- Home

- Visiting Costa Rica

- Money

Search this site

Costa Rica Money

The official Costa Rica money is called the Colon (pronounced ko-lone) and the plural is Colones, (ko-lo-nays). The first thing that you will notice are the vibrant colors, varying sizes and tribute to both important people and nature.

The Colon

Coin denominations are 5, 10, 25, 50, 100 and 500 colones. Bills are 1000, 2000, 5000, 10000, 20000 and 50000 colones. Bills are denoted in units of MIL, or one thousand. For example, 20 MIL is 20 thousand colones. The 50 MIL bill remains legal tender but has been removed from circulation.

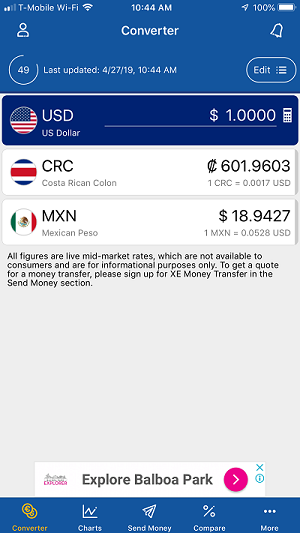

In February 2022, 640 colones were the equivalent to $1 USD. In December 2023, this has eroded to 533 colones, a decrease of nearly 17%. This means that the 1,000 colones bill is now equivalent to $1.88 USD, 10,000 colones is $18.75, 20,000 colones is $37.50, 100 colones coin is about 19 cents, 10 colones coin is just under 2 cents.

What does this mean ? If you have a Costa Rica bank account in colones, congratulations, your money appreciated by 17% over the last 10 months, if you were to convert it to USD and then leave the country. However, most people visiting or living here have USD meaning that the value has dropped 17%. Add in Costa Rica inflation for the same period and the buying power lost is probably around 25%, if not more. That's a lot in short period of time.

For more details on the colon and history, Wikipedia has a great write up.

Costa Rica Money - Important Update !

Costa Rica has completed withdrawing the older paper money, printed on cotton, from circulation and replacing it with new bills printed on polymer plastic with a small transparent window. For those that have older style bills that have expired, they can no lonber be used but they can be exchanged at a bank for the new style.

The new style bills have been introduced for improved durability and thus a longer life span, plus it reduces the chances of counterfeit.

Important Note: If you are in the United States and request Colones from a bank prior to traveling to Costa Rica, make sure that you don't receive the old style bill that is no longer valid. If this happens, upon arrival, you will have to go to the bank to exchange. In Costa Rica, banking is not the best way to spend part of your day, trust me. Check with you bank before ordering.

New Style 10,000 bill with Transparent Window

New Style 10,000 bill with Transparent WindowThe US Dollar in Costa Rica

The US dollar is widely accepted in Costa Rica, however, only certain denominations can generally be used. The $20 bill is preferred and you may have to go to the bank to break $50 and $100 bills. Important - Only the new style $100 US bills are accepted. Bills cannot have any tears, markings or be overly worn, no matter how minor. They won't be accepted.

We tried to use a $1 bill at a McDonalds and they would not accept anything less than $5. If you use US money, you will most likely receive change in Colones. The exchange rate is generally pretty fair but you will do better just using Colones everywhere.

For most tourist activities and restaurants in touristy locations, such as Tamarindo, Jaco and Coco, you will find some prices quoted in US dollars. If this is the case, it is best to pay with USD cash or credit card processed in US dollars. If you convert, you risk getting an unfavorable exchange rate, often times by someone doing quick math in their head.

If prices are quoted in Colones, it is best of pay with Colones, cash or credit card. Important - Specifically ask that your credit card be processed in Colones. If you look like you are from the US, the vendor may decide to charge you in US dollars, at their exchange rate, thus pocketing a few percentage more. You will always get the best conversion rate by your credit card company.

Exchanging your Money

Do not exchange money at the Liberia or San Jose airport. While they will tell you that they don't charge a fee, the exchange rate will be very unfavorable, which in essence is their fee. During our first trip to Costa Rica, when the Colon was valued at about 590 colones to the US dollar, the exchange rate at the San Jose airport was 490 colones, which means they are profiting by 17%.

Instead, go to a local Bank ATM. While you may be charged a service fee of $3 to $4 USD, you will get the current exchange rate. Alternately, go to one of the major banks to exchange USD into Colones, either Banco National de Costa Rica (BNCR) or Bank of Costa Rica (BCR). You will need your actual passport as copies are not accepted. No passport - no exchange.

For those traveling from other countries such as Canada, convert to USD before leaving home. For Canadians, this will most likely come as a shock due to the unfavorable US/Canada exchange rate but there is really nothing you can do about it.

If you plan on driving, you should carry some colones (bills and coins) before getting away from the airport, especially in the San Jose area. Depending on where you travel, you may run across some toll roads. Highway 27 which takes you west from the San Jose airport through the port city of Caldera is a toll road with several toll plazas along the way. Make sure you have several 100 and 500 colon coins and 1,000 bills and it will make your life easier at the toll booth.

