A loophole in the sanctions

Sanctioned goods of almost all types, worth billions of dollars, are imported into Russia. Verstka conducted an investigation

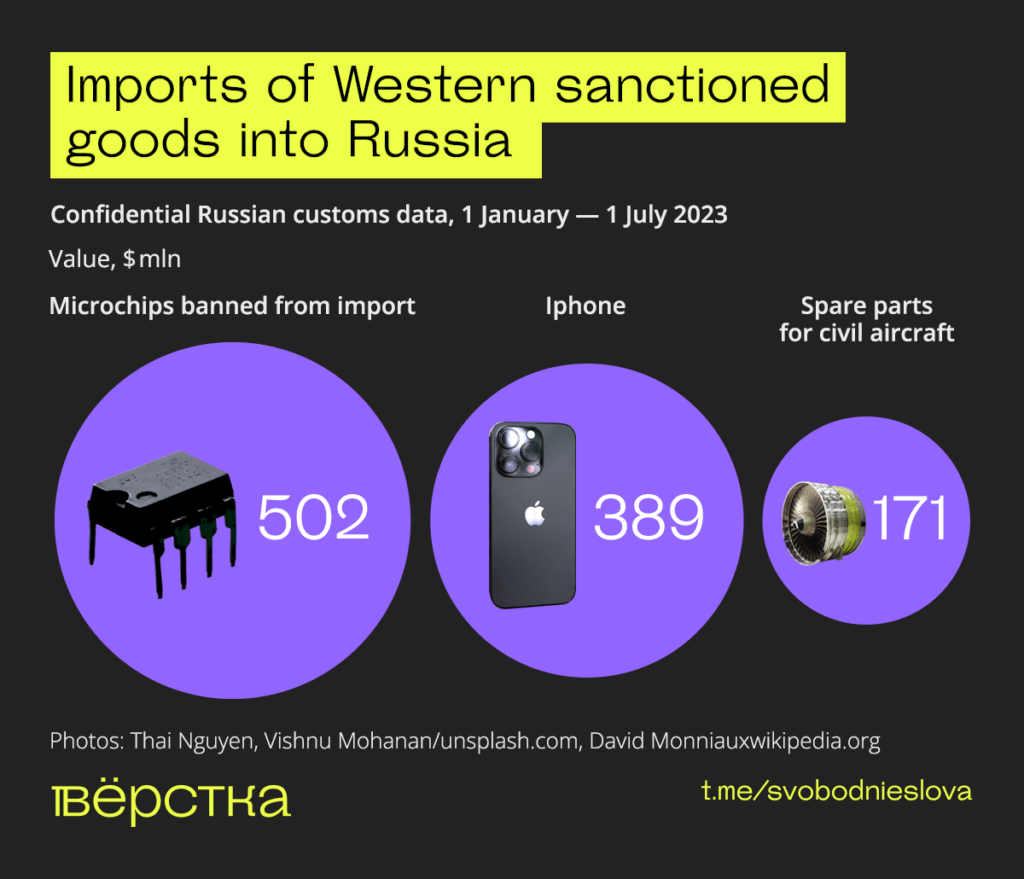

Over $502m worth of Western microchips, which are banned for import into Russia and used in missiles and other weapons, entered Russia in the previous six months. Also imported were millions of dollars’ worth of machine tools for the arms industry, at least $171m worth of Western spare parts for civil aircraft, and $389m worth of iPhones. Verstka analysed confidential Russian customs data, calculated the volume of sanctioned goods imported into Russia, and interviewed logisticians, freight forwarders and businessmen who outlined the schemes of illegal import.

Subscribe to Verstka’s Telegram channel so that you do not miss our new publications.

Contents

- Which goods for the arms industry are imported despite the sanctions

- How Russia solved the problem of the sanctioned civil aviation

- Why there is no shortage of iPhones in Russia and the prices for them have barely increased

- How do the illegal supply schemes work and which countries are involved

- What is «the Chinese hub»

After Russia started the war in Ukraine, it was heavily sanctioned by the USA and the EU. Immediately after the war started, it seemed that the industrial production in Russia, including the arms industry, and the Russian companies will be cut off from critically important foreign technologies. European and American goods were expected to disappear from store shelves. However, none of this happened.

Since the beginning of the war, the Russian government classified a large portion of statistical data; among others, the foreign trade statistics are no longer published. Verstka used confidential Russian customs data to calculate the volume of sanctioned goods since the start of 2023. This data, unlike the providers of customs records usually employed for such research (such as Import Genius), allowed us to estimate imports into Russia in real time and at a larger scale. We gave estimates for sanctioned goods used in both the arms industry and the civilian sector, such as aircraft parts and smartphones. We analysed the period from 1 January until 1 July 2023.

Over 13,500 restrictions and prohibitions were put on Russian citizens, companies and economy sectors since 24 February 2022, Castellum.AI has counted. Together with the sanctions imposed because of Sergei Magnitsky’s death and the annexation of Crimea, the total number exceeds 16,000. Russia tops the list of the most sanctioned countries: the number of sanctions put on Iran is more than three times lower.

