2002 Qantas Annual Report

2002 Qantas Annual Report

2002 Qantas Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

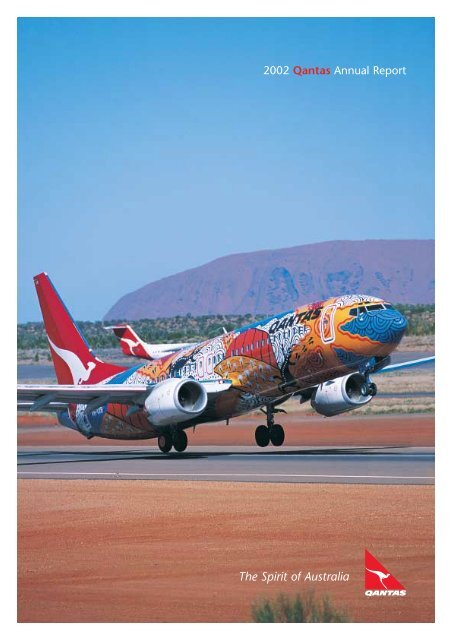

<strong>2002</strong> <strong>Qantas</strong> <strong>Annual</strong> <strong>Report</strong><br />

The Spirit of Australia

QF<br />

20<br />

02<br />

<strong>Qantas</strong> was founded in the Queensland outback<br />

in 1920 and is Australia’s largest domestic and<br />

international airline. Registered originally as<br />

Queensland and Northern Territory Aerial Services<br />

Limited (QANTAS), the airline has built a reputation<br />

for excellence in safety, operational reliability,<br />

engineering and maintenance, and customer service.<br />

<strong>Qantas</strong> operates a fleet of 187 aircraft across a network<br />

spanning 142 destinations in 32 countries. <strong>Qantas</strong><br />

carried more than 27 million passengers this year and<br />

employs more than 33,000 staff who speak more than<br />

50 different languages. <strong>Qantas</strong> also operates subsidiary<br />

businesses in specialist markets such as <strong>Qantas</strong> Holidays<br />

and <strong>Qantas</strong> Flight Catering.<br />

p<br />

1 <strong>Report</strong> from the<br />

Chairman and<br />

Chief Executive<br />

Officer<br />

p<br />

5 Review of our<br />

Business<br />

p<br />

24 Board of<br />

Directors<br />

p<br />

26 Corporate<br />

Governance<br />

p<br />

27 Financial<br />

Review<br />

<strong>Qantas</strong> Airways Limited ABN 16 009 661 901

QF<br />

20<br />

02<br />

Chief Executive Officer Geoff Dixon<br />

Chairman Margaret Jackson<br />

to our fellow shareholders<br />

It has been a dramatic and at times traumatic year for <strong>Qantas</strong> and the<br />

global aviation industry. The events of 11 September 2001 changed the<br />

industry forever and the collapse of Ansett has transformed the Australian<br />

aviation market. <strong>Qantas</strong> performed well in the face of these tumultuous<br />

events and this was a tribute to our management and staff.<br />

p<br />

1

PROFIT BEFORE TAX OF $631.0 MILLION. REVENUE OF $11.3 BILLION<br />

Passengers Carried<br />

000<br />

Net Profit Attributable to<br />

Members of the Company<br />

$M<br />

27,128<br />

517.3<br />

22,147<br />

20,485<br />

19,236 18,865<br />

428.0<br />

415.4<br />

421.6<br />

304.8<br />

QF<br />

20<br />

02<br />

02<br />

01<br />

00<br />

99<br />

98<br />

02<br />

01<br />

00<br />

99<br />

98<br />

A TUMULTUOUS YEAR In last year’s annual report,<br />

we noted that <strong>Qantas</strong> had performed well in a<br />

challenging environment and as part of an industry<br />

characterised by low overall profitability.<br />

Those words were written one week before<br />

September 11.<br />

The world is still trying to come to terms with<br />

the terrorist attacks in the United States and the<br />

thousands of lives lost, including a number of<br />

Australians. The tragic deaths included two <strong>Qantas</strong><br />

staff members – Alberto Dominguez, 66, a baggage<br />

handler at Sydney Domestic Terminal and Laura Lee<br />

Morabito, 34, Area Sales Manager in Boston. Both<br />

Alberto and Laura Lee were highly regarded workers<br />

who were extremely popular with their colleagues.<br />

The impact of September 11 on our industry<br />

was enormous. According to the International Air<br />

Transport Association, 2001 was only the second year<br />

in the history of civil aviation in which international<br />

traffic declined. The IATA membership of airlines<br />

collectively lost more than US$12 billion.<br />

At the same time, in the domestic market, Ansett<br />

collapsed. <strong>Qantas</strong> leased extra aircraft and added<br />

hundreds of special flights, including to regional<br />

Australia, to help travellers stranded by the crisis.<br />

<strong>Qantas</strong> flew over 50,000 former Ansett passengers<br />

for free and another 65,000 on heavily discounted fares.<br />

<strong>Qantas</strong> was able to add the equivalent of about seven<br />

years’ growth, virtually overnight. This huge effort<br />

was critical in minimising the impact of the Ansett<br />

collapse on the Australian economy, tourism, business<br />

and national life.<br />

ANNUAL RESULTS In these extraordinary<br />

circumstances, <strong>Qantas</strong> delivered a profit before tax of<br />

$631.0 million for the year ended 30 June <strong>2002</strong> and a<br />

net profit after tax of $428.0 million.<br />

Domestic operations, <strong>Qantas</strong>Link, <strong>Qantas</strong> Flight<br />

Catering and <strong>Qantas</strong> Holidays performed strongly<br />

and this offset the substantial decline in international<br />

operations after September 11. International<br />

operations improved in the second half of the year<br />

as some confidence was restored.<br />

The Directors declared a fully franked final dividend<br />

of nine cents per share, bringing total fully franked<br />

dividends for the year to 17 cents per share.<br />

<strong>Qantas</strong> staff received a special four per cent bonus<br />

payment due to their efforts during the year and in<br />

line with a commitment made to them in late 2001.<br />

The Board also decided to allocate $1,000 worth of<br />

<strong>Qantas</strong> shares to all Australia-based eligible employees<br />

under the <strong>Qantas</strong> Profitshare Scheme.<br />

p<br />

2

TOTAL FULLY FRANKED DIVIDENDS FOR THE YEAR OF 17 CENTS PER SHARE<br />

Sales and Operating Revenue<br />

$M<br />

Ordinary Dividends per Share*<br />

Cents per Share<br />

11,322.6<br />

10,188.2<br />

9,106.8<br />

8,448.7 8,131.5<br />

17.0 9.0<br />

9.0<br />

20.0<br />

22.0<br />

11.0<br />

19.0<br />

11.0<br />

Final<br />

Interim<br />

13.5<br />

7.0<br />

11.0<br />

11.0<br />

8.0<br />

8.0<br />

6.5<br />

02<br />

01<br />

00<br />

99<br />

98<br />

02<br />

01<br />

00<br />

99<br />

98<br />

* Excludes special dividends paid<br />

BOARD CHANGES Paul Anderson was appointed a<br />

non-executive Director on the <strong>Qantas</strong> Board on 2<br />

September <strong>2002</strong>. Mr Anderson has outstanding<br />

management and operational skills and an<br />

extraordinary record as a senior executive in the<br />

international mining and energy industries. We are<br />

delighted that he is bringing his diverse range of<br />

corporate skills to <strong>Qantas</strong>.<br />

In November 2001, Rod Eddington stepped down as<br />

a non-executive Director. This followed a $450 million<br />

placement of shares by <strong>Qantas</strong> in October 2001 and<br />

the consequent reduction of British Airways’<br />

shareholding in <strong>Qantas</strong> to less than 22.5 per cent.<br />

As a result, British Airways was entitled to appoint<br />

two, rather than three, Directors to the <strong>Qantas</strong> Board.<br />

Roger Maynard and Nick Tait continue to serve on<br />

the <strong>Qantas</strong> Board as Directors appointed by British<br />

Airways. It has been a pleasure to have had Rod serve<br />

on the <strong>Qantas</strong> Board, we thank him for his<br />

involvement and we will continue to work with him<br />

in his role as Chief Executive of British Airways.<br />

GOING FORWARD <strong>Qantas</strong> will continue its strategies of:<br />

• segmenting its flying business to align costs and<br />

revenues in particular markets. This will see <strong>Qantas</strong><br />

operate:<br />

■ the premium <strong>Qantas</strong> international product with<br />

three and two-class service;<br />

■ Australian Airlines, a full-service, single class<br />

international carrier that will begin flying between<br />

Cairns and a number of Asian ports from<br />

27 October;<br />

■ Cityflyer, the two-class domestic “shuttle” service<br />

tailored for business travellers on the popular<br />

Sydney–Melbourne, Sydney–Brisbane and<br />

Melbourne–Brisbane routes and which will<br />

soon be extended to Adelaide and Perth;<br />

■ the full service, two-class product for other<br />

domestic destinations;<br />

■ an all economy domestic service for leisure routes<br />

where there is little or no demand for business<br />

travel; and<br />

■ expanded <strong>Qantas</strong>Link services to regional Australia.<br />

• investing in and growing subsidiary businesses –<br />

<strong>Qantas</strong>Link, <strong>Qantas</strong> Flight Catering, <strong>Qantas</strong> Holidays<br />

and <strong>Qantas</strong> Freight – so that in the future they can<br />

contribute about one third of <strong>Qantas</strong> profits.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

