Posts tagged ‘HFT’

Re-Questioning the Death of Buy & Hold Investing

Article originally posted September 17, 2010: At the time this original article was written, the Dow Jones Industrial Average was hovering around 11,500. Last week, the Dow closed at 20,624. Sure there have been plenty of ups and downs since 2010, but as I suggested seven years ago, perhaps “buy and hold” still is not dead today?

In the midst of the so-called “Lost Decade,” pundits continue to talk about the death of “buy and hold” (B&H) investing. I guess it probably makes sense to define B&H first before discussing it, but like most amorphous financial concepts, there is no clear cut definition. According to some strict B&H interpreters, B&H means buy and hold forever (i.e., buy today and carry to your grave). For other more forgiving Wall Street lexicon analysts, B&H could mean a multi-year timeframe. However, with the advent of high frequency trading (HFT) and supercomputers, the speed of trading has only accelerated further to milliseconds, microseconds, and even nanoseconds. Pretty soon B&H will be considered buying a stock and holding it for a day! Average mutual fund turnover (holding periods) has already declined from about 6 years in the 1950s to about 11 months in the 2000s according to John Bogle.

Technology and the lower costs associated with trading advancements arre obviously a key driver to shortened investment horizons, but even after these developments, professionals success in beating the market is less clear. Passive gurus Burton Malkiel and John Bogle have consistently asserted that 75% or more of professional money managers underperform benchmarks and passive investment vehicles (e.g., index funds and exchange traded funds).

This is not the first time that B&H has been held for dead. For example, BusinessWeek ran an article in August 1979 entitled The Death of Equities (see Magazine Cover article), which aimed to eradicate any stock market believers off the face of the planet. Sure enough, just a few years later, the market went on to advance on one of the greatest, if not the greatest, multi-decade bull market run in history. People repudiated themselves from B&H back then, and while B&H was in vogue during the 1980s and 1990s it is back to becoming the whipping boy today.

Excuse Me, But What About Bonds?

With all this talk about the demise of B&H and the rise of the HFT machines, I can’t help but wonder why B&H is dead in equities but alive and screaming in the bond market? Am I not mistaken, but has this not been the largest (or darn near largest) thirty-year bull market in bonds? The Federal Funds Rate has gone from 20% in 1981 to 0% thirty years later. Not a bad period to buy and hold, but I’m going to go out on a limb and say the Fed Funds won’t go from 0% to a negative -20% over the next thirty years.

Better Looking Corpse

There’s no denying the fact that equities have been a lousy place to be for the last ten years, and I have no clue what stocks will do for the next twelve months, but what I do know is that stocks offer a completely different value proposition today. At the beginning of the 2000, the market P/E (Price Earnings) valued earnings at a 29x multiple with the 10-year Treasury Note trading with a yield of about 6%. Today, the market trades at 13.5 x’s 2010 earnings estimates (12x’s 2011) and the 10-Year is trading at a level less than half the 2000 rate (2.75% today). Maybe stocks go nowhere for a while, but it’s difficult to dispute now that equities are at least much more attractive (less ugly) than the prices ten years ago. If B&H is dead, at least the corpse is looking a little better now.

As is usually the case, most generalizations are too simplistic in making a point. So in fully reviewing B&H, perhaps it’s not a bad idea of clarifying the two core beliefs underpinning the diehard buy and holders:

1) Buying and holding stocks is only wise if you are buying and holding good stocks.

2) Buying and holding stocks is not wise if you are buying and holding bad stocks.

Even in the face of a disastrous market environment, here are a few stocks that have met B&H rule #1:

Maybe buy and hold is not dead after all? Certainly, there have been plenty of stinking losing stocks to offset these winners. Regardless of the environment, if proper homework is completed, there is plenty of room to profitably resurrect stocks that are left for a buy and hold death by the so-called pundits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: At the time the article was originally written, Sidoxia Capital Management (SCM) and some of its clients owned certain exchange traded funds and AAPL, AMZN, ARMH, and NFLX, but at the time of publishing SCM had no direct position in GGP, APKT, KRO, AKAM, FFIV, OPEN, RVBD, BIDU, PCLN, CRM, FLS, GMCR, HANS, BYI, SWN (*2,901% is correct %), CTSH, CMI, ISRG, ESRX, or any other security referenced in this article. As of 2/19/17 – Sidoxia owned AAPL, AMZN, and was short NFLX. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Is the Stock Market Rigged? Yes…In Your Favor

Is the Market Rigged? The short answer is “yes”, but unlike gambling in Las Vegas, investing in the stock market rigs the odds in your favor. How can this be? The market is trading at record highs; the Federal Reserve is artificially inflating stocks with Quantitative easing (QE); there is global turmoil flaring up everywhere; and author Michael Lewis says the stock market is rigged with HFT – High Frequency Traders (see Lewis Sells Flash Boys Snake Oil). I freely admit the headlines have been scary, but scary headlines will always exist. More importantly for investors, they should be more focused on factors like record corporate profits (see Halftime Adjustments); near generationally-low interest rates; and reasonable valuation metrics like the price-earnings (P/E) ratios.