Our investigation showed that almost any product produced in any part of the world can be imported into Russia — from dual-use microchips to a turbojet engine for an Airbus plane. Western companies are involved in import schemes through third countries, and the Russian government successfully circumvents European and American sanctions.

How Russia obtains new missiles and modern weapons

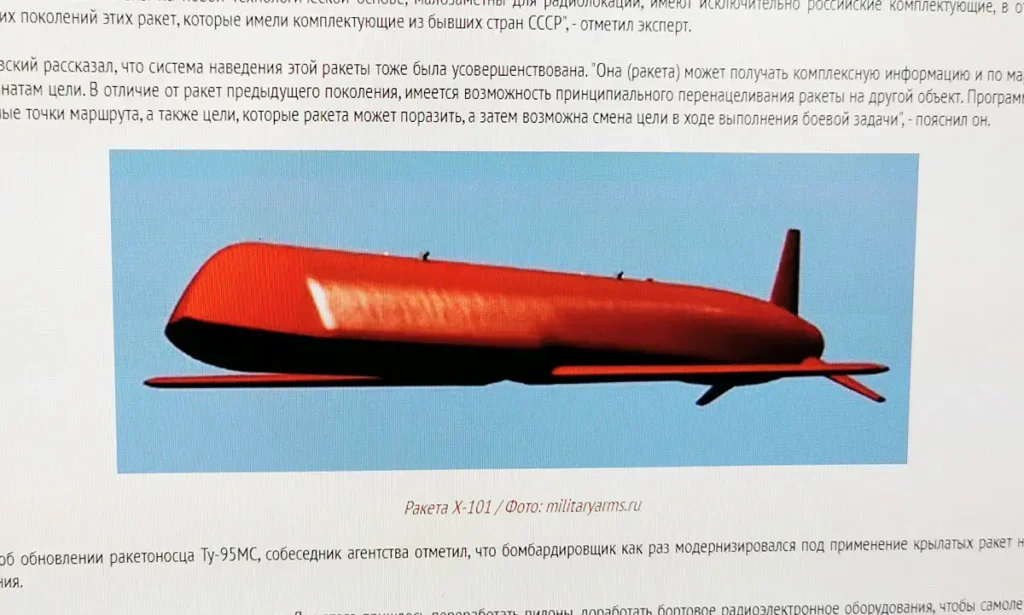

Dual-use goods became the first to be sanctioned. The Russian arms industry is critically dependent on foreign microchips and microprocessors. For example, strategic cruise missile Kh-101, one of the most modern missiles in the arsenal of the Russian armyi, contains an Intel processor, microchips produced by Xilinx and Texas Instruments, as well as a transceiver from Analog Devices Inc i. Kh-101 is produced by MKB Raduga, a subsidiary of Tactical Missiles Corporation.

All these electronic components are still freely imported into Russia. Customs data shows that, in the last 6 months, Russian authorities gave customs clearance for components produced by Analog Devices Inc. (with a total value of more than $98m), Xilinx (more than $75m), Microchip Technology (more than $42m) and Texas Instruments (at least $38m). All these companies are American. Components produced by Infineon, the largest semiconductors manufacturer in Germany, were imported for a total value of over $28m. Among other companies whose products entered Russia are Marvell, a microchip manufacturer (more than $11m), Cypress Semiconductor (more than $3.8m) and Atmel (more than $2.7m).

