Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

Return of Or anization Exem t From Income Tax g p - Foundation ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

For Paperwork Reduction Act Notice , see the separate instructions.<br />

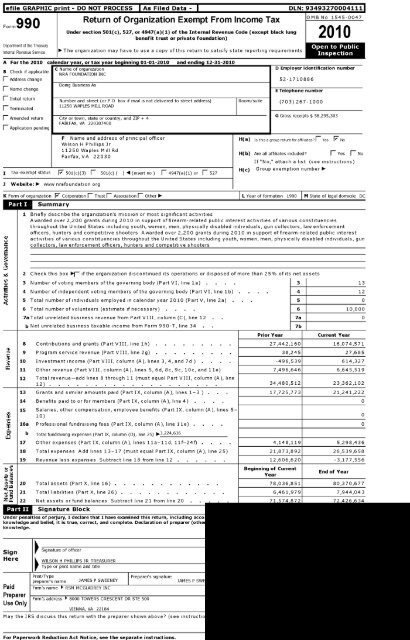

l efile GRAPHIC rint - DO NOT PROCESS As Filed Data - DLN: 93493270004111<br />

Form<br />

990<br />

Department <strong>of</strong> the Treasury<br />

<strong>Return</strong> <strong>of</strong> <strong>Or</strong>g<br />

<strong>anization</strong> <strong>Exem</strong> pt<br />

<strong>From</strong> <strong>Income</strong> <strong>Tax</strong><br />

Under section 501 (c), 527, or 4947( a)(1) <strong>of</strong> the Internal Revenue Code ( except black lung<br />

benefit trust or private foundation)<br />

Internal Revenue Service -The org<strong>anization</strong> may have to use a copy <strong>of</strong> this return to satisfy state reporting requirements<br />

OMB No 1545-0047<br />

201 0<br />

A For the 2010 calendar year , or tax year beginning 01 -01-2010 and ending 12 -31-2010<br />

C Name <strong>of</strong> org<strong>anization</strong><br />

D Employer identification number<br />

B Check if applicable<br />

NRA FOUNDATION INC<br />

F Address change 52-1710886<br />

Doing Business As<br />

F Name change<br />

E Telephone number<br />

fl Initial return<br />

F_ Terminated<br />

Number and street (or P 0 box if mail is not delivered to street address) Room/suite (703) 267-1000<br />

11250 WAPLES MILL ROAD<br />

1 Amended return City or town, state or country, and ZIP + 4<br />

FAIRFAX, VA 220307400<br />

F_ Application pending<br />

G Gross receipts $ 58,295,303<br />

F Name and address <strong>of</strong> principal <strong>of</strong>ficer H(a) Is this a group return for affiliates Yes I' No<br />

Wilson H Phillips Jr<br />

11250 Waples Mill Rd<br />

H(b) Are all affiliates included Yes No<br />

Fairfax, VA 22030<br />

If "No," attach a list (see instructions)<br />

I <strong>Tax</strong>-exempt status F 501(c)(3) fl 501(c) ( ) I (insert no fl 4947(a)(1) or F_ 527<br />

3 Website : 1- www nrafoundation org<br />

H(c)<br />

Group exemption number 0-<br />

K Form <strong>of</strong> org<strong>anization</strong> F Corporation 1 Trust F_ Association 1 Other 1- L Year <strong>of</strong> formation 1990 M State <strong>of</strong> legal domicile DC<