Even if you were to ignore these previously mentioned factors, one can use history as a guide for evidence that stocks are rigged in your favor. In fact, if you look at S&P 500 stock returns from 1928 (before the Great Depression) until today, you will see that stock prices are up +72.1% of the time on average.

If the public won at such a high rate in Las Vegas, the town would be broke and closed, with no sign of pyramids, Eiffel Towers, or 46-story water fountains. There’s a reason Las Vegas casinos collected $23 billion in 2013 – the odds are rigged against the public. Even Shaquille O’Neal would be better served by straying away from Vegas and concentrating on stocks. If Shaq could have improved his 52.7% career free-throw percentage to the 72.1% win rate for stocks, perhaps he would have earned a few more championship rings?

Considering a 72% winning percentage, conceptually a “Buy-and-Hold” strategy sounds pretty compelling. In the current market, I definitely feel this type of strategy could beat most market timing and day trading strategies over time. Even better than this strategy, a “Buy Winners-and-Hold Winners” strategy makes more sense. In other words, when investing, the question shouldn’t revolve around “when” to buy, but rather “what” to buy. At Sidoxia Capital Management we are primarily bottom up investors, so the appreciation potential of any security in our view is largely driven by factors such as valuation, earnings growth, and cash flows. With interest rates near record lows and a scarcity of attractive alternatives, the limited options actually make investing decisions much easier.

Scarcity of Alternatives Makes Investing Easier

U.S. investors moan and complain about our paltry 2.42% yield on the 10-Year Treasury Note, but how appetizing, on a risk-reward basis, does a 2.24% Irish 10-year government bond sound? Yes, this is the same country that needed a $100 billion+ bailout during the financial crisis. Better yet, how does a 1.05% yield or 0.51% yield sound on 10-year government treasury bonds from Germany and Japan, respectively? Moreover, what these minuscule yields don’t factor in is the potentially crippling interest rate risk investors will suffer when (not if) interest rates rise.

Fortunately, Sidoxia’s client portfolios are diversified across a broad range of asset classes. The quantitative results from our proprietary 5,000 SHGR (“Sugar”) security database continue to highlight the significant opportunities in the equities markets, relative to the previously discussed “bubblicious” parts of the fixed income markets. Worth noting, investors need to also remove their myopic blinders centered on U.S. large cap stocks. These companies dominate media channel discussions, however there are no shortage of other great opportunities in the broader investment universe, including such areas as small cap stocks, floating-rate bonds, real estate, commodities, emerging markets, alternative investments, etc.

I don’t mind listening to the bearish equity market calls for stock market collapses due to an inevitable Fed stimulus unwind, mean reverting corporate profit margins, or bubble bursting event in China. Nevertheless, when it comes to investing, there is always something to worry about. While there is always some uncertainty, the best investors love uncertainty because those environments create the most opportunities. Stocks can and eventually will go down, but rather than irresponsibly flailing around in and out of risk-on and risk-off trades to time the market (see Market Timing Treadmill), we will continue to steward our clients’ money into areas where we see the best risk-reward prospects.

For those other investors sitting on the sidelines due to market fears, I commend you for coming to the proper conclusion that stock markets are rigged. Now you just need to understand stocks are rigged for you (not against you)…at least 72% of the time.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold a range of exchange traded fund positions, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Lewis Sells Flash Boys Snake Oil

I know what you’re saying, “Please, not another article on Michael Lewis’s Flash Boys book and high frequency trading (HFT),” but I can’t resist putting in my two cents after the well-known author emphatically proclaimed the stock market as “rigged.” Lewis is not alone with his outrageous claims… Clark Stanley (“The Rattlesnake King”) made equally outlandish claims in the early 1900s when he sold lucrative Snake Oil Liniment to heal the ailments of the masses. Ultimately Stanley’s assets were seized by the government and the healing assertions of his snake oil were proven fraudulent. Like Stanley, Lewis’s over-the-top comments about HFT traders are now being scrutinized under a microscope by more thoughtful critics than Steve Kroft from 60 Minutes (see television profile). For a more detailed counterpoint, see the Reuters interview with Manoj Narang (Tradeworx) and Haim Bodek (Decimus Capital Markets).