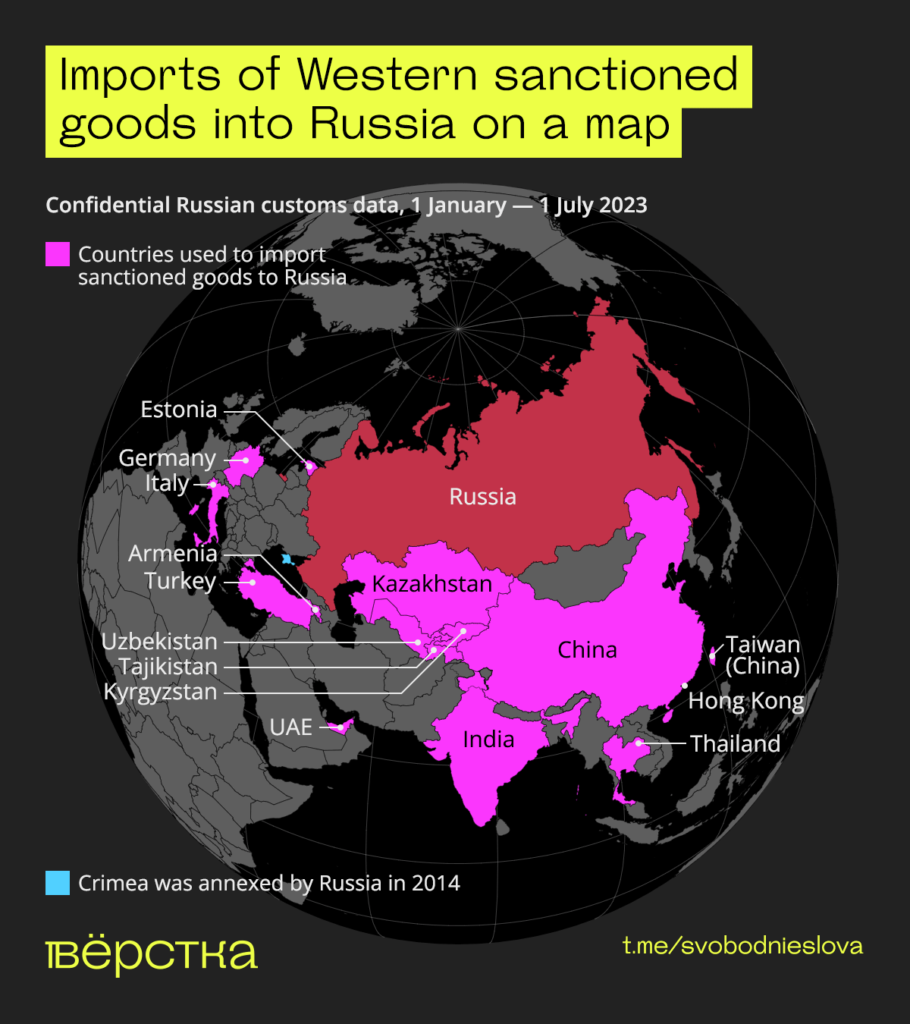

Besides that, Intel and AMD products were imported (both companies are American), including microprocessors, with total values of more than $169m and $35m respectively. Almost all Western electronics are transported into Russia through China and Hong Kong. For example, the three largest consignors of Intel components are Hong Kong companies: Time Art International Limited (shipped goods worth almost $40m), Union Tech Inc. Limited (more than $17m) and Dexp International Limited (almost $15m).

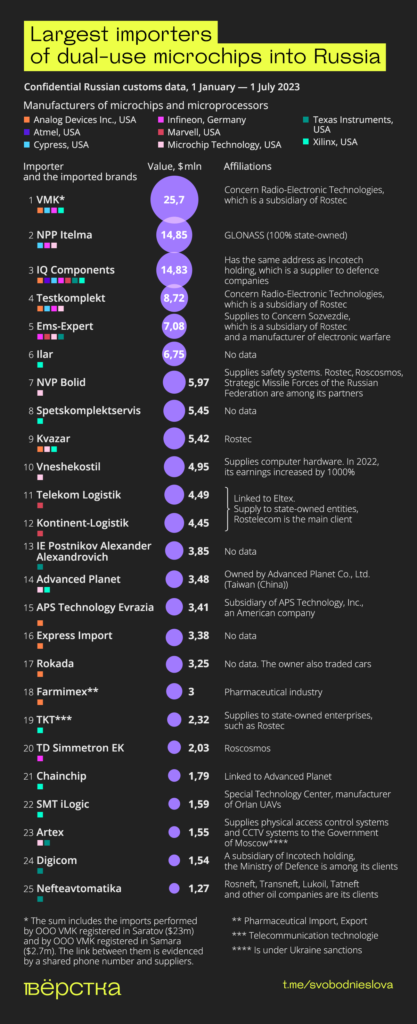

Hundreds of companies import dual-use microchips into Russia. Verstka compiled a list of the largest microchip importers. We identified that 11 out of 25 leaders, including the top five, are direct suppliers to defence companies.

The complete list of the 25 largest importers can be found here.

Two companies from the top five (iStories reported on their involvement in supplies to defence companies) have been sanctioned by the US. These are VMK and Testkomplekt, which import Analog Devices Inc. products and work as suppliers with subsidiaries of Rostec, a state-owned industrial conglomerate. The sanctions imposed in January have not been an obstacle to their business activities. Since the start of the year, these companies have imported components for a total value of almost $20m. VMK and Testkomplekt receive goods through companies located in China and Hong Kong. For example, Tordan Industry Limited, a company from Hong Kong, is the main trading partner for VMK. In June, the EU put sanctions on Tordan Industry Limited. VMK is also the largest merchant of Xilinx microchips, having imported over $10m worth of electronics produced by this US company.

These are not the only importers of key electronic components. Kvazar is another large importer of Analog Devices Inc. products: since the year started, Kvazar has imported $3.3m worth of these components. Kvazar has multiple suppliers, which are primarily located in China and Hong Kong. The biggest shipment, worth over $870k, was sent in January by LL Electronic Limited, a Hong Kong company. The shipment was paid for in US dollars and arrived from Thailand. However, Kvazar also had partners in Europe. For example, Elmec Trade OU, an Estonian company, transported at least $250k worth of illegal electronics into Russia from January to May. The US government sanctioned both Kvazar and Elmec Trade OU in May this year. Nevertheless, Kvazar continued to freely import components through China. In June, the same company, LL Electronic Limited, shipped $200k worth of components produced by Analog Devices Inc. to their Russian partner. This time, the components were shipped directly from China.

