning food that consists of all minimally processed fruits, vegetables, whole grains, legumes, nuts and seeds, herbs, and spices and excludes all animal products) may reach $162 billion by 2030, which is an increase of more than $100 billion compared to 2022. The plant-based market is growing 5 times faster than the overall food industry. In the Middle East and Africa, the plant-based meat and dairy products market is projected to witness a CAGR of ~6% from 2022 to 2027. As more people are moving toward a healthier and cleaner lifestyle, the term “flexitarian” (meaning a casual vegetarian) is growing fast. With 14% vegetarians and vegans worldwide and 15% flexitarians, this means that 29% of consumers globally are now embracing plant-based alternatives The Asia-Pacific region has the largest share of the global plant-based market, and with a growth scenario of around $51 billion from 2020 to 2030, its market could reach $64.8 billion. This growth is driven by cultural and demographic factors, since the region’s population is expected to exceed 5 billion people by 2030, increasing the demand for plant-based alternatives. Plant-based meat In 2025, the global meat market share is expected to reach 90% of the global meat supply, and this ratio is expected to decrease by 50% in 2040. While meat alternatives are expected to increase by around 15%, reaching 25% of sales during the same period, cultured meat (genuine meat that is produced by cultivating animal cells directly) is expected to increase by 35%. These predictions demonstrate the market potential of plant-based alternatives, and that plant-based and cell-based meat will account for most of the meat sold by 2040 (with a combined share of 60%). The Asia Pacific plant-based food market was valued at $17.1 billion in 2020 and is forecasted to grow at a CAGR of 15.9 percent between 2018 and 2026. With a market share of 37.9% in 2020, China dominates the Asian plant-based food market. On top of that, the Chinese government is planning to reduce meat consumption in the country by 50% by 2030. According to a study published in 2021 by DuPont Nutrition & Biosciences and IPSOS, demand for plant-based meat substitutes in China and Thailand is expected to increase by 200% by 2025. In the US, the plant-based food market reached $7 billion in sales in 2020, compared to $4.8 billion in 2018, recording a growth of 43%. The growth of plant-based food sales has outpaced the growth of total food sales by 2.5 times during that same period The table below illustrates the top 5 companies in meat alternatives by dollar share: In the Middle East, meat alternatives are increasing, for instance, UAE-based Halal food brand Al Islami launched its first vegan burger in 2021. In 2019, the global plant-based meat market reached $19 billion, with the Middle East accounting for $176.5 million, and was projected to grow by 4 to 5% annually until 2023. Plant-based milk The plant-based milk and derivatives market has already disrupted the dairy market and still has significant room for growth. Multiple factors are contributing to this growth potential, including lactose intolerance, and rising health concerns. According to the Food Intolerance Network, as much as 75% of the world’s population is lactose intolerant. Dairy products also contain high levels of saturated fats, which increases the risk of high cholesterol. As people are moving toward a healthier lifestyle, plant-based dairy alternatives have the potential to reach $68.8 billion by 2030, compared to their 2021 value of $25.2 billion, growing at a CAGR of 11.8% from 2022 to 2030 In the Asia-Pacific region, alternative dairy products are projected to make up 57% of the plant-based protein market by 2030 In the GCC region, 65% of consumers suffer from lactose intolerance, and 48% of consumers claim to prefer the taste of almond and oat milk to cow’s milk. Lulu hypermarket, a leading supermarket in the UAE, stated that the plant-based milk market has grown by 50% in 2020. New market access Millennials and Gen Z are more likely to become vegetarians and vegans, as they are more environmentally aware and have a strong sense of social responsibility. Regarding their consumption, 63% of Gen Zers consume a vegetarian or vegan meal at least once per month, and 44% do so once a week or more. According to a 2022 report, 79% of millennials and Gen Zers