While Lewis may not be selling snake oil, the cash register is still ringing with book sales until the real truth is disseminated. In the meantime, Lewis continues to laugh to the bank as he makes misleading and deceptive claims, just like his snake oil selling predecessors.

The Inside Perspective

Regardless of what side of the fence you fall on, the debate created by Lewis’s book has created deafening controversy. Joining the jihad against HFT is industry veteran Charles Schwab, who distributed a press release calling HFT a “growing cancer” and stating the following:

“High-frequency trading has run amok and is corrupting our capital market system by creating an unleveled playing field for individual investors and driving the wrong incentives for our commodity and equities exchanges.”

What Charles Schwab doesn’t admit is that their firm is receiving about $100 million in annual revenues to direct Schwab client orders to the same HFT traders at exchanges in so called “payment-for-order-flow” contracts. Another term to describe this practice would be “kick-backs”.

While Michael Lewis screams bloody murder over investors getting fraudulently skimmed, some other industry legends, including the godfather of index funds, Vanguard founder Jack Bogle, argue that Lewis’s views are too extreme. Bogle reasons, “Main Street is the great beneficiary…We are better off with high-frequency trading than we are without it.”

Like Jack Bogle, other investors who should be pointing the finger at HFT traders are instead patting them on the back. Cliff Asness, managing and founding principal of AQR Capital Management, an institutional investment firm managing about $100 billion in assets, had this to say about HFT in his Wall Street Journal Op-Ed:

“How do we feel about high-frequency trading? We think it helps us. It seems to have reduced our costs and may enable us to manage more investment dollars… on the whole high-frequency traders have lowered costs.”

Is HFT Good for Main Street?

Many investors today have already forgotten, or were too young to remember, that stocks used to be priced in fractions before technology narrowed spreads to decimal points in the 1990s. Who has benefited from all this technology? You guessed it…everyone.

Lewis makes the case that the case that all investors are negatively impacted by HFT, including Main Street (individual) investors. Asness maintains costs have been significantly lowered for individual investors:

“For the first time in history, Main Street might have it rigged against Wall Street.”

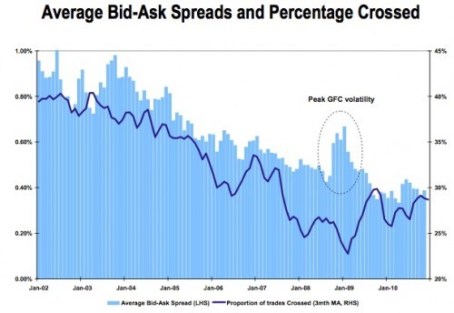

In Flash Boys, Lewis claims HFT traders unscrupulously scalp pennies per share from retail investor pockets by using privileged information to jump in front of ordinary investors (“front-run”). The reality, even if you believe Lewis’s contentions are true, is that technology has turned any perceived detrimental penny-sized skimming scheme into beneficial bucks for ordinary investors. For example, trades that used to cost $40, $50, $100, or more per transaction at the large wirehouse brokerage firms can today be purchased at discount brokerage firms for $7 or less. What’s more, the spread (i.e., the profits available for middlemen) used to be measured in increments of 1/8, 1/4, and 1/2 , when today the spreads are measured in pennies or fractions of pennies. Without any rational explanation, Lewis also dismisses the fact that HFT traders add valuable liquidity to the market. His argument of adding “volume and not liquidity” would make sense if HFT traders only transacted solely with other HFT traders, but that is obviously not the case.

Regardless, as you can see from the chart below, the trend in spreads over the last decade or so has been on a steady, downward, investor-friendly slope.

Source: Business Insider

How Did We Get Here? And What’s Wrong with HFT?

Similarly to our country’s 73,954 page I.R.S. tax code, the complexity of our financial market trading structure rivals that of our government’s money collection system. The painting of all HFT traders as villains by Lewis is no truer than painting all taxpayers as crooks. Just as there are plenty of crooked and deceitful individuals that push the boundaries of our income tax system, so too are there traders that try to take advantage of an inefficient, Byzantine exchange system. The mere presence of some tax dodgers doesn’t mean that all taxpayers should go to jail, nor should all HFT traders be crucified by the SEC (Securities and Exchange Commission) police.