3

QANTAS CARRIED MORE THAN 27 MILLION PASSENGERS DURING THE YEAR<br />

Year Ended 30 June <strong>2002</strong> 2001 2000 1999 1998<br />

Sales and Operating Revenue $M 11,322.6 10,188.2 9,106.8 8,448.7 8,131.5<br />

Earnings Before Interest and Tax $M 679.3 695.8 874.0 762.6 581.7<br />

Profit From Ordinary Activities Before Tax $M 631.0 597.1 762.8 662.5 478.0<br />

Net Profit Attributable to Members of the Company $M 428.0 415.4 517.3 421.6 304.8<br />

Earnings per Share cents 29.1 33.0 42.8 35.4 26.8<br />

Ordinary Dividends per Share cents 17.0 20.0 22.0 19.0 13.5<br />

Passengers Carried 000 27,128 22,147 20,485 19,236 18,865<br />

Available Seat Kilometres M 95,944 92,943 85,033 81,765 81,537<br />

Revenue Passenger Kilometres M 75,134 70,540 64,149 59,863 58,619<br />

Revenue Seat Factor % 78.3 75.9 75.4 73.2 71.9<br />

Aircraft in Service at Balance Date # 193 178 147 135 146<br />

• seeking mutually beneficial partnerships with other<br />

quality airlines. For example, <strong>Qantas</strong> is in<br />

discussions with Air New Zealand about the<br />

possibility of a strategic alliance between the two<br />

companies and an acquisition by <strong>Qantas</strong> of a<br />

minority equity interest in Air New Zealand. No<br />

agreement or commitment has been reached or<br />

entered into at this time and any agreement would<br />

be conditional on a number of approvals.<br />

<strong>Qantas</strong> is also well placed to continue substantial<br />

investment in new aircraft, upgraded inflight products<br />

and airport infrastructure. This investment is needed<br />

as our competitors are also upgrading aircraft and<br />

product and competing aggressively.<br />

On 21 August <strong>2002</strong>, <strong>Qantas</strong> announced it intended<br />

to raise approximately $800 million of ordinary equity<br />

through an entitlement offer to existing shareholders<br />

to support our capital expenditure program and help<br />

fund other potential investment opportunities that<br />

may arise.<br />

The institutional entitlement offer closed successfully<br />

on 23 August and the retail entitlement offer is<br />

expected to close on 27 September.<br />

These strategic initiatives and substantial investment<br />

programs confirm our commitment to:<br />

• our customers, who will enjoy further improved<br />

facilities and services;<br />

• our employees, who will benefit from the airline’s<br />

strong foundations and growth opportunities;<br />

• our shareholders, who expect us to grow and be<br />

profitable; and<br />

• the Australian community, which we continue to<br />

support by employing over 31,000 Australians,<br />

spending billions of dollars with Australian suppliers<br />

and being a major supporter of arts, sports and<br />

charitable organisations.<br />

Chairman Margaret Jackson<br />

Chief Executive Officer Geoff Dixon<br />

p<br />

4<br />

THE SPIRIT OF AUSTRALIA

QF<br />

20<br />

02<br />

p<br />

6 International<br />

Operations<br />

p<br />

10 Domestic<br />

Operations<br />

p<br />

14 Regional<br />

Operations<br />

p<br />

16 Subsidiary<br />

Businesses<br />

p<br />

18 Freight p<br />

20 Fleet p<br />

22 Community<br />

p<br />

5

international operations<br />

QF<br />

20<br />

02<br />

QANTAS operates approximately 540 international flights every week to and from Australia, offering<br />

services to 68 destinations in 31 countries across the Asia Pacific region, Europe, North America,<br />

South America and South Africa.<br />

IMPROVED PRODUCT During the year, <strong>Qantas</strong> substantially upgraded many of its international<br />

aircraft and lounges. A highlight was the $300 million project to install a new inflight entertainment<br />

system on the <strong>Qantas</strong> fleet of Boeing 747-400s – featuring larger screens in First and Business Class,<br />

individual seatback video screens in Economy Class, and inseat telephones in all classes.<br />

The interiors of the Boeing 747-400 aircraft are also being upgraded, with new design seat fabrics,<br />

curtains, carpets and accessories for First, Business and Economy Class cabins.<br />

The upgrade program has been extended to the Boeing 747-300 fleet at an additional cost of<br />

$125 million and is due for completion by the end of 2003.<br />

<strong>Qantas</strong> will invest a further $300 million to relaunch its International Business Class, featuring<br />

newly designed sleeper seats and cabin upgrades. The first of the new Business Class seats will be<br />

available on the London and Hong Kong routes in the first half of 2003.<br />

Facilities are also being improved on the ground. The new flagship <strong>Qantas</strong> Club Lounge at Sydney<br />

International Terminal opened in May <strong>2002</strong>, accommodating up to 150 First Class customers and<br />

500 Business Class customers. This facility sets a new standard for First and Business Class<br />

passengers, top tier Frequent Flyers and <strong>Qantas</strong> Club members.<br />

Overseas, the completely redesigned <strong>Qantas</strong> Club Lounge at Honolulu International Airport<br />

reopened in August 2001 and a substantially larger <strong>Qantas</strong> and British Airways First Class Lounge<br />

at Changi Airport in Singapore opened in November 2001.<br />

NETWORK <strong>Qantas</strong> has always managed its international network closely, scrutinising every route<br />

to ensure its ongoing viability.<br />

Following the terrorist attacks in the United States on 11 September 2001 and the resulting fall<br />

in demand for international air travel, <strong>Qantas</strong> reduced a number of scheduled international<br />

flights. Demand is steadily increasing, resulting in the reintroduction or planned reintroduction<br />

of additional services.<br />

• United States Soon after September 11, <strong>Qantas</strong> reduced return services between Australia and<br />

Los Angeles from 31 per week to 26 per week, and suspended New York services. New York<br />

services resumed in February <strong>2002</strong> and services to Los Angeles increased to 28 per week in<br />

July <strong>2002</strong>.<br />

<strong>Qantas</strong> also operates three 747 services each week to Honolulu.<br />

• United Kingdom and Europe <strong>Qantas</strong> will add three Boeing 747-400 services to London from<br />

December <strong>2002</strong>, taking the total number of Australia–London return services to 21 per week.<br />

A fourth return weekly service to Rome will also be added from the end of October <strong>2002</strong>.<br />

• Hong Kong <strong>Qantas</strong> boosted Hong Kong capacity significantly in April 2001, including a<br />

25 per cent increase between Sydney and Hong Kong and a 20 per cent capacity increase<br />

on the Melbourne and Brisbane–Hong Kong routes.<br />

p<br />

6

QANTAS IS SUBSTANTIALLY UPGRADING ITS INTERNATIONAL AIRCRAFT AND LOUNGES<br />

PETER BOTTEN, Managing Director Oil Search Ltd. A top tier frequent flyer, Peter<br />

Botten appreciates the high standard of facilities that <strong>Qantas</strong> offers the international<br />

business traveller. This includes the new flagship <strong>Qantas</strong> Club Lounge in the Sydney<br />

International Terminal which opened in May <strong>2002</strong> as part of a $50 million program<br />

to upgrade lounge facilities in Australia and overseas.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

7

INTERNATIONALLY, QANTAS OPERATES 540 FLIGHTS EACH WEEK TO 68 DESTINATIONS IN 31 COUNTRIES<br />

SPIRIT OF FRIENDSHIP. In late June <strong>2002</strong>, <strong>Qantas</strong> launched<br />

a unique global initiative that focused worldwide attention<br />

on international air travel.<br />

International star John Travolta joined <strong>Qantas</strong> as Ambassadorat-Large<br />

and promptly flew his former <strong>Qantas</strong> Boeing 707,<br />

repainted in its original livery, around the world on a Spirit<br />

of Friendship tour. The tour attracted huge interest and<br />

support at each stage of its 13-city journey, from Los Angeles<br />

to New York via Auckland, Sydney, Melbourne, Perth,<br />

Singapore, Hong Kong, Tokyo, London, Rome, Paris<br />

and Frankfurt.<br />

A talented and highly qualified pilot and avid fan of aviation<br />

and <strong>Qantas</strong>, Travolta used the tour as a way of reaching<br />

across borders and bringing a sense of excitement and<br />

optimism back to air travel.<br />

p<br />

8<br />

THE SPIRIT OF AUSTRALIA

international operations<br />

• Japan The opening of the new runway at Narita Airport provided <strong>Qantas</strong> with an opportunity to<br />

increase services. In July <strong>2002</strong>, <strong>Qantas</strong> introduced a daily Melbourne–Narita 767 service and<br />