IQ Components is another company among the top 10 largest importers of products manufactured by Analog Devices Inc., Texas Instruments, and Xilinx. It imported more than $13.8m worth of components produced by these three companies alone. All imports were made through China and Hong Kong i . The phone number on the IQ Components website is the same of another company, Incotech. Incotech does not hide its links to the Russian arms industry. Some of the components it manufactures are used in military radiolocation systems. Incotech’s co-founder, Pavel Grishanovich, is under US sanctions since 2012.

Xilinx microchips are used not only in missiles. SMT iLogic, a company which forms part of the supplier chain for the manufacturing of Orlan UAVs, has imported almost $1.6m worth of Xilinx microchips. Among its consignors are two Chinese companies and Margi̇ana Inşaat Diş Ticaret Li̇mi̇ted Şi̇rketi̇, a Turkish company.

Ranzhir-M1, command posts for surface-to-air missile (SAM) batteries, are produced by Radiozavod, a subsidiary of Rostec. One of the suppliers to Radiozavod, TD Simmetron EK, is also one of the largest importers of German microchips produced by Infineon. Since the year started, TD Simmetron EK has imported $2m worth of these components. This company is directly linked to the Russian arms industry. It is a part of Simmetron, an electronics holding company, but in May — June 2023 its owners changed. Igor Sukhanov was a co-owner of TD Simmetron EK when it was sanctioned. Sukhanov graduated from the Voenmekh institute in Saint Petersburg and started his career at Severny Press factory, one of his colleagues recalls. At Severny Press, the first prototypes of seeker heads for Oniks missiles were adjustedi.

Verstka estimates that in total, over $502m worth of Western microchips has been imported into Russia since the start of 2023.