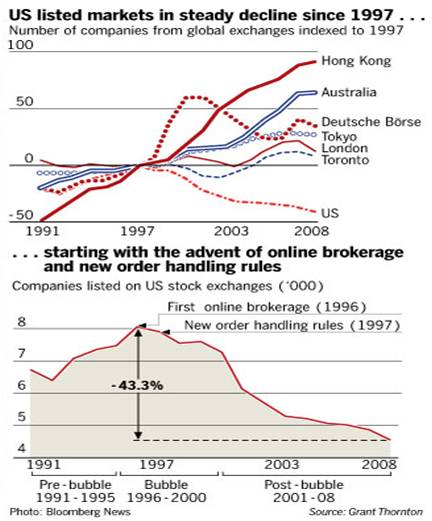

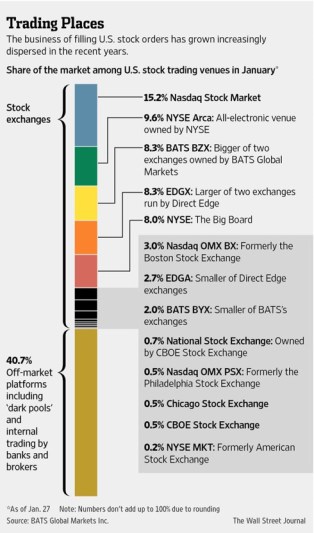

The heightened convoluted nature to our country’s exchange-based financial system can be traced back to the establishment of Regulation NMS, which was passed by the SEC in 2005 and implemented in 2007. The aim of this regulatory structure was designed to level the playing field through fairer trade execution and the creation of equal access to transparent price quotations. However, rather than leveling the playing field, the government destroyed the playing field and fragmented it into many convoluted pieces (i.e., exchanges) – see Wall Street Journal article and chart below.

Source: Wall Street Journal

The new Reg NMS competition came in the form of exchanges like BATS and Direct Edge (now merging), but the new multi-faceted structures introduced fresh loopholes for HFT traders to exploit – for both themselves and investors. More specifically, HFT traders used expensive, lightning-fast fiber optic cables; privileged access to data centers physically located adjacent to trading exchanges; and then they integrated algorithmic software code to efficiently route orders for best execution.

Are many of these HFT traders and software programs attempting to anticipate market direction? Certainly. As the WSJ excerpt below explains, these traders are shrewdly putting their capitalist genes to the profit-making test:

Computerized firms called high-frequency traders try to pick up clues about what the big players are doing through techniques such as repeatedly placing and instantly canceling thousands of stock orders to detect demand. If such a firm’s algorithm detects that a mutual fund is loading up on a certain stock, the firm’s computers may decide the stock is worth more and can rush to buy it first. That process can make the purchase costlier for the mutual fund.

Like any highly profitable business, success eventually attracts competition, and that is exactly what has happened with high frequency trading. To appreciate this fact, all one need to do is look at Goldman Sachs’s actions, which is to leave the NYSE (New York Stock Exchange), shutter its HFT dark pool trading platform (Sigma X), and join IEX, the dark pool created by Brad Katsuyama, the hero placed on a pedestal by Lewis in Flash Boys. Goldman is putting on their “we’re doing what’s best for investors” face on, but more experienced veterans understand that Goldman and all the other HFT traders are mostly just greedy S.O.B.s looking out for their best interests. The calculus is straightforward: As costs of implementing HFT have plummeted, the profit potential has dried up, and the remaining competitors have been left to fend for their Darwinian survival. The TABB Group, a financial markets’ research and consulting firm, estimates that US equity HFT revenues have declined from approximately $7.2 billion in 2009 to about $1.3 billion in 2014. As costs for co-locating HFT hardware next to an exchange have plummeted from millions of dollars to as low as $1,000 per month, the HFT market has opened their doors to anyone with a checkbook, programmer, and a pulse. That wasn’t the case a handful of years ago.

The Fixes

Admittedly, not everything is hearts and flowers in HFT land. The Flash Crash of 2010 highlighted how fragmented, convoluted, and opaque our market system has become since Reg NMS was implemented. And although “circuit breaker” remedies have helped prevent a replicated occurrence, there is still room for improvement.

What are some of the solutions? Here are a few ideas:

- Reform complicated Reg NMS rules – competition is good, complexity is not.

- Overhaul disclosure around “payment-for-order-flow” contracts (rebates), so potential conflicts of interest can be exposed.

- Stop inefficient wasteful “quote stuffing” practices by HFT traders.

- Speed up and improve the quality of the SIP (Security Information Processor), so the gaps between SIP and the direct feed data from exchanges are minimized.