Cairns–Narita services have been boosted by 10 per cent. Bookings have returned to last year’s<br />

levels and continue to grow.<br />

• New Zealand From 1 July <strong>2002</strong>, <strong>Qantas</strong> added nine return services per week between Australia<br />

and New Zealand, increasing the total number of trans-Tasman services to more than 100 return<br />

flights each week.<br />

<strong>Qantas</strong> began domestic New Zealand services in April 2001, flying between the major centres<br />

of Auckland, Wellington and Christchurch and has built a codeshare relationship with local airline,<br />

Origin Pacific, to service a number of regional destinations.<br />

• South America From 1 July <strong>2002</strong>, following political and economic turmoil in Argentina, <strong>Qantas</strong><br />

replaced two flights a week to Buenos Aires with three flights per week between Sydney and<br />

Santiago, Chile with oneworld partner, LanChile.<br />

AUSTRALIAN AIRLINES During the year, <strong>Qantas</strong> announced it will launch a new wholly owned,<br />

full-service, single-class international carrier that will commence operations on 27 October <strong>2002</strong>.<br />

Australian Airlines is independently managed and will not compete with <strong>Qantas</strong>. It will operate on<br />

routes from which <strong>Qantas</strong> has withdrawn and on routes where <strong>Qantas</strong> has been unable to extract<br />

a satisfactory return.<br />

Australian Airlines will initially offer services between Cairns and Osaka, Fukuoka, Nagoya,<br />

Singapore, Taipei and Hong Kong. The airline will operate Boeing 767-300 aircraft on all routes,<br />

beginning with a fleet of four and building to a potential fleet of 12 aircraft.<br />

ALLIANCES AND PARTNERSHIPS <strong>Qantas</strong> has entered into a number of strategic alliances to create<br />

scale and scope for its operations and deliver enhanced customer service.<br />

<strong>Qantas</strong> is a founding member of the oneworld alliance, which features eight of the world’s leading<br />

airlines – <strong>Qantas</strong>, Aer Lingus, American Airlines, British Airways, Cathay Pacific, Finnair, Iberia and<br />

LanChile – as well as 23 regional affiliates.<br />

<strong>Qantas</strong> also has separate bilateral alliances with British Airways, American Airlines, Japan Airlines and<br />

Air Pacific as well as codeshare arrangements with numerous other airlines including Air Calin,<br />

Air Niugini, Air Tahiti Nui, Air Vanuatu, Alaska Airlines, Alitalia, Asiana, China Eastern, Eva Air, Gulf Air,<br />

Origin Pacific, Polynesian Airlines, South African Airways and Vietnam Airlines.<br />

These alliances and codeshare arrangements allow <strong>Qantas</strong> to offer customers an expanded global<br />

network, increased ease of transfer, greater choice and flexibility and provide increased rewards and<br />

recognition for frequent flyers.<br />

QF<br />

20<br />

02<br />

p<br />

9

domestic operations<br />

The core domestic airline of <strong>Qantas</strong> operates an average of 373 flights each day. During the year,<br />

Ansett – the major domestic competitor of <strong>Qantas</strong> – collapsed. As a result, <strong>Qantas</strong> significantly<br />

increased the number of scheduled flights operated by its core domestic airline.<br />

QF<br />

20<br />

02<br />

CITYFLYER The inaugural <strong>Qantas</strong> Cityflyer service took off on the airline’s busiest route,<br />

Sydney–Melbourne, on 1 July 2001.<br />

The service, that offers flights every half hour on weekdays, quickly established itself as the best<br />

domestic product in the market for the business traveller.<br />

In February <strong>2002</strong>, the service was extended to Sydney–Brisbane, offering flights every half hour<br />

during peak times and every hour at other times, and Melbourne–Brisbane, offering hourly flights.<br />

The service will soon be extended to Adelaide and Perth.<br />

Cityflyer streamlines the airport process for business travellers and includes:<br />

• priority departure gates nearest to airport security screening and the <strong>Qantas</strong> Club;<br />

• complimentary newspapers for early morning flights;<br />

• dedicated baggage carousels; and<br />

• free bar service after 4.00 pm.<br />

LOUNGE UPGRADE <strong>Qantas</strong> is investing $50 million to upgrade its domestic <strong>Qantas</strong> Club Lounges<br />

around the country. Work has already commenced on the lounges at Sydney, Melbourne and<br />

Brisbane domestic terminals, with these projects scheduled for completion in September <strong>2002</strong>.<br />

There are also plans to expand and improve the domestic <strong>Qantas</strong> Club Lounges in Perth, Gold<br />

Coast, Darwin, Adelaide and other ports.<br />

A highlight of the upgrade program is enhanced business facilities featuring the latest technology.<br />

This includes upgrading communications capabilities to allow customers to plug in laptops, charge<br />

mobile phones and access email from the comfort of an armchair.<br />

QUICKCHECK <strong>Qantas</strong> introduced QuickCheck kiosks at Sydney and Melbourne Domestic Airports<br />

in August <strong>2002</strong>, allowing customers to check themselves in at state-of-the-art, self-service<br />

QuickCheck kiosks.<br />

QuickCheck provides real customer benefits by reducing check-in times to less than one minute.<br />

The kiosks are easily accessible in terminal departure areas, in <strong>Qantas</strong> Club Lounges and close to<br />

Cityflyer departure gates.<br />

In a first for Australia, QuickCheck will soon be available for customers with baggage.<br />

TOURISM <strong>Qantas</strong> has continued its strong support for the Australian domestic and inbound tourism<br />

industry, working closely with the major national and state and territory tourist organisations and<br />

travel agents.<br />

Our support for the Federal Government’s See Australia domestic tourism initiative continued the<br />

effort to encourage Australians to holiday in their own country. At the same time, <strong>Qantas</strong> was<br />

involved in tactical marketing efforts with state and territory tourist bodies in early <strong>2002</strong> to help<br />

boost the recovery of the domestic market.<br />

The Australian Tourism Exchange, held in Brisbane in May <strong>2002</strong>, and the Dreamtime incentive<br />

travel market event in July 2001 were the cornerstone elements of <strong>Qantas</strong>’ excellent working<br />

relationship with the Australian Tourist Commission (ATC).<br />

p<br />

10

QANTAS CITYFLYER MEETS THE NEEDS OF AUSTRALIAN BUSINESS TRAVELLERS<br />

KEITH BALES, Businessman. Keith lives in Sydney and commutes to<br />

and from Melbourne each week for work. With peak period flights<br />

between Sydney and Melbourne every 30 minutes, the frequency<br />

and business travel focus of <strong>Qantas</strong>’ new Cityflyer services suit<br />

corporate customers large, medium and small.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

11

QANTAS’ CORE DOMESTIC AIRLINE OPERATES AN AVERAGE OF 373 FLIGHTS EACH DAY<br />

MATTHEW ARCIDIACONO and family. The Canberra<br />

optometrist welcomes wife, Lee, and daughters Hayley and Livvy,<br />

home from a school holiday trip to the Gold Coast. <strong>Qantas</strong>’<br />

extensive schedule of flights and range of discounted fares make<br />

it easy for families to enjoy everything Australia has to offer the<br />

domestic traveller.<br />

p<br />

12<br />

THE SPIRIT OF AUSTRALIA

domestic operations<br />

An ongoing global marketing agreement sees <strong>Qantas</strong> and the ATC working together across the<br />

world to promote and develop leisure and business tourism to Australia.<br />

<strong>Qantas</strong> also supports other key tourism organisations such as the Australian Tourism Export Council<br />

and the Tourism Task Force, works closely with the Australian Federation of Travel Agents and has<br />

taken a lead role with special events such as Year of the Outback <strong>2002</strong> and a number of state and<br />

territory tourism awards.<br />

NEW AND INCREASED SERVICES In a major boost for Australian tourism, <strong>Qantas</strong> introduced<br />

a number of non-stop services on popular tourist routes including:<br />

QF<br />

20<br />

02<br />

• Adelaide–Gold Coast;<br />

• Brisbane–Alice Springs;<br />

• Cairns–Darwin;<br />

• Melbourne–Darwin;<br />

• Melbourne–Alice Springs;<br />

• Melbourne–Maroochydore;<br />

• Melbourne–Hamilton Island;<br />

• Perth–Darwin;<br />

• Sydney–Proserpine; and<br />

• Sydney–Rockhampton.<br />

Other domestic services introduced include:<br />

• additional weekly services between Adelaide and Sydney, Melbourne and Brisbane;<br />