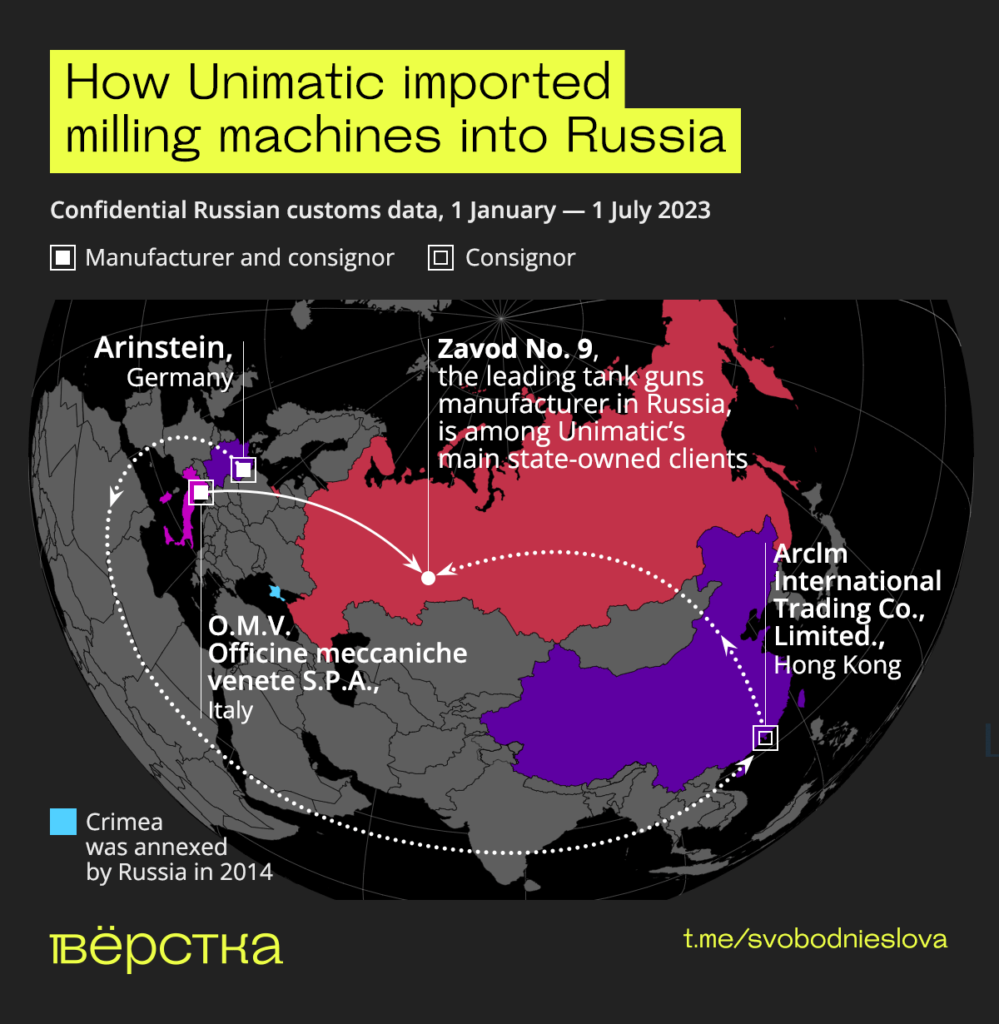

Microchips are not the only type of sanctioned goods badly needed by the Russian military — industrial complex. Hundreds of goods categories crucial for the Russian arms industry are sanctioned. Machine tools are among them. For example, at least $5m worth of machine tools produced by O. M. V., an Italian company, and Arinstein, a German company, has been freely imported into Russia by a company called Unimatic since the year started. In some cases, machines were shipped directly from the manufacturer. For instance, in May, Unimatic imported milling machines. They were shipped from Italy by O. M. V. Officine itself even though this specific category of goods is under EU export controls. Zavod No. 9, the leading manufacturer of tank guns in Russia, is among Unimatic’s main state-owned clients. As for the German machines produced by Arinstein, they were shipped from China by Arclm International Trading Company Limited, a Hong Kong company.

Simpler military components are also imported. For example, 52,400 telescopic sights produced in China, the US and Japan, worth $9m, were imported into Russia in 2023 by a company named Pointer. Pointer works with Russian security agencies: in 2021, it provided shooting supplies to the Federal Protective Service (FSO). Another company, CitiImpex, imported 150 Chinese thermal imagers worth $1m. i.

The largest shipment of thermal weapon sights was performed by ART-ELV: it imported 15,728 items with a total value of $13.5m: each item was priced at between 40,000 and 740,000 Russian roubles ($410‑7700 per the current exchange rate). ART-ELV is a wholesale supplier of thermal imaging equipment manufactured by Yantai Iray, a Chinese company.

How Russian planes remain in operation

Russian civil aviation is one of the industries most harmed by sanctions. Russian airlines lost access to international routes, leasing, maintenance, new foreign planes, and insurance instruments. At the end of 2022, the International Civil Aviation Organization (ICAO), which is part of the UN structure, issued a «red flag» to Russia, citing potential problems with safety. The only other countries with a «red flag» are Bhutan, Liberia, and the Democratic Republic of the Congo.

Nevertheless, it appears that Russian airlines managed to solve the most critical problem: a shortage of spare parts. As the customs data shows, any parts can be imported into Russia through parallel import.

Verstka calculated that the four largest Russian airlines — Aeroflot, S7, Pobeda and Rossiya, — have imported into Russia aircraft spare parts worth $47m, $35m, $13m and $15m respectively since the year started. Almost all of these spare parts were manufactured in the West. For example, Aeroflot imported spare parts produced by US companies Honeywell ($7.5m), Woodward ($4.5m) and Boeing ($2.5m), as well as $4.5m worth of spare parts produced by Safran Nacelles, a French company.

A whole turbojet engine for the Airbus А319/А320/A321 family was imported into Russia in March 2023 by Globus, a subsidiary of S7. These engines are produced by CFM International, a Franco-American joint venture. The price for such an engine starts at $7.5m. This particular engine was shipped by DLA (GZ) Technology Company Limited, a Chinese company. Its website states that the company’s core business is «to ‘repair’ and ‘supply’ aircrafts and parts» and that it is «the leader in area of recycling and remanufacturing the retired aircrafts in P. R. China». Meanwhile, half of the website sections are missing. Also in March, S7 imported into Russia an engine for the Embraer E170 passenger jet, which is produced by General Electric, a US company. This engine is worth around $4.4m. This time, the engine was shipped by Desert Sun Supply, a company registered in the UAE.

In January this year, Pobeda imported two shipments of non-military radiolocation equipment produced by Honeywell and worth over $580k. A Trade Service, an Armenian company, was the consignor both times. The shipment was delivered by air from the UAE. Since the year started, Pobeda imported spare parts produced by Honeywell (worth over $3.5m in total), Rockwell Collins Inc and Boeing (worth over $2m in total).

Rossiya imported over $6m worth of spare parts produced by Honeywell alone. For example, in February this airline received a shipment of pressure measurement equipment worth over $1.2m. The equipment was shipped by Yunnan Rongjin Agriculture China Products, a Chinese company.

Not all airlines order spare parts directly. Sometimes other companies do it for them. For instance, a small company named Protektor has seen huge success since the sanctions were introduced. In 2022 alone its earnings soared by 1000%. Since the start of 2023, Protektor imported aircraft spare parts worth at least $61m, including six jet engines for Boeing 767, Boeing 737 and Airbus A320. Each of these engines is priced in the range of $1.9m to $10m. They are manufactured by CFM and General Electric. The engines were shipped by two UAE companies: Desert Sun Supply (it also supplies spare parts to S7) and Jam Jum Supply. Protektor also imported two helicopter engines for AS350 Écureuil, a French helicopter. These were produced by Turbomeca, a French company, and shipped by KHWA Wang Parts, a Thai company.