- Improve tracking and transparency, which can weed out shady players and lower probabilities of another Flash Crash-like event.

These shortcomings of HFT trading do not mean the market is “rigged”, but like our overwhelmingly complex tax system, there is plenty of room for improvement. Another pet peeve of mine is Lewis’s infatuation with stocks. If he really thinks the stock market is rigged, then he should write his next book on the less efficient markets of bonds, futures, and other over-the-counter derivatives. This is much more fertile ground for corruption.

As a former manager of a $20 billion fund, I understand the complications firsthand faced by large institutional investors. In an ever-changing game of cat and mouse, investors of all sizes will continue looking to execute trades at the best prices (lowest possible purchase and highest possible sales price), while middlemen traders will persist with their ambition to exploit the spread (generate profits between the bid and ask prices). Improvements in technology will always afford a temporary advantage for a few, but in the long-run the benefits for all investors have been undeniable. The same undeniable benefits can’t be said for reading Michael Lewis’s Flash Boys. Like Clark Stanley and other snake oil salesmen before him, it will only take time for the real truth to come out about Lewis’s “rigged” stock market claims.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold long positions in certain exchange traded funds (ETFs), but at the time of publishing SCM had no direct position in GS, SCHW, ICE, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Doing the Opposite – Slow Frequency Trading

The business of robot trading, or so-called high-frequency trading (HFT) has grabbed a lot of headlines recently. The recent exposé released by 60 Minutes on the subject has only fanned the flames, which have been blazing harder since the May 6th “flash crash” earlier this year. The SEC is still working through proposed rule changes and regulatory reforms in hopes of preventing a similar crash that saw the Dow Jones Industrial Index almost fall 1,000 points in fifteen minutes, only to recover much of those losses minutes later.

The debate will rage on about the fairness of HFT (read more), but let’s not confuse active day-trading with high-frequency trading. In the case of HFT, the traders are actually getting paid to trade with the assistance of “liquidity rebates.” In exchange for the service of providing liquidity, these computer-based trading companies are earning cold, hard cash. Wouldn’t that be nice if individual day traders got paid money too for trading, rather than flushing commissions down the toilet?

Rather than warn unsuspecting working class Americans of the dangers of trading, discount brokerages and other trading firms peddle talking babies, loud music, back-testing voodoo software, and the prospect of discovering a profit elixir. As it turns out, investing is like weight loss…easy to understand, but difficult to execute. There’s no such thing as a miracle drug or chocolate diet that will shed pounds off your frame, just like there is no miracle trading system that will instantaneously generate millions in profits.

Doing the Opposite

Rather than succumb to the vagaries of the market, investors would be better served by following the mantra of character George Costanza from the hit, comedic television show Seinfeld. In the classic episode, astutely captured by Josh Brown (The Reformed Broker) and also cataloged in chapter four of my book, George realizes that all his instincts are wrong and discovers the road to success can be achieved by doing everything in an opposite fashion. George goes on to flaunt his contrarian approach when he runs into a blonde bombshell at the diner. Rather than boast about his accomplishments, George fesses up to his professional shortcomings by revealing his unemployment status and admitting that he lives at home with his parents. No need to worry, this strategy captivates her and results in George immediately getting the girl. George doesn’t stop there; during the same episode he gets his way with New York Yankee owner, George Steinbrenner, by telling him off. Before long, George is generating big bucks and making key decisions for the organization.

The same contrarian instincts of George apply to the investing world. Resisting the urge to follow the herd is key. The grass is greener and the eating more abundant away from animal pack. Investor extraordinaire Warren Buffett encapsulates the idea in the following advice, “Be fearful when others are greedy, and be greedy when others are fearful.”

There will constantly be an urge to trade frequently and chase performance, whether you’re talking about technology stocks during the boom, real estate five years ago, or the perceived safe-haven of Treasuries and gold today. The melody sounds so beautiful, until the music stops and prices come crashing back down to Earth. If you want to win in the losing game of the financial markets, do yourself a favor and become a slow frequency trader – George would be proud of you doing the opposite.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Questioning the Death of Buy & Hold Investing

In the midst of the so-called “Lost Decade,” pundits continue to talk about the death of “buy and hold” (B&H) investing. I guess it probably makes sense to define B&H first before discussing it, but like most amorphous financial concepts, there is no clear cut definition. According to some strict B&H interpreters, B&H means buy and hold forever (i.e., buy today and carry to your grave). For other more forgiving Wall Street lexicon analysts, B&H could mean a multi-year timeframe. However, with the advent of high frequency trading (HFT) and supercomputers, the speed of trading has only accelerated further to milliseconds, microseconds, and even nanoseconds. Pretty soon B&H will be considered buying a stock and holding it for a day! Average mutual fund turnover (holding periods) has already declined from about 6 years in the 1950s to about 11 months in the 2000s according to John Bogle.