• additional weekly services between state capital cities and Canberra;<br />

• additional Sydney–Townsville services;<br />

• additional services between Sydney, Brisbane and Hamilton Island;<br />

• additional Sydney–Ayers Rock services;<br />

• additional Melbourne–Alice Springs services; and<br />

• additional services between Sydney, Melbourne, Brisbane and Cairns.<br />

TAXES, CHARGES AND LEVIES Costs of safety, security and airport usage rose during the year.<br />

New charges included the Ansett staff entitlements levy ($10 per ticket, collected by <strong>Qantas</strong> on<br />

behalf of the Federal Government) and a $6 per sector insurance levy flowing from the catastrophic<br />

events in the United States.<br />

<strong>Qantas</strong> continues to seek ways of reducing the impost represented by taxes, levies and charges,<br />

while meeting market needs for transparency and openness on the total cost of airline tickets.<br />

<strong>Qantas</strong> has revised its fare and holiday package advertising to show prices on an all-inclusive basis.<br />

Customers have reacted positively to the change, and <strong>Qantas</strong> is now the industry leader in relation<br />

to fare transparency, simplicity and fairness.<br />

p<br />

13

QANTASLINK OPERATES MORE THAN 2,700 FLIGHTS ACROSS REGIONAL AUSTRALIA EACH WEEK<br />

regional operations<br />

QF<br />

20<br />

02<br />

QANTAS’ REGIONAL OPERATIONS have been flying under one brand name – <strong>Qantas</strong>Link – since May 2001.<br />

<strong>Qantas</strong>Link operates more than 2,700 flights each week to 55 destinations within Australia. <strong>Qantas</strong>Link provides<br />

important transport services for regional Australia and connections to <strong>Qantas</strong> domestic and international<br />

networks. <strong>Qantas</strong>Link employs approximately 1,600 people and has:<br />

• operational bases in Hobart, Cairns and Mildura;<br />

• a Dash 8 line maintenance facility in Mildura;<br />

• a Boeing 717 heavy maintenance facility in Newcastle; and<br />

• a Dash 8 heavy maintenance facility and administration centre in Tamworth.<br />

Following the collapse of Ansett, <strong>Qantas</strong>Link operated hundreds of additional services to regional Australia and<br />

provided and arranged for services to 22 regional destinations previously served only by Ansett and its subsidiaries.<br />

<strong>Qantas</strong>Link has grown significantly since September 2001. In January <strong>2002</strong>, five Dash 8-300 aircraft were added<br />

to the <strong>Qantas</strong>Link fleet, boosting services and creating more than 90 jobs. Three months later, six Boeing 717<br />

aircraft were added, resulting in more non-stop services and creating more than 150 jobs for pilots, flight<br />

attendants, engineers and operational staff.<br />

p<br />

14

QANTASLINK PROVIDES EMPLOYMENT FOR APPROXIMATELY 1,600 PEOPLE<br />

RENE SUTHERLAND, Director Dubbo Regional Gallery. <strong>Qantas</strong>Link<br />

is an integral part of life in regional Australia. Rene Sutherland, Director<br />

of the Dubbo Regional Gallery in central western NSW, is a regular<br />

<strong>Qantas</strong>Link traveller between Sydney and her home town. <strong>Qantas</strong>Link<br />

is a major sponsor of the Gallery, exemplifying the way <strong>Qantas</strong> supports<br />

cultural development in regional centres such as Dubbo.<br />

<strong>Qantas</strong>Link introduced a number of new regional destinations to its network during the year, including<br />

Longreach, Mt Isa and Weipa in Queensland, and Port Hedland and Newman in Western Australia.<br />

<strong>Qantas</strong>Link is also a strong supporter of regional tourism and is involved extensively in the sponsorship<br />

and promotion of rural and regional events and organisations, including:<br />

• Australian Wool Fashion Awards, Armidale;<br />

• Dubbo Regional Gallery;<br />

• Flying Fruit Fly Circus, Albury-Wodonga;<br />

• <strong>Qantas</strong> Founders Outback Museum, Longreach;<br />

• <strong>Qantas</strong>Link Newcastle Knights;<br />

• <strong>Qantas</strong>Link Northern Tasmania Football League;<br />

• <strong>Qantas</strong>Link Squad (Western Australian Cricket Association initiative in the Pilbara); and<br />

• Riverina Theatre Company, Wagga Wagga.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

15

SNAP FRESH WILL PRODUCE UP TO 20 MILLION MEALS FOR QANTAS EACH YEAR<br />

MATTHEW SNARE, Research and Development Chef, Snap<br />

Fresh. At <strong>Qantas</strong> subsidiary Snap Fresh, Matthew takes quality<br />

produce and designs flavour-driven dishes for <strong>Qantas</strong> customers.<br />

Snap Fresh will be able to produce up to 20 million snap frozen<br />

meals per year for <strong>Qantas</strong>, other airlines and, ultimately,<br />

businesses in the hospitality, health care and mining industries.<br />

p<br />

16<br />

THE SPIRIT OF AUSTRALIA

subsidiary businesses<br />

QANTAS has a number of non-flying, airline-related subsidiary businesses, including <strong>Qantas</strong> Flight<br />

Catering, <strong>Qantas</strong> Holidays and <strong>Qantas</strong> Freight. <strong>Qantas</strong> subsidiary businesses, including <strong>Qantas</strong>Link,<br />

contributed 26 per cent of the <strong>Qantas</strong> Group’s earnings before interest and tax in the <strong>2002</strong> financial<br />

year. By shaping and growing these key businesses so that they contribute about one third of future<br />

profits, <strong>Qantas</strong> hopes to boost the airline’s overall profitability.<br />

CATERING <strong>Qantas</strong> operates three catering businesses within the <strong>Qantas</strong> Catering Group – <strong>Qantas</strong><br />

Flight Catering Limited (QFCL), Caterair Airport Services and Snap Fresh. These three businesses<br />

collectively employ more than 3,800 Australians.<br />

The <strong>Qantas</strong> Catering Group operates seven catering centres in Sydney, Melbourne, Brisbane,<br />

Cairns, Adelaide and Perth.<br />

During the year, <strong>Qantas</strong> Catering Group provided nearly 38 million meals to <strong>Qantas</strong> and other<br />

airlines as well as non-airline clients including railways and hospitals.<br />

On 1 February <strong>2002</strong>, <strong>Qantas</strong> Chairman Margaret Jackson and Queensland Premier Peter Beattie<br />

opened Snap Fresh – a wholly owned <strong>Qantas</strong> subsidiary located at Crestmead on the outskirts<br />

of Brisbane.<br />

Snap Fresh is one of the most modern meal production centres in the world, using rapid freezing<br />

technology to produce meals that retain all the goodness and flavour of their natural ingredients.<br />

Snap Fresh has a team of about 70 people and will grow to produce up to 20 million meals each<br />

year for <strong>Qantas</strong>, other airlines and businesses in the hospitality, health care and mining industries.<br />

QANTAS HOLIDAYS is Australia’s largest travel wholesaler of both international and domestic<br />

holidays designed for independent travellers and small groups. <strong>Qantas</strong> Holidays caters to more than<br />

one million customers a year and employs more than 1,000 people across the world, including<br />

nearly 700 within Australia.<br />

With nearly 30 years’ experience, <strong>Qantas</strong> Holidays continues to offer customers an unsurpassed<br />

range of holiday packages and product.<br />

The 2001–<strong>2002</strong> product range encompassed 37 brochures covering Australia, Asia, Africa, Europe,<br />

Canada, the Pacific and North and South America.<br />

As a travel industry leader, <strong>Qantas</strong> Holidays was recognised with a number of highly regarded<br />

awards, including the National Travel Industry Award for Wholesaler of the Year for the fifth<br />

consecutive year.<br />

In August 2001, <strong>Qantas</strong> and <strong>Qantas</strong> Holidays created a new website exclusively for Australia-based<br />

travel agents, giving them quick and easy access to on-line information to help them help their<br />

customers. Information available on-line includes flyers that can be emailed directly to customers<br />

and Federal Government travel advisories.<br />

QF<br />

20<br />

02<br />

p<br />

17

freight<br />

QF<br />

20<br />

02<br />

QANTAS FREIGHT is the specialised air freight division of <strong>Qantas</strong> and has been operating since the<br />

inaugural <strong>Qantas</strong> scheduled service in November 1922.<br />

<strong>Qantas</strong> Freight employs more than 700 people and offers a varied and flexible range of services<br />

through three primary products – Cargo, Mail and Express Service – on all international sectors<br />

of <strong>Qantas</strong> flights.<br />

Domestic freight is marketed by Australian air Express (AaE), a 50 per cent joint venture company<br />

with Australia Post. AaE is the largest domestic airline-haul company in Australia.<br />