How iPhones stay in steady supply in Russia at barely increased prices

In 2021, over 30 million smartphones were imported into Russia. After the war started, both Apple and Samsung announced a suspension of shipments to Russia. At the time, these two brands accounted for more than 40% of the whole smartphone market in Russia. In the first half of 2022, the imports of smartphones into Russia dropped by 38%. By the end of the year, it recovered, but only partially. The Russian smartphone market shrank by 19% during the first year of the war as compared to 2021.

However, the shares of Apple and Samsung almost did not change. By the end of 2022, one in five smartphones sold in Russia was produced by Samsung, and one in ten smartphones was still produced by Apple. Smartphone prices only increased by 3%.

For a long time after the war started, importing iPhones into Russia was perfectly legal. Finally, on February 25 this year, the US government banned the export of smartphones worth over $300 into Russia. Using customs data, Verstka counted that since February 25 over $389m worth of iPhones were imported into Russia. They were mainly ordered from the UAE. This number only includes the shipments officially declared to Russian customs. Some iPhones enter Russia through grey import (it is described in more detail in a separate section).

How the grey import of iPhones works

Grey import into Russia was functioning long before the sanctions. In these schemes, goods enter Russia and clear customs as if these are different goods or as if their prices are lower. Gorbushka, a famous electronics market in Moscow, has always had one of the lowest prices in Russia specifically because the products sold there were grey-imported.

The schemes were designed in the 1990s and keep functioning until this day. This is how they work. 100 – 150 devices, for example, Apple devices, are bought through a middleman company registered in a country with the lowest price for these devices, such as the USA or Thailand. After that, goods can be grey-imported into Russia in several ways. First, you can pay lower taxes if you cut a deal with customs officers and declare a lower price for the goods, as if the iPhones were bought for 100$ each rather than for 1000$. Second, the goods can be classified under a cheaper category: not as smartphones, but as something similar. It is possible to get iPhones through customs clearance «as if they are bricks», but that would be “outrageous”, an ex-employee of the customs service says, because «at least some logic has to be followed».

Small-size electronics can be brought into the country by chelnoki, «shuttle traders», a profession which has been around for a long time. Such a person travels to the UAE as a regular tourist (tax regulations in the UAE are less strict, so Apple products are cheaper) and buys four or five smartphones for a total price of no more than $10,000 so they can avoid declaring these goods at the Russian customs. Then they fill out the tax-free forms and bring smartphones to Russia in an ordinary suitcase. The scheme was described to Verstka by a store owner at Gorbushka.

Other electronic devices also continue to freely enter Russia. Among them are Dell devices. This US company was the main supplier of server hardware into Russia before the war. In August last year, Dell ceased all Russian operations. However, since the start of 2023, more than $88m worth of Dell products were imported into Russia. Servers and spare parts for them were imported by companies registered in China, Hong Kong, India, Turkey, Thailand and the UAE.

Subscribe to Verstka’s Telegram channel so that you do not miss our new publications.

How sanctioned goods are imported

At the basic level, all schemes for importing sanctioned goods into Russia have the same structure. Several people involved in parallel import have told Verstka that first, a company is registered in a third country. Then this company buys the desired goods on the internal market or orders them directly from the manufacturer and re-exports them into Russia. These companies may be registered by both Russian and foreign citizens. A company with a foreign founder is more reliable because some suppliers pay attention to that, several people involved in parallel import have told Verstka.

Businessmen working in the field of re-exporting prefer registering middleman companies in a neutral country with a large economy and an active foreign trade, such as China or India. Countries are also picked based on the category of goods and shipment volumes. For electronics, China and Hong Kong are most widely chosen.

Taha Mousavi/unsplash. com

For some shipments, importers use the UAE and post-Soviet countries, such as Kazakhstan, Kyrgyzstan, Armenia and Uzbekistan. The schemes for each country are different, businessmen interviewed by Verstka say. For example, a shipment from Armenia, if it is too big to be transported by air, is exported by land to Iran. From there, it is carried by ships across the Caspian Sea to Astrakhan port. The route is so complex because Armenia does not have a land border with Russia; Georgia lies between them. In Georgia, problems might occur if you are transporting sanctioned goods, says Armen, a logistician in Right-Flow.

Some goods enter Russia through small businesses and in smaller shipments. Armen notes: «Bringing some kind of reagents or equipment is easy. Problems arise when the shipment is big. For example, if it is in a shipping container. Then China and India are involved.» He describes the nature of parallel import: «The routes that in the earlier days were used for small shipments are now used for all imports into Russia.»

After the war started, the volume of imports into Russia began to drop and reached its lowest point in April 2022. However, by September it went back to the pre-war levels because new countries took the roles of importers. By October 2022, imports from Europe and the US into Russia dropped by 50% and 80% respectively, Silverado analysts calculated. The positions left vacant by Europeans and Americans were filled in by China, Turkey and CIS countries. Trade volumes with these countries soared. For example, Armenian exports into Russia increased by 187% in 2022 and reached $2.37b. Kazakhstani exports increased by 25% in 2022 and totalled $8.78b. Kyrgyz exports increased by 250% and surpassed $960m. One of the growth factors is transit of sanctioned goods.