Technology and the lower costs associated with trading advancements is obviously a key driver to shortened investment horizons, but even after these developments, professionals success in beating the market is less clear. Passive gurus Burton Malkiel and John Bogle have consistently asserted that 75% or more of professional money managers underperform benchmarks and passive investment vehicles (e.g., index funds and exchange traded funds).

This is not the first time that B&H has been held for dead. For example, BusinessWeek ran an article in August 1979 entitled The Death of Equities (see Magazine Cover article), which aimed to eradicate any stock market believers off the face of the planet. Sure enough, just a few years later, the market went on to advance on one of the greatest, if not the greatest, multi-decade bull market run in history. People repudiated themselves from B&H back then, and while B&H was in vogue during the 1980s and 1990s it is back to becoming the whipping boy today.

Excuse Me, But What About Bonds?

With all this talk about the demise of B&H and the rise of the HFT machines, I can’t help but wonder why B&H is dead in equities but alive and screaming in the bond market? Am I not mistaken, but has this not been the largest (or darn near largest) thirty year bull market in bonds? The Federal Funds Rate has gone from 20% in 1981 to 0% thirty years later. Not a bad period to buy and hold, but I’m going to go out on a limb and say the Fed Funds won’t go from 0% to a negative -20% over the next thirty years.

Better Looking Corpse

There’s no denying the fact that equities have been a lousy place to be for the last ten years, and I have no clue what stocks will do for the next twelve months, but what I do know is that stocks offer a completely different value proposition today. At the beginning of the 2000, the market P/E (Price Earnings) valued earnings at a 29x multiple with the 10-year Treasury Note trading with a yield of about 6%. Today, the market trades at 13.5 x’s 2010 earnings estimates (12x’s 2011) and the 10-Year is trading at a level less than half the 2000 rate (2.75% today). Maybe stocks go nowhere for a while, but it’s difficult to dispute now that equities are at least much more attractive (less ugly) than the prices ten years ago. If B&H is dead, at least the corpse is looking a little better now.

As is usually the case, most generalizations are too simplistic in making a point. So in fully reviewing B&H, perhaps it’s not a bad idea of clarifying the two core beliefs underpinning the diehard buy and holders:

1) Buying and holding stocks is only wise if you are buying and holding good stocks.

2) Buying and holding stocks is not wise if you are buying and holding bad stocks.

Even in the face of a disastrous market environment, here are a few stocks that have met B&H rule #1:

Maybe buy and hold is not dead after all? Certainly there have been plenty of stinking losing stocks to offset these winners. Regardless of the environment, if proper homework is completed, there is plenty of room to profitably resurrect stocks that are left for a buy and hold death by the so-called pundits.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds and AAPL, AMZN, ARMH, and NFLX, but at the time of publishing SCM had no direct position in GGP, APKT, KRO, AKAM, FFIV, OPEN, RVBD, BIDU, PCLN, CRM, FLS, GMCR, HANS, BYI, SWN (*2,901% is correct %), CTSH, CMI, ISRG, ESRX, or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

Making +457,425,000% – 13 Minutes at a Time

I love investing, but sometimes the shear boredom can get a little tiresome. I mean, a puny little -500 point collapse in the Dow Jones Industrial Average every five minutes can be so 1987. Thank goodness for yesterday’s largest, intra-day point-drop in history (almost 1,000 points) because without out such a meltdown, I might fall asleep at the trading desk and there would be no way to make an annualized +457,425,000% (~457 million percent) trade in a single day. Earning a well-deserved return like that will not only exceed the rates achieved on T-Bills, but will also likely outpace inflation as well. Making that kind of money is not bad work, if you can get it.

Executing the Tricky Trade

Sound difficult to do? Well, not really. All you need to do is find a stock or security that has fallen more than 99% in a single day, then buy the security for 10 cents per share and then sell it immediately, minutes later at $61.09. Repeat this process another 390 times per day for 52 weeks, and you’re well on your way of turning $1 into $4.5 million over a year.