<strong>Qantas</strong> Freight carries letters and lettuces, parcels and pets, frozen seafood and prime breeding<br />

stock. Special facilities include coolrooms and freezers for perishable goods, warmrooms for tropical<br />

fish and other live animals and strongrooms and safes for valuables.<br />

Early this year, <strong>Qantas</strong> Freight coordinated the movement of the Relics of St Therese of Lisieux<br />

during a three-month tour of Australia. The Relics attracted huge crowds across the country and<br />

the tour was described by the Catholic Church as the largest Catholic event in Australia since the<br />

visit of the Pope.<br />

During the year, significant investment was made in upgrading security at <strong>Qantas</strong> freight terminals<br />

to ensure safer handling and more secure transport of all air freight.<br />

<strong>Qantas</strong> Freight is part of the oneworld global route network of 135 countries and territories –<br />

and growing. During this year, for example, <strong>Qantas</strong> joined forces with US-based freighter, Polar Air<br />

Cargo, to provide customers with a full range of all-cargo services across the South Pacific.<br />

<strong>Qantas</strong> Freight is an industry leader in e-commerce with 80 per cent of bookings now made on-line<br />

and a range of services that provide fast and easy access to accurate information on worldwide<br />

freight movements round the clock. Indeed, <strong>Qantas</strong> Freight was selected as a finalist in the <strong>2002</strong><br />

Ericsson Innovation Awards for Follow Me Tracking, an internet-based tracking application which<br />

informs customers of the status of their freight as it moves from origin to destination.<br />

p<br />

18

QANTAS FREIGHT OFFERS A COMPREHENSIVE RANGE OF CARGO, MAIL AND EXPRESS SERVICES<br />

PETER FRASER, Managing Director Lobster Australia. A leader<br />

in the Australian seafood industry, Fremantle’s Lobster Australia<br />

handles more than 2,000 tonnes of lobster and other seafood<br />

each year and exports across the country and into Asia. Managing<br />

Director Peter Fraser relies heavily on <strong>Qantas</strong> freight services to get<br />

the company’s produce to where it needs to be.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

19

QANTAS OPERATES A FLEET OF 187 AIRCRAFT<br />

fleet<br />

QANTAS FLEET <strong>Qantas</strong> continues to be a world leader in the selection of new aircraft types.<br />

Highlights of the year included:<br />

• delivery of 15 Next Generation Boeing 737-800s between February and August <strong>2002</strong>;<br />

• the ordering of an additional four Boeing 737-800s for delivery from May 2003;<br />

• delivery of six Boeing 717s between April and June <strong>2002</strong>;<br />

• finalising preparations for the delivery in November <strong>2002</strong> of the first of six Boeing 747-400ER aircraft;<br />

• finalising preparations for the delivery in November <strong>2002</strong> of the first of 13 Airbus A330 aircraft; and<br />

• continuing preparations for the delivery of 12 Airbus A380 aircraft between 2006 and 2011.<br />

The new Boeing 737-800s are more fuel efficient and cost effective and offer more spacious cabins,<br />

more headroom and larger windows than the Boeing 737-300.<br />

The speed with which <strong>Qantas</strong> selected and acquired these aircraft was unprecedented in the airline’s history.<br />

The first new aircraft entered service just three months after a contract was signed with Boeing and all 15 were<br />