are already regularly eating plant-based. In the United States, while only 2.5% of Americans over the age of 50 consider themselves vegetarians, 7.5% of Millennials and Gen Z have given up meat. Since future consumers are millennials and Gen Z, companies are focusing on offering products that appeal to them." The plant-based food industry is rapidly expanding and capturing a sizable market share; it also shows promising growth potential over the next 10 years. Therefore, now is the time for companies to innovate and develop plant-based alternatives. Interest in alternative proteins, for instance, is increasing globally, as plants have limited environmental impacts and are a healthy alternative filled with protein. Although alternative proteins accounted for only 2% of the world protein market in 2020, they are expected to reach 12% by 2035. Pea protein, for instance, grew at a 30% CAGR from 2004 to 2019. Animal protein will stay prevalent in the market; this, however, does not eliminate the room for plant-based foods to grow and solidify their place in the market. According to a Bloomberg study, the plant-based food market is estimated to hit $162 billion in the next 10 years. Author: Dina AlGarf Sources: https://www.theguardian.com/environment/2021/sep/13/meat-greenhouses-gases-food-production-study https://www.myclimate.org/information/faq/faq-detail/what-are-greenhouse-gases/ https://unece.org/challenge https://news.un.org/en/story/2018/11/1025271 https://www.cleanwateraction.org/features/meat-industry-%E2%80%93-environmental-issues-solutions https://www.bbc.com/news/explainers-59232599 https://www.sustain.ucla.edu/food-systems/the-case-for-plant-based/#:~:text=Now%2C%20for%20those%20of%20you%20worried%20about%20protein%20content%3A&text=From%20a%20water%20perspective%2C%20using,to%20eat%20plant-based%20foods. https://www.forbes.com/sites/christophermarquis/2021/03/02/plant-based-foods-are-our-future-and-entrepreneurs-are-helping-us-make-the-shift/?sh=7dbeae5351f5 https://insideclimatenews.org/news/21102019/climate-change-meat-beef-dairy-methane-emissions-california/#:~:text=Emissions%20from%20livestock%20account%20for,for%20grazing%20and%20feed%20crops. https://www.theworldcounts.com/challenges/consumption/foods-and-beverages/world-consumption-of-meat/story https://www.washingtonpost.com/world/interactive/2022/amazon-beef-deforestation-brazil/ https://www.livekindly.co/middle-easts-vegan-food-market-growing-fast/ https://assets.bbhub.io/professional/sites/10/1102795_PlantBasedFoods.pdf https://foodspecialities.com/industry-news/dairy-ingredients-industry-news/high-margin-growth-opportunities-with-plant-based-milks/ https://cultivateinsights.com/2019/07/22/alternative-meats-could-be-60-of-the-market-by-2040/ https://gfi.org/marketresearch/ https://thevou.com/lifestyle/2019-the-world-of-vegan-but-how-many-vegans-are-in-the-world/#:~:text=Right%20now%2C%20the%20total%20number,percent%20of%20the%20world%20population. https://foodinstitute.com/focus/veganuary-2022-coincides-with-growing-flexitarian-trend/#:~:text=Flexitarians%20are%20more%20flexible.&text=It's%20estimated%2015%25%20of%20the%20population%20already%20is%20flexitarian. https://tradeinsights.amys.com/millennial-gen-z-buying-habits-spell-growing-opportunity-for-plant-based/ https://www.visualcapitalist.com/sp/how-does-animal-meat-compare-to-plant-based-meat/ https://www.bloomberg.com/company/press/plant-based-foods-market-to-hit-162-billion-in-next-decade-projects-bloomberg-intelligence/ https://www.mordorintelligence.com/industry-reports/middle-east-and-africa-plant-based-meat-and-dairy-products-industry https://web-assets.bcg.com/a0/28/4295860343c6a2a5b9f4e3436114/bcg-food-for-thought-the-protein-transformation-mar-2021.pdf https://www.plantbasedfoods.org/marketplace/retail-sales-data-2020/ https://www.globenewswire.com/news-release/2022/05/18/2446161/0/en/Plant-Based-Meat-Products-Market-Size-Worth-US-14-527-55Mn-Globally-by-2028-at-15-3-CAGR-Exclusive-Report-by-The-Insight-Partners.html https://www.globenewswire.com/news-release/2019/10/14/1929284/0/en/Plant-based-Meat-Market-To-Reach-USD-30-92-Billion-By-2026-Reports-And-Data.html https://www.globenewswire.com/en/news-release/2022/08/16/2499600/0/en/Dairy-Alternative-Market-Size-to-Hit-USD-68-79-Billion-by-2030.html#:~:text=The%20global%20dairy%20alternatives%20market,11.8%25%20from%202022%20to%202030.