Take for example, the iShares Russell 1000 Value Exchange Traded Fund (ETF), IWD, which yesterday traded for pennies at 3:47 p.m. Eastern Standard Time (EST) and skyrocketed over +600x fold in the subsequent 13 minutes. Fortunately (or unfortunately), depending on how you perceive the situation, the irregular trading activity was not limited to IWD. Other securities showing severe abnormal trading patterns include, Accenture (ACN), Boston Beer (SAM), Exelon (EXC), CenterPoint Energy (CNP), Eagle Material (EXP), Genpact Ltd (G), ITC Holdings (ITC), Brown & Brown (BRO), and Casey’s General (CASY). In full disclosure, I did not take advantage of any 99% pullbacks yesterday, but now that I know how the game works, I will be on full alert.

What the F*%$# Happened?

Initially reports pointed to a Citigroup (C) trader who entered into an inadvertent $16 billion (with a “b”) E-Mini futures trade order, when the trader meant to enter a trade for $16 million (with an “m”)…ooops! This alleged transaction purportedly triggered a wave of selling, culminating in a select group of stocks temporarily trading down to pennies in value. There is a related, yet more plausible, potential explanation. Quite possibly, as a function of excessive trading volume overwhelming the New York Stock Exchange, the overflow of trades migrated to less liquid ECNs (Electronic Communication Networks) and over-the-counter markets. Chances are the high frequency traders were not blindly jumping in front of the train. Whom really got screwed were the retail investors that had stop loss orders at “market” prices, which likely were triggered at unattractive prices.

I’m not sure if we will ever find out what truly happened, but whatever explanations are provided, rest assured there will be multiple more conspiracy theories on top of the legitimate guesses. The top 5 conspiracies I’m pushing are the following:

1) Frustrated by the fraud charges filed by the SEC (Securities and Exchange Commission), Goldman Sachs intentionally tripped over a power cord at the New York Stock Exchange (NYSE), which triggered a wave of bogus trades.

2) High Frequency Traders (see HFT Article) were upgrading their computers from Windows Vista to Windows 7 and experienced an outage causing global disruption.

3) In order to pay for the potential upcoming lawsuit liabilities and SEC fines, Goldman shorted the Dow Jones Industrial index at 10,800 and then went long once the index broke 10,000.

4) Warren Buffett was rumored to suffer a heart attack, but after realizing belching relieved his chest pain, the markets recovered dramatically.

5) Worried that regulatory reform may not pass, a secret group of Congressmen shorted stocks (see Do As I Say, Not As I Do article) to push stocks lower, then distributed TARP (Troubled Asset Relief Program) assets to voters minutes later in order to buy November votes and push stock prices higher.

Political Aftermath

Politicians will be frothing at the mouth or be pressured into approving financial reform. Even if markets manage to stabilize in the coming days and weeks, the pressure to ram regulatory reform through Capitol Hill will be mind-numbing. Mary Shapiro, Chairman of the SEC, and politicians will also be pushing to produce a clear scapegoat to throw under the bus, whether it is a trader at Citi, a high frequency traders at Goldman Sachs, the CEO at the NYSE (Duncan Niederauer), or a talking baby from the E-TRADE commercials. Regardless, depending on how quickly a credible explanation is unearthed, we will know how much, if any, reform is needed. If the markets are genuinely transparent, following the paper trail of responsibility to the stocks that dropped to $.00 or $.01 a share should be a piece of cake. If the systems are too complex to explain why handfuls of stocks are trading to $0, then even I am willing to look up to the skies and say heaven help us with some tighter oversight.

Over the last few years, there have been very few dull, financial moments and the markets did very little to disappoint yesterday. Irrespective of the political mudslinging, scapegoating, or irresponsible behavior, the SEC needs to get to the bottom of these issues rapidly in order to protect the integrity and trust of global players in our markets. What we don’t need is a political knee-jerk reaction that merely creates unintended, negative consequences. No matter what happens, I will at least be equipped to test a new strategy designed to make +457,425,000%.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

*DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct positions in GS, IWD, C, BRKA/B, CNP, EXP, G, ITC, BRO, and CASY, or any security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.

High Frequency Trading: Buggy Whip Deja Vu

Innovation can be a thorn in the side of dying legacy industries. With the advent of the internal combustion engine from Swiss inventor Isaac de Riva (1807) and the subsequent introduction of Henry Ford’s affordable Model-T automobile (1908), the buggy whip industry came under assault and eventually disappeared. I’m sure the candle lobbyists weren’t too happy either when Thomas Edison first presented the light bulb (1879).