operating six months later.<br />

p<br />

20<br />

THE SPIRIT OF AUSTRALIA

QANTAS IS A WORLD LEADER IN THE SELECTION OF NEW AIRCRAFT TYPES<br />

QF<br />

20<br />

02<br />

YANANYI DREAMING. The third <strong>Qantas</strong> plane to become a<br />

flying work of art, Yananyi Dreaming was used to launch<br />

<strong>Qantas</strong>’ fleet of 15 new Boeing 737-800 aircraft. The<br />

spectacular aircraft is a collaborative design between<br />

Sydney's Balarinji Studio and Uluru indigenous artist,<br />

Rene Kulitja. The new 737-800s feature the latest Boeing<br />

technology and design, including distinctive 2.5 metre<br />

‘winglets’ that give the aircraft greater range and more<br />

fuel-efficient and cost-effective operation. They have already<br />

become the single-aisle flagship aircraft of the <strong>Qantas</strong><br />

domestic fleet, flying routes serving Sydney, Melbourne,<br />

Brisbane, the Gold Coast, Adelaide, Cairns and Ayers Rock.<br />

OPERATIONAL AIRCRAFT FLEET (as at 30 June <strong>2002</strong>)*<br />

Aircraft Type Owned, HP Other Total in<br />

& Finance Operating Service<br />

Leases<br />

Leases<br />

Boeing 747-400 18 7 25<br />

Boeing 747-300 6 – 6<br />

Boeing 747-200** 3 – 2<br />

Boeing 767-300ER 17 12 29<br />

Boeing 767-200ER 7 – 7<br />

Boeing 737-800*** 9 – 9<br />

Boeing 737-400 21 1 22<br />

Boeing 737-300 16 1 17<br />

Total Core Fleet 97 21 117<br />

Aircraft Type Owned, HP Other Total in<br />

& Finance Operating Service<br />

Leases<br />

Leases<br />

British Aerospace 146 – 17 17<br />

De Havilland Dash 8 28 4 32<br />

Shorts 360 1 – 1<br />

Beechcraft 1900*** 12 – 12<br />

Boeing 717-200 – 14 14<br />

Total <strong>Qantas</strong>Link Fleet 41 35 76<br />

Total <strong>Qantas</strong> Fleet 138 56 193<br />

* excludes two Boeing 767s, six Boeing 737s and one Dash 8 currently<br />

operating under short-term lease agreement<br />

** one Boeing 747-200 on lease to Air Pacific<br />

*** at 20 August <strong>2002</strong>, an additional six Boeing 737-800 aircraft had joined the<br />

fleet and the 12 Beechcraft 1900 aircraft had been retired<br />

p<br />

21

community<br />

QF<br />

20<br />

02<br />

QANTAS continues to play a vital role in supporting<br />

cultural, sporting and community organisations across<br />

Australia. The company also has well established<br />

programs for indigenous Australian employees and<br />

communities.<br />

COMMUNITY SUPPORT Every day of the year, <strong>Qantas</strong><br />

helps people who are disadvantaged, chronically ill or<br />

in need of urgent assistance. <strong>Qantas</strong>’ support for<br />

major community organisations includes:<br />

• Bobby Goldsmith Foundation<br />

• CanTeen<br />

• CARE Australia<br />

• Clean Up Australia and Clean Up the World<br />

• Mission Australia<br />

• National Breast Cancer Foundation<br />

• National Australia Day Council Australian<br />

of the Year Awards<br />

• Starlight Children’s Foundation of Australia<br />

• UNICEF Change for Good<br />

• World Vision.<br />

THE ARTS During the year, <strong>Qantas</strong> entered<br />

into new sponsorship agreements with:<br />

• Australian Ballet<br />

• Australian Chamber Orchestra.<br />

These new partnerships complemented<br />

the company’s long-term relationships with:<br />

• Art Gallery of NSW<br />

• Australian Brandenburg Orchestra<br />

• Australia Business Arts Foundation<br />

• Australian Youth Orchestra<br />

• Bangarra Dance Theatre<br />

• Bell Shakespeare Company<br />

• Melbourne Festival<br />

• Musica Viva<br />

• Opera Australia<br />

• Sydney Dance Company.<br />

SPORT <strong>Qantas</strong> was a major sponsor of<br />

the 2001 Goodwill Games in Brisbane and<br />

this year entered into new agreements with:<br />

• Australian Cricket Board<br />

• Australian Football League<br />

• National Rugby League.<br />

<strong>Qantas</strong> also continued its partnerships with:<br />

• Australian Formula One Grand Prix<br />

• Australian Rugby Union<br />

• Australian Swimming<br />

• One Basketball<br />

• Netball Australia<br />

• Soccer Australia<br />

• Tennis Australia.<br />

INDIGENOUS PROGRAMS <strong>Qantas</strong> is committed to<br />

working in partnership with Aboriginal and Torres<br />

Strait Islander communities through a range of<br />

initiatives, including employment and training<br />

programs, community involvement and sponsorships.<br />

Through the <strong>Qantas</strong> Indigenous Employment<br />

Program, 180 indigenous Australians are employed<br />

in areas including catering, engineering and<br />

maintenance, airports, flight operations, ramp services,<br />

cabin crew, human resources, sales and freight.<br />

<strong>Qantas</strong> is a signatory to the Federal Government’s<br />

Corporate Leaders for Indigenous Employment Project,<br />

which aims to generate more jobs in the private sector<br />

for indigenous people.<br />

ENVIRONMENT <strong>Qantas</strong> is committed to promoting<br />

processes and work practices that minimise the<br />

environmental impact of its operations and the airline<br />

is a long-time supporter of Clean Up Australia and<br />

Clean Up the World.<br />

<strong>Qantas</strong> and Visy Closed Loop were recognised at the<br />

prestigious <strong>2002</strong> Banksia Environmental Awards for the<br />

environmental benefits flowing from the boxed meals<br />

introduced on <strong>Qantas</strong> domestic services in 2001. The<br />

boxes substantially reduce waste – about 250 tonnes<br />

of materials are recycled every month that may<br />

otherwise have gone to landfill – and deliver energy<br />

savings when compared with the traditional tray service.<br />

<strong>Qantas</strong> will also be presented with a Bronze Award<br />

at the Sustainable Energy Development Authority’s<br />

Globe Awards in October <strong>2002</strong> because the<br />

introduction of lighting and air-conditioning<br />

improvements and the use of solar energy have<br />

reduced <strong>Qantas</strong>’ greenhouse gas emissions by<br />

almost 10,000 tonnes per year.<br />

p<br />

22

QANTAS PLAYS A VITAL ROLE IN THE COMMUNITY, CULTURAL AND SPORTING LIFE OF AUSTRALIA<br />

STARLIGHT CHILDREN’S FOUNDATION OF AUSTRALIA Elevenyear-old<br />

Debbie Thake and Captain Starbright enjoy the fun<br />

and games of the Starlight Room at Sydney Children’s<br />

Hospital, Randwick. <strong>Qantas</strong> supports dozens of charitable,<br />

cultural and sporting institutions and organisations each year,<br />

including the Starlight Children’s Foundation which<br />

brightens the lives of seriously ill children and their families,<br />

by the granting of wishes and providing entertainment both<br />

in and out of hospitals throughout Australia. <strong>Qantas</strong> staff are<br />

also very active when it comes to their own fundraising<br />

efforts. One unique program is Teams for Dreams where staff<br />

work with the Foundation to raise funds and then personally<br />

deliver dreams and wishes to children.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

23

oard of directors<br />

Margaret Jackson<br />

Chairman<br />

Geoff Dixon<br />

Chief Executive Officer<br />

Peter Gregg<br />

Chief Financial Officer<br />

Paul Anderson<br />

Non-Executive Director<br />

Mike Codd, AC<br />

Non-Executive Director<br />

Trevor Eastwood, AM<br />

Non-Executive Director<br />

Jim Kennedy, AO, CBE<br />

Non-Executive Director<br />

Trevor Kennedy, AM<br />

Non-Executive Director<br />

Roger Maynard<br />

Non-Executive Director<br />

Dr John Schubert<br />

Non-Executive Director<br />

Nick Tait<br />

Non-Executive Director<br />

p<br />

24<br />

THE SPIRIT OF AUSTRALIA

Margaret Jackson<br />

Chairman, Age 49<br />

• Appointed to the Board in July 1992 and as<br />

Chairman in August 2000<br />

• Chairperson of Methodist Ladies College,<br />

Melbourne<br />

• Director of Australia and New Zealand<br />

Banking Group Limited and Billabong<br />

International Limited<br />

• Fellow of the Institute of Chartered<br />

Accountants in Australia<br />

• Member of the Business Council of Australia<br />

Chairman’s Panel<br />

• Council Member of the Asialink Centre<br />

Geoff Dixon<br />

Chief Executive Officer, Age 62<br />

• Appointed to the Board in August 2000 and<br />

as Chief Executive Officer in March 2001<br />

• Member of the Safety, Environment &<br />

Security Committee and Chairman of a<br />

number of controlled entities of <strong>Qantas</strong><br />

• Director of Leighton Holdings Limited and<br />

Air Pacific Limited<br />

• Member of the International Marketing<br />

Institute of Australia<br />

• Member of the Boards of Mission Australia<br />

and the Starlight Foundation of Australia<br />

Peter Gregg<br />

Chief Financial Officer, Age 47<br />

• Appointed to the Board in September 2000<br />

• Director of a number of controlled entities<br />

of <strong>Qantas</strong><br />

• Director of Air Pacific Limited<br />

• Fellow of the Finance and Treasury<br />

Association<br />

• Member of the Australian Institute of<br />

Company Directors<br />

Paul Anderson<br />

Non-Executive Director, Age 57<br />

• Appointed to the Board in September <strong>2002</strong><br />

• Non-Executive Director of BHP Billiton<br />

Limited, BHP Billiton Plc and Temple-Inland<br />

Inc<br />

• Board of the Business Council of Australia<br />

• Member of the Advisory Board of Stanford<br />

University Graduate School of Business<br />

• Global Counsellor for The Conference Board<br />

Mike Codd, AC<br />

Non-Executive Director, Age 62<br />

• Appointed to the Board in January 1992<br />

• Chairman of the Safety, Environment &<br />

Security Committee<br />

• Member of the Audit, Risk & Compliance<br />

Committee<br />

• Chancellor, University of Wollongong<br />

• Chairman of National Australia Asset<br />

Management Limited and National<br />

Corporate Investment Services Limited<br />

• Director of National Wealth Management<br />

Holdings Limited, National Australia<br />

Financial Management Limited, National<br />

Australia Fund Management Limited, MLC<br />

Limited, MLC Investments Limited and<br />

Toogoolawa Consulting Pty Limited<br />

• Member of the Advisory Boards of Spencer<br />

Stuart and Blake Dawson Waldron<br />

Trevor Eastwood, AM<br />

Non-Executive Director, Age 60<br />

• Appointed to the Board in October 1995<br />

• Member of the Audit, Risk & Compliance<br />

Committee and the Chairman’s Committee<br />

• Chairman of Gresham Partners Holdings<br />

Limited and Gresham Rabo Management<br />

Limited<br />

• Director of Wesfarmers Limited<br />

• Fellow of Curtin University, the Australian<br />

Institute of Management and the Australian<br />

Institute of Company Directors<br />

Jim Kennedy, AO, CBE<br />

Non-Executive Director, Age 68<br />

• Appointed to the Board in October 1995<br />

• Chairman of the Audit, Risk & Compliance<br />

Committee<br />

• Member of the Chairman’s Committee<br />

• Deputy Chairman of GWA International<br />

Limited<br />

• Director of the Australian Stock Exchange<br />

Limited, Macquarie Goodman Management<br />

Limited, Macquarie Goodman Funds<br />

Management Limited and Suncorp-Metway<br />

Limited<br />

• Member of the Advisory Board of Blake<br />

Dawson Waldron and the Prime Minister’s<br />

"Community Business Partnership"<br />

Trevor Kennedy, AM<br />

Non-Executive Director, Age 60<br />

• Appointed to the Board in April 1994<br />

• Director of <strong>Qantas</strong> Superannuation Limited<br />

• Chairman of Oil Search Limited, Commsoft<br />

Group Limited and Cypress Lakes Group<br />

Limited<br />

• Deputy Chairman of CTI Logistics Limited<br />

• Director of several other public and private<br />

companies including Downer EDI Limited,<br />

FTR Holdings Limited and RG Capital Radio<br />

Limited<br />

Roger Maynard<br />

Non-Executive Director, Age 59<br />

• Appointed to the Board by British Airways<br />

Plc in March 1993<br />

• Member of the Audit, Risk & Compliance<br />

Committee<br />

• Director of Alliances, Investments and Joint<br />

Ventures for British Airways Plc<br />

• Chairman of British Airways Citi Express<br />

and Deutsche BA Luftfahrtgesellschaft mbH<br />

• Director of Iberia, Lineas Aereas<br />

de Espana<br />

Dr John Schubert<br />

Non-Executive Director, Age 59<br />

• Appointed to the Board in October 2000<br />

• Member of the Safety, Environment &<br />

Security Committee<br />

• Deputy Chairman of Commonwealth Bank<br />

of Australia<br />

• Director of BHP Billiton Limited, BHP Billiton<br />

Plc and Hanson Plc<br />

• President of the Business Council of Australia<br />

• Chairman of the Advisory Board of Worley<br />

Limited<br />

• Chairman of G2 Therapies Limited<br />

• Director of the Australian Graduate School<br />

of Management Limited, the Great Barrier<br />

Reef Research Foundation, the Salvation<br />

Army Advisory Board and the Opera<br />

Australia National Foundation<br />

Nick Tait<br />

Non-Executive Director, Age 63<br />

• Appointed to the Board by British Airways<br />

Plc in March 1993<br />

• Member of the Safety, Environment &<br />

Security Committee and the Chairman’s<br />

Committee<br />

• Director of Concorde International Travel<br />

Services Pty Limited and the Garvan<br />

Research Foundation<br />

• Fellow of the Australian Institute of<br />

Company Directors<br />

QF<br />

20<br />

02<br />

executive committee<br />

Geoff Dixon<br />

Chief Executive Officer<br />

Peter Gregg<br />

Chief Financial Officer<br />

Denis Adams<br />

Chief Executive Officer<br />

Australian Airlines<br />

Fiona Balfour<br />

Executive General Manager<br />

and Chief Information Officer<br />

John Borghetti<br />

Executive General Manager<br />

Sales and Marketing<br />

Kevin Brown<br />

Executive General Manager<br />

Human Resources<br />

Paul Edwards<br />

Executive General Manager<br />

Airline Strategy and Network<br />

Grant Fenn<br />

Executive General Manager<br />

Finance and Deputy Chief<br />

Financial Officer<br />

David Forsyth<br />

Executive General Manager<br />

Aircraft Operations<br />

David Hawes<br />

Group General Manager,<br />

Government and<br />

International Relations<br />

Brett Johnson<br />

General Counsel and<br />

Company Secretary<br />

Narendra Kumar<br />

Executive General Manager<br />

Subsidiary Businesses<br />

Michael Sharp<br />

Group General Manager<br />

Public Affairs<br />

p<br />

25

corporate governance statement<br />

BOARD RESPONSIBILITIES<br />

In preparing this Statement, the <strong>Qantas</strong> Board has focussed on<br />