Credit and Debit Cards

Visa is by far the most widely accepted credit card followed by American Express and Mastercard. Some vendors will add a small fee if you use a credit card but I have found this to be rare. Again, if the bill is in Colones, ask for the charge to be in Colones. Same for the US dollar.

Debit cards will work, but I strongly recommend that you do not use them. If the charge is incorrect, you will not have any recourse. I have read about several cases where the amount due was 5000 colones and the vendor charged 5000 USD.

ATMs

ATMs are widely available and we have not experienced any problems with them. In most cases, you will be charged a service fee that could range from $3 to $5 USD. Some US financial institutions, such as Charles Schwab, will reimburse any ATM fees accrued.

Sometimes the ATM transactions that get processed back to your financial institution will be processed as one lump sum and not specify withdrawal amount and fee separately. Make sure you check with your bank as they may have to manually process any credit. This has happened to us several times.

Just like in the US, it is best to use an ATM that is inside a building. Some banks in Costa Rica have their ATMs outside, next to the entrance. Some have a separate room inside. Second choice would be inside a store, like a Walmart. Last choice would be an ATM in an outside public location. These are more susceptible to the use of skimmers in attempt to steal your information.

Some ATM machines will have the option to disburse US dollars, but not all do.

Some ATMs will recognize that your card is from a US financial institution and give you the option of an English menu, but not all will.

Be prepared if you are not fluent in Spanish. Have Google translate ready to go just in case.

Opening a Bank Account

The two preferred banks in Costa Rica are Banco National de Costa Rica (BNCR) and Bank of Costa Rica (BCR). From talking to others that have lived down here for a while, BCR's online banking is far superior to BNCR so we opened an account at BCR.

Upon entering a bank you cannot wear hats or sunglasses.

Once inside, at some banks such as BCR, there is an automated ticket dispenser where you will need to select the transaction type (all in Spanish). If you need to visit a teller, select "Caja". If you need to open an account then visit the "platforma". Take a number and wait to be called.

For Costa Rica money exchanges, the wait can be just a few minutes or sometimes 30-45 minutes. For opening an account, the wait can be much longer, sometimes over an hour. For us to open a basic account, we waited about 45 minutes but it took another hour plus to complete the process.

Avoid Monday mornings, weekdays before or after a holiday and Friday afternoons. Holidays can sneak up on you in Costa Rica such as Guanacaste day in July.

You must have your passport and a Costa Rica phone number to open up an account. Strike one for us....we waited 45 minutes to be seen and immediately found out about the Costa Rica phone requirement. We visited the Kolbi store and were back in a few days to complete the process.

At BCR, non-residents are not allowed to open up a bank account unless you have applied for residency and your application has been accepted for processing. You will need a letter from your attorney. Our immigration attorney gave us a formal letter with all of the information that we needed regarding our Residency status.

As a non-resident, Deposits are limited to $1,500 USD per month but limits are calculated on an annual basis. In other words, I can deposit $18,000 USD (12 x $1,500) all at once, but won't be allowed additional deposits for the remainder of the year.

Wire transfers into bank accounts are not allowed until Residency is obtained.

This is where the inconsistencies of the Costa Rican banking system start to show up. We have friends that have both deposited and wire transferred money far greater than the limits above, even without Residency. However, all have been contacted at a later time, sometimes months or years later, and required to declare the origin of the money and how it was earned. For some, this has been a painful process. If you don't comply, your account will be closed and you will be banned from having an account at that bank forever. With so few highly recommended banks available, this is not something that you want to have happen.

You have to ask for an ATM card, they don't just happen as a standard process. ATM cards are processed in the bank and takes 3-4 days to be ready. ATM cards are not mailed. You must pick them up in person. This means waiting in line again for the new accounts person. Plan on at least an hour, probably more.

Online access, at least for BCR, comes with a BINGO card. This is a card with labeled rows and columns such at A-4 and D-3. Each cell contains a number. Every time you log in, you will be prompted to enter the number from three different cells. Simple, but what a great security measure !

Summary

- The Costa Rica Colon is preferred but US dollars are widely accepted.

- If you are from Canada, convert to USD before you leave.

- Visa, Mastercard and American Express are widely accepted.

- Do not use a debit card to pay for something.

- Bring USD in $20 denominations.

- Only newer style $100 USD bills are accepted.

- USD bills cannot be marked, torn or overly worn.

- If the price is quoted in USD, pay with USD. Likewise with the colon.

- Don't exchange money at the airport.

- Get colones at a bank or from an ATM inside a store such as Walmart.

- Bring your original passport to the bank to exchange money.

- Carry change in small denominations for toll roads and bus fares (50, 100 and 500 coins and 1000 bills).

- Be prepared to spend 2-3 hours to open a bank account.

- You need a Costa Rican phone number to open a bank account.

- BCR is preferred over BNCR, primarily for ease of online access.

- ATM cards must be picked up in person and will take 3-4 days to be ready.

- Use the XE Currency App for easy conversion calculations while shopping.

- Make sure your paper money is the new style.

When it comes to money and banking, as with many other things in Costa Rica, use this information as a guideline so that you are as well prepared as possible, but your results may vary. Pura Vida :)