Legacy broker dealers and floor traders are suffering similar pains as those in the buggy whip industry did. New competitors are shrewdly exploiting technology in the field of High Frequency Trading (HFT) and as a result are gaining tremendous market share. Supercomputers and complex mathematical algorithms have now invaded the financial market exchanges, shrinking the profit pools of slow-moving, fat-cat broker dealers (a.k.a., Slow Frequency Traders – SFT) by simply trading faster and smarter than the legacy dealers and exchanges. As Dan Akroyd says to Eddie Murphy in the movie Trading Places, before making millions on the commodities trading floor, “It’s either kill, or be killed.” And right now it’s the traditional broker dealers and floor traders that are getting killed. According to a study by the Tabb Group, 73% of U.S. daily equity volume currently comes from high frequency traders (up from 30% in 2005). And despite only representing 2% of the relevant, actively trading financial institutions, the HFT industry generated an estimated $21 billion in profits last year.

HFT Controversy: So what’s the big controversy regarding HFT? Critics of these high speed traders (including Joe Saluzzi at Themis Trading) claim the fast traders are unfairly using the technology for selfish, greedy profit motives, and in the process are disadvantaging investors. Screams of “front-running,” effectively using the information obtained from fast computer processes to surreptitiously trade before poor, unassuming individual investors can react, is a foundational argument used by opponents. Also the detractors argue that the additional liquidity (traditionally considered a positive factor by academics) provided by the HFT-ers is “low-quality” liquidity because the fast trades are believed to suck valuable liquidity out of the system and contribute to heightened volatility. HFT participants are equated to aggressive ticket scalpers, who in the real world buy low priced tickets and later gouge legitimate buyers by reselling the original tickets at outrageously high prices.

Rebuttal:

- On HFT Price Impact: If HFT is so damaging for individual investors, then why have price spreads narrowed so dramatically since the existence of this fast style of trading? The computerization and decimalization of trading has made trading more efficient – much like ATM machines and e-mail have made banking and document mailing more efficient. Investors can buy at lower prices and sell at higher prices – sounds like a beneficial trend to me.

- On HFT Volatility: If HFT-ers are demonized for the market crash, then why isn’t anyone patting them on the back or buying them a drink for the ~+50% surge in the equity markets since March of this year? Maybe the investment banks that were levered 30x’s, or the $100s of billions in unregulated mortgage debt stand to shoulder more of the volatility blame?

- On HFT Price Discovery: At the end of the day, if HFT partakers (robots) are actually manipulating prices, then reasonable and greedy capitalists (humans) will stabilize prices by either scooping up irrationally low-priced stocks and/or selling short illogically high priced securities.

On HFT Front-Running and Flash Orders: The New York Times recently ran an article describing a very specific one sided scenario where “flash orders” tipped off HFT traders to unfairly exploit a profitable trade in Broadcom (BRCM) stock. However, trades do not occur in a vacuum. Other scenarios could have easily been drawn up to show HFT-ers losing money on their computer-based strategy. “Quite possibly these flash orders are happening as an unintended consequence of an automated algorithmic trading program,” says Alex Green, Managing Partner at AMG Advisory Group, an institutional trading consulting firm. Flash orders are used when trying to display an order for a small amount of time while waiting to be displayed in the National Best Bid Best Offer (the bid-ask quotes viewable to the public).

In addition, if front-running is indeed occurring, it is happening at prices between the bid-ask spread, thereby incentivizing other market makers to lower their offer price and raise their bid price (a positive development for investors). Any trading occurring outside the bounds of nationally displayed regulated price quotes constitutes illegal activity and can result in time behind bars.

Common Ground – Dark Pools: One area I believe I share common ground with the SFT-ers is on the issue of “dark pools.” In this murky realm, trading occurs in pools of anonymous buyers and sellers where no price quotes are displayed. These pools are bound by the same regulations as other exchanges, but due to their opaqueness are more difficult to police. According to a recent WSJ article, intensified scrutiny has fallen on these dark pools by the SEC because a large number flash orders are routed to them. Although flash orders may not in and of itself be a problem, there is more room for potential abuse in these dark pools.

Conclusion: When all is said and done, it is very clear to me that innovation through technology has translated into a huge gain for individual and institutional investors. It may take a PhD to write the code for a complex high frequency trading algorithm, however it doesn’t take a genius to figure out spreads have narrowed and liquidity has risen dramatically over the last decade – thanks in large part to HFT technological innovation. Certainly technology, globalization, along with the introduction of electronic communication networks (ECNs) like Direct Edge, flash orders, and dark pools have made trading complex. With a denser group of players and structures, it is important that SEC Chairman Mary Schapiro continue to regulate financial market exchanges with the aim of improved transparency and equality. As long as the trends of heightened liquidity and narrowed spreads continue, investors will benefit while the buggy whip lobbyists (legacy broker dealers and floor traders) will continue to scream.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.