Anything can still be imported to Russia, says Sergey, a businessman. Sergey brings to Russia all kinds of sanctioned goods, including spare parts for cars. There are always several possible routes, he says, such as through China, Turkey and post-Soviet countries. There are also several payment options, he adds.

Payment options are an integral part of any parallel import scheme, importers interviewed by Verstka note. One of the easiest options used to pay for relatively small purchases — up to several million dollars — is through offsetting debts. This option can be used by an organization which owns companies registered in Russia and several other countries. Their client brings roubles to the Russian company. In turn, the foreign company, registered in China, the UAE or maybe in Kyrgyzstan, buys in its name the goods for the client. Sergey gives an example: «Right now we are working on a freight that we should pay for in the Netherlands. The payment is made through Hong Kong. My friends own a company with offices and warehouses both in Hong Kong and Russia. I simply give them the money here in Moscow, and they pay for the freight through their Hong Kong company.» Sergey adds that his freight will be transported into Russia through Tajikistan.

These «intermediaries» make money as well. A Russian company cannot register a subsidiary abroad. It contacts people who can provide this service and pays them a share of the profits. The share is between 1.5% and 5%, several businessmen who make a profit by helping with payments for imports told Verstka.

Interbank transfers, a more traditional payment method, are also used. For Chinese goods, Russian importers sometimes do not even need an intermediary. They can order products directly from the factory and pay for them per invoices through SWIFT in yuan, one of the importers working with China told Verstka. However, if goods are ordered through China from Europe or the USA, a Chinese company is needed: this company orders the products and then re-exports them. The importer added that the company’s beneficiary must be a Chinese citizen: «If you let a European company know that a Russian citizen is the beneficiary, they turn the offer down immediately.» Such companies are often registered in Hong Kong because a money transfer from Hong Kong can reach any part of the world within 24 hours, the interviewed importer notes.

However, not all Chinese banks accept transfers from Russia. A major bank, such as the Agricultural Bank of China (ABC), will not get involved because this is an international bank with branches in the US and the UK, and it does not need extra problems. Smaller banks, «which are lesser known, like Guangdong Bank, will be happy to receive Russian money», the importer says.

Parallel import schemes work both ways. Russian goods banned for import into Western countries, such as petroleum products, enter Europe through similar routes. After the war started, Russian exports of petroleum products into African countries surged more than tenfold, S&P Global notes in a recent analysis. These countries, in turn, re-export these products to Europe.

The Chinese Trade Road

China is the key hub for importing sanctioned goods into Russia. Products shipped from China cover a large number of various Russian needs, not only military ones. Some of these products are re-exported sanctioned goods from the USA and Europe. The schemes of Chinese imports are a good illustration for the whole «industry».

A businessman working with China gave Verstka the following example. A Chinese company orders tractors from the USA for itself or for subsequent shipment to India or another country. The tractors arrive at Shekou and Guangzhou. He claims that these ports are widely known for the fact that it is always possible to «get things done»» there. When the ship enters the port, the Chinese company suddenly decides to find a new buyer, not in India, or even to reject the shipment in favour of another buyer. Then, while still in the port, these tractors «are loaded into other containers, re-exported to Vladivostok or Sakhalin and transported by railway from there», the businessman tells. Until the goods are in the duty-free zone, until they have not crossed the border, have not left the port, the whole affair can be arranged right there. If the goods leave the port, the affair becomes far more difficult.

«And a foreign consignor, which is located in Denver, for example, and which shipped tractors to a Chinese buyer, fulfilled its contract obligations: it sees that a Chinese company paid for all goods. The ship-owner sees that the cargo entered the port and was unloaded there. After that, it’s hard to trace the goods. The original containers [in which the tractors were brought in] belong to Evergreen, for example, and they are sent along new routes, while the Chinese containers [in which the tractors are now] are shipped to the Far East, to Sakhalin», the businessman narrates.

He adds that the ports in the Russian Far East are currently so busy with Chinese ships that they look more like domestic Chinese ports: «If you say the word ‘Vladivostok’ to a Chinese man now, first, he pretends that he doesn’t understand, and then says, ‘Aah! Haishenwai!’» (Haishenwai was the name for the current Vladivostok area when it was controlled by China, until the middle of the 19th century.) «This did not happen two years ago, and now the Chinese even correct you», he notes.

The interviewed businessman mentions Japan as an example of a country which controls re-exporting. He tells: «The control is extremely strict. They check the freight destination and the ordering company ten times. After that, they even send representatives to the factories: ‘We shipped you ten boxes of such and such products.’ These representatives come and check: did these products actually arrive at the factory? are they installed here? The Japanese are pedants. Meanwhile, in the USA — China business, pfft, shipments flow both ways and nobody cares.»

Goods produced in China itself are also actively imported into Russia. Russian military volunteers and civil organisations which send supplies to the Russian forces in Ukraine work with China directly.

After the war started, a lot of companies started importing supplies for Russian soldiers and selling them to volunteer organisations, which deliver these supplies to the frontline, Roman Alekhin, a businessman from Kursk, told Verstka. Roman is one of these volunteers. He says that the imports are performed by «patriotic companies» and many of them deliver goods with no markup. «Prominent volunteer groups no longer buy products from retailers and on Avito [a Russian website with classified advertisements], as they did at the start of the operation», Roman explains.

He lists product categories imported from China: drones, anti-drone guns, walkie-talkies, various spare parts, medical supplies, anaesthetic equipment, etc. Roman claims that, for a Russian buyer, getting a shipment from China is not much harder than getting a shipment from a distant Russian city. «There are many middlemen, Russians, in every province of China. You call them, tell them what you need, and they get it for you», Roman explains.

Verstka interviewed a businessman who imports Chinese products used for the war in Ukraine. Before the war started, he registered a company in China together with a Chinese citizen. They specified construction as the main business scope. However, in the past few months, the company has gone beyond this scope and also occasionally buys Chinese DJI drones for the Russian army. There are several types of DJI drones: there are amateur drones, and there are professional drones which can record videos from a greater distance or even at night. These drones are used for various purposes: gun laying, adjusting artillery fire, reconnaissance and even dropping explosives. Most bird’s‑eye-view videos of the war in Ukraine you have seen were most likely recorded with DJI drones.

SZ DJI Technology Company Limited, the Chinese company which produces these drones, announced a suspension of their imports into Russia back in April last year. However, it freely sells them to Chinese companies co-founded by Russian citizens, several interviewees told Verstka. Moreover, it is possible to get a good discount if you order several shipments. DJI Mavic 3, the cheapest drone suitable for reconnaissance, will cost around 200,000 roubles ($2080) if imported directly from China, interviewees told Verstka. The retailers’ prices are almost two times higher: for comparison, an authorized DJI retailer in Russia sells Mavic 3 drones for almost 345,000 roubles ($3600).

Not only drones but also other military equipment can be bought in China. For example, the entire Russian communications depend on imports, an interviewee admits. He describes the procurement process: «My men arrived at the factory for the first time, they came in. They saw a showroom which is around a kilometre long. They looked at the prices: $150 for an [active] headset. [These headsets are used by artillerists.] They wanted to place an order. But when the Chinese discovered why we need it [that is, for the war in Ukraine], they said: wrong door, you should use a different door, and a Chinese person should come in. In that room, the same headsets are stored in less pretty packages and do not have an American license mark. The price is now $19 if you order in bulk.» Not only Russians but also those who support Ukraine do business with Chinese companies on these terms. For example, the same businessman told Verstka that he «saw Polish guys at the next table», who were ordering equipment and gear for the Ukrainian army.

Most of these goods enter Russia through official channels, but sometimes importers have to resort to grey schemes. “For many products, such as walkie-talkies, it takes a long time to get a certificate [in Russia]”, an importer explains. He says that Kazakhstan is an active route for grey import, that is, importing goods without customs clearance or registering them under a different category. «The fastest and ‘blackest’ delivery method is by road», another interviewee told Verstka. It is easy to hide several boxes of goods in a regular passenger car or in a semi-truck filled with packages. These boxes will be unnoticed, or ignored if you grease the right palm. “A lot of this black [import]” is performed directly through the Russian — Chinese border, he adds.

The interviewed person transports the goods needed by the Russian military but does not make a profit from the parallel import. At first, he only transported goods for the volunteers. Next, he told us, he was contacted by governments of several Russian oblasts. «They made a request for their men, and we equipped them. Then was the *** oblast — I fully equipped them too, with drones, helmets, thermal imagers», he claims. He uses his connections to speed up customs clearance. «I have contacts within the FTS [the Federal Customs Service] and with senators. When I am shipping a consignment, I make a call, tell them that I need this and that to clear customs, and they do it for me within 24 hours», he says.

Since the start of the war in Ukraine, more and more often it is said that sanctions against Russia do not work the intended way. Russia manages to bypass them. The latest package of sanctions, the 11th one already, which was adopted by the EU at the end of June, includes a mechanism for imposing restrictions on third countries which help Russia bypass sanctions. This mechanism includes «last-resort measures»: restricting the sales of goods to the countries which violate the sanctions.

Importing goods into Russia is now more difficult than last year, says Armen, a logistician. Suppliers started to take preventive measures. This is because manufacturers calculate sales statistics per country. And they see that the volume of sales into Turkey suddenly doubled. Some companies, after seeing such anomalies, may place limits on sales into Turkey. «They break the chain at the wholesaler step, not the import into Russia itself», Armen explains. This was done, for example, by a manufacturer of geological equipment: its products were transported by an intermediary of Right-Flow. In situations like that, importers need to find transit routes through other countries, which leads to an increase in prices. Full control over exports to Russia is only possible in cooperation with the private sector, Silverado experts concluded in their report.

Infographics: Elle