the structure and values which it has in place to ensure that the<br />

Board protects and enhances shareholder value.<br />

The Board maintains, and ensures that <strong>Qantas</strong> management<br />

maintains, the highest level of corporate ethics. The Board<br />

comprises a majority of independent Non-Executive Directors<br />

who, together with the BA Directors and Executive Directors,<br />

have extensive commercial experience and bring independence,<br />

accountability and judgement to the Board’s deliberations to<br />

ensure maximum benefit to shareholders, employees and the<br />

wider community.<br />

In particular, the Board:<br />

• ensures compliance with laws and all appropriate<br />

accounting standards<br />

• sets and reviews strategic direction<br />

• monitors the operating and financial performance of the<br />

<strong>Qantas</strong> Group<br />

• monitors the performance of the Chief Executive Officer,<br />

Chief Financial Officer and executive management<br />

• monitors risk management<br />

• ensures that the market and shareholders are fully informed<br />

of material developments<br />

BOARD STRUCTURE<br />

• 11 Directors<br />

• seven independent Non-Executive Directors elected by<br />

shareholders other than British Airways – no substantial<br />

shareholder/supplier/customer relationship nor previous<br />

executive roles within <strong>Qantas</strong><br />

• Chairman is an independent Non-Executive Director<br />

• maximum 12 year term for independent Non-Executive<br />

Directors and six year term for the Chairman<br />

• two Non-Executive Directors are appointed by British Airways<br />

(a right acquired from the Australian Government in 1993<br />

when British Airways purchased its shareholding)<br />

• two Executive Directors – Chief Executive Officer and<br />

Chief Financial Officer<br />

• new independent Non-Executive Directors are nominated by<br />

the Chairman’s Committee, appointed by the other independent<br />

Non-Executive Directors and elected by shareholders<br />

• details of the Directors and their qualifications are on page 25<br />

• at the 2000 <strong>Annual</strong> General Meeting, shareholders approved<br />

the entering of Director Protection Deeds with each Director<br />

AUSTRALIAN PROVISIONS<br />

• the Constitution contains provisions to ensure the<br />

independence of the <strong>Qantas</strong> Board and to protect the<br />

airline’s position as the Australian flag carrier<br />

• head office must be in Australia<br />

• two-thirds of the Directors must be Australian citizens<br />

• Chairman must be an Australian citizen<br />

• British Airways cannot vote in any election of independent<br />

Non-Executive Directors<br />

• quorum for a Directors’ meeting must include a majority<br />

of non-BA Directors who are Australian citizens and at least<br />

one BA Director<br />

• maximum 49 per cent aggregate foreign ownership<br />

• maximum 35 per cent aggregate foreign airline ownership<br />

• maximum 25 per cent ownership by one foreign person<br />

BOARD MEETINGS<br />

• eight formal meetings a year<br />

• additional meetings held as required (eg during the aviation<br />

crisis resulting from the combination of the 11 September<br />

2001 terrorist attacks and the 14 September 2001 collapse<br />

of Ansett)<br />

• two-day meeting held each year to review and approve the<br />

strategy and financial plan for the next financial year<br />

COMMITTEES<br />

• Board does not delegate major decisions to Committees<br />

• Committees are responsible for considering detailed issues<br />

and making recommendations to the Board<br />

• Audit, Risk & Compliance Committee – assists the Board<br />

in fulfilling its audit, accounting and reporting obligations,<br />

monitors internal and external auditors (including the<br />

independence of the external auditors), monitors business<br />

risk management and compliance with legal and statutory<br />

obligations<br />

• Safety, Environment & Security Committee – receives detailed<br />

reports on all safety (including occupational health and<br />

safety), environment and security aspects of the airline and<br />

ensures that the appropriate risk management procedures are<br />

in place to protect the airline, its passengers, employees and<br />

the community<br />

• Chairman’s Committee – review Board’s performance and<br />

remuneration, nomination of new Directors, recommends<br />

remuneration for Chief Executive Officer and senior<br />

executives and monitors succession planning<br />

• Nominations Committee – approval of Chairman and any<br />

Alternate Directors<br />

• the Audit, Risk & Compliance Committee, Safety, Environment<br />

& Security Committee and Chairman’s Committee operate<br />

under formal Terms of Reference which are updated regularly<br />

• Non-Executive Directors are a majority on and hold the Chair<br />

of all Committees<br />

• Chairman of the Audit, Risk & Compliance Committee has<br />

appropriate financial experience<br />

• membership of and attendance at <strong>2002</strong> Board and<br />

Committee meetings are detailed on page 30<br />

STANDARDS<br />

• annual formal review of Board performance<br />

• active participation by all Directors at all meetings<br />

• open access to information<br />

• regular management presentations and visits to interstate/<br />

offshore operations<br />

• Chief Executive Officer and Chief Financial Officer certify the<br />

accuracy and completeness of financial information provided<br />

to the Board<br />

• independent professional advice is available to the Directors<br />

• formal Code of Conduct – including conflict of interest<br />

• formal share trading policy<br />

• formal Continuous Disclosure Policy – ensures compliance<br />

with the Listing Rules and Corporations Act and that all<br />

shareholders have equal access to material information<br />

EXTERNAL AUDITOR INDEPENDENCE<br />

• the Board closely monitors the independence of the<br />

external auditors<br />

• regularly reviews the independence safeguards put in place<br />

by the external auditors<br />

• requires the rotation of the audit partner every seven years<br />

• policies to restrict the type of non-audit services which can<br />

be provided by the external auditors<br />

• undertakes a detailed monthly review of non-audit fees paid<br />

to the external auditor<br />

• imposes restrictions on the employment of ex-employees<br />

of the external auditor<br />

• the Audit, Risk & Compliance Committee meets regularly<br />

with management without the external auditors and with<br />

the external auditors without management<br />

p<br />

26<br />

<strong>2002</strong> QANTAS ANNUAL REPORT

performance summary<br />

for the year ended 30 June <strong>2002</strong><br />

<strong>Qantas</strong> Group<br />

Increase/<br />

<strong>2002</strong> 2001 (Decrease)<br />

$M $M %<br />

Financial results<br />

Sales and operating revenue<br />

Net passenger revenue 9,027.5 7,941.8 13.7<br />

Net freight revenue 563.6 596.3 (5.5)<br />

Tours and travel revenue 674.4 604.3 11.6<br />

Contract work revenue 479.1 457.3 4.8<br />

Other sources* 578.0 588.5 (1.8)<br />

Sales and operating revenue 11,322.6 10,188.2 11.1<br />

Expenditure<br />

Manpower and staff related 2,689.2 2,549.9 5.5<br />

Selling and marketing 1,158.7 1,141.6 1.5<br />

Aircraft operating – variable 2,200.9 2,023.0 8.8<br />

Fuel and oil 1,570.0 1,329.8 18.1<br />

Property 264.3 246.9 7.0<br />

Computer and communication 408.4 365.0 11.9<br />

Depreciation and amortisation 693.5 706.7 (1.9)<br />

Non-cancellable operating lease rentals 255.7 181.8 40.6<br />

Tours and travel 584.4 525.7 11.2<br />

Capacity hire 499.9 220.2 127.0<br />

Other 354.4 201.8 75.6<br />

Share of net profit of associates (36.1) – n/a<br />

Expenditure 10,643.3 9,492.4 12.1<br />

Earnings before interest and tax 679.3 695.8 (2.4)<br />

Net borrowing costs (48.3) (98.7) (51.1)<br />

Profit from ordinary activities<br />

before related income tax expense 631.0 597.1 5.7<br />

Income tax expense relating to ordinary activities (201.7) (177.4) 13.7<br />

Net profit 429.3 419.7 2.3<br />

Outside equity interests in net profit (1.3) (4.3) (69.8)<br />

Net profit attributable to members of the company 428.0 415.4 3.0<br />

Financial position<br />

Total assets 14,801.5 12,513.6 18.3<br />

Total liabilities 10,548.0 9,197.7 14.7<br />

Total equity 4,253.5 3,315.9 28.3<br />

Cash flows<br />

Net cash provided by operating activities 1,143.3 1,100.7 3.9<br />

Net cash used in investing activities (2,306.1) (871.3) 164.7<br />

Net cash provided by/(used in) financing activities 1,688.8 (659.0) 356.3<br />

Net increase/(decrease) in cash held 526.0 (429.6) 222.4<br />

Performance ratios<br />

Net debt to net debt plus equity (ratio) 31:69 28:72 n/a<br />

Net debt to net debt plus equity including off balance sheet debt (ratio) 50:50 55:45 n/a<br />

Net debt to net debt plus equity including off balance sheet debt<br />

and revenue hedge receivables (ratio) 49:51 53:47 n/a<br />

Earnings per share (cents per share) 29.1 33.0 (11.8)<br />

Return on shareholders’ equity (percentage) 10.1 12.6 (2.5) points<br />

Return on shareholders’ equity including the notional capitalisation<br />

of non-cancellable operating leases on a hedged basis (percentage) 12.0 10.6 1.4 points<br />

Profit from ordinary activities before income tax expense as a percentage<br />

of sales and operating revenue (percentage) 5.6 5.9 (0.3) points<br />

Earnings before interest and tax as a percentage of sales<br />

and operating revenue (percentage) 6.0 6.8 (0.8) points<br />

* Excludes proceeds on sale (and on sale and leaseback) of non-current assets of $52.0 million (2001: $163.9 million), and interest revenue<br />

of $69.3 million (2001: $69.0 million) which is included in net borrowing costs.<br />

THE SPIRIT OF AUSTRALIA<br />

p<br />

27

contents<br />

page<br />

Directors’ <strong>Report</strong> 29<br />

Statement of financial performance 34<br />

Discussion and analysis of the statement<br />

of financial performance 35<br />

Statement of financial position 37<br />

Discussion and analysis of the statement<br />

of financial position 38<br />

Statement of cash flows 39<br />

Discussion and analysis of the statement<br />

of cash flows 40<br />

Notes to the financial statements 41<br />

1. Basis of the preparation of the<br />

concise financial report 41<br />

2. Change in accounting policy 41<br />

3. Revenue from ordinary activities 42<br />

4. Individually significant items included<br />

in profit from ordinary activities<br />

before income tax expense 42<br />

5. Individually significant income tax item 42<br />

6. Retained profits 42<br />

7. Dividends 43<br />

8. Total equity reconciliation 43<br />

9. Segment information 44<br />

10. Contingent liabilities 46<br />

11. Capital expenditure commitments 47<br />

12. Events subsequent to balance date 47<br />

Directors’ declaration 48<br />

Independent audit report on the concise financial report 48<br />

Shareholder information 49<br />

<strong>Qantas</strong> Group five-year summary 50<br />

Glossary 52<br />

Financial calendar 52<br />

Corporate directory<br />

IBC<br />

Information for shareholders is provided in this <strong>Annual</strong> <strong>Report</strong> and in a separate Financial <strong>Report</strong>.<br />

This <strong>Report</strong> is a Concise Financial <strong>Report</strong> which contains key financial information about <strong>Qantas</strong> in a concise format.<br />

The Financial <strong>Report</strong> provides more detailed financial information. The Concise Financial <strong>Report</strong>, whilst derived from the<br />

Financial <strong>Report</strong>, cannot be expected to provide as full an understanding of the financial performance, financial position<br />

and financing and investing activities of <strong>Qantas</strong> and its controlled entities as the Financial <strong>Report</strong>.<br />

A copy of the Financial <strong>Report</strong>, including the Independent Audit <strong>Report</strong> thereon, is available to all shareholders, free<br />

of charge, upon request. The Financial <strong>Report</strong> can be requested by telephone (toll free within Australia 1800 177 747,<br />

overseas 61 2 8234 5470).<br />

p<br />

28<br />

THE SPIRIT OF AUSTRALIA

directors’ report<br />

for the year ended 30 June <strong>2002</strong><br />

The Directors of <strong>Qantas</strong> Airways Limited (<strong>Qantas</strong>) present their report together with the Concise Financial <strong>Report</strong> of the<br />

consolidated entity, being <strong>Qantas</strong> and its controlled entities (<strong>Qantas</strong> Group), for the financial year ended 30 June <strong>2002</strong><br />

and the Audit <strong>Report</strong> thereon.<br />

Directors<br />

The Directors of <strong>Qantas</strong> at any time during or since the end of the financial year are:<br />

Margaret Jackson<br />

Geoff Dixon<br />

Peter Gregg Paul Anderson (appointed 2 September <strong>2002</strong>)<br />

Mike Codd, AC<br />

Trevor Eastwood, AM<br />

Rod Eddington # (resigned 23 November 2001)<br />

Jim Kennedy, AO, CBE<br />

Trevor Kennedy, AM<br />

Roger Maynard<br />

John Rishton ~ (ceased to be an alternate Director<br />

John Schubert<br />

23 November 2001) Nick Tait.<br />

Details of Directors, their experience and any special responsibilities are set out on pages 24 and 25.<br />

# Rod Eddington is the Chief Executive Officer of British Airways Plc. When it was not possible for him to attend <strong>Qantas</strong><br />

Board Meetings, he was represented by an alternate, Roger Maynard.<br />

~ John Rishton was an alternate for Rod Eddington.<br />

Principal activities<br />

The principal activities of the <strong>Qantas</strong> Group during the course of the financial year were the operation of international and<br />

domestic air transportation services, the sale of worldwide and domestic holiday tours and associated support activities<br />

including information technology, catering, ground handling and engineering and maintenance. There were no significant<br />

changes in the nature of the activities of the <strong>Qantas</strong> Group during the financial year.<br />

Dividends<br />

The Directors declared a final dividend of $140.7 million (final ordinary dividend of 9.0 cents per share) for the year ended<br />

30 June <strong>2002</strong> (2001: final ordinary dividend of 9.0 cents per share). The final dividend will be fully franked and follows a fully<br />

franked interim ordinary dividend of $124.1 million (8.0 cents per share), which was paid during the financial year.<br />

Review of operations and state of affairs<br />

A review of the <strong>Qantas</strong> Group’s operations, including the results of those operations, and changes in the state of affairs of the<br />

<strong>Qantas</strong> Group during the financial year is contained on pages 6 to 23. In the opinion of the Directors, there were no other<br />

significant changes in the state of affairs of the <strong>Qantas</strong> Group that occurred during the financial year under review not<br />

otherwise disclosed in this <strong>Annual</strong> <strong>Report</strong>.<br />

Events subsequent to balance date<br />

On 21 August <strong>2002</strong>, <strong>Qantas</strong> announced its intention to raise up to $800 million of ordinary equity through an entitlement<br />

offer to existing shareholders to support its capital expenditure program and help fund other potential investment<br />

opportunities that may arise.<br />

The funds will be raised by way of a non-renounceable entitlement offer made in two parts, an institutional entitlement<br />

offer of $600 million and a retail entitlement offer of $200 million. Qualifying shareholders will be entitled to subscribe<br />

for a pro-rata entitlement of 1 ordinary share for every 8.2 ordinary shares held, at an issue price of $4.20 per share.<br />

The institutional component and $100 million of the retail component of the offer have been underwritten.<br />

The institutional entitlement offer was successfully completed on 23 August <strong>2002</strong>. <strong>Qantas</strong> will allocate shares to participating<br />

institutions on 5 September <strong>2002</strong>.<br />

A prospectus for the retail entitlement offer is scheduled to be dispatched to qualifying shareholders by 6 September <strong>2002</strong><br />

to allow those shareholders to subscribe for ordinary shares. The retail entitlement offer is scheduled to open on 9 September<br />

<strong>2002</strong> and close on 27 September <strong>2002</strong>.<br />

Other than the abovementioned, there has not arisen in the interval between the end of the financial year and the date of this<br />

<strong>Report</strong>, any item, transaction or event of a material and unusual nature that, in the opinion of the Directors, has significantly<br />

affected, or may significantly affect, the operations of the <strong>Qantas</strong> Group, the results of those operations, or the state of affairs<br />

of the <strong>Qantas</strong> Group, in this financial year or in future financial years.<br />

Likely developments<br />

Pages 6 to 23 of this report include information on developments likely to affect the operations of the <strong>Qantas</strong> Group.<br />

<strong>2002</strong> QANTAS ANNUAL REPORT<br />

p<br />

29

directors’ report continued<br />

for the year ended 30 June <strong>2002</strong><br />

Further information about likely developments in the operations of the <strong>Qantas</strong> Group and the expected results of those<br />

operations in future financial years has not been included in this Directors’ <strong>Report</strong> because disclosure of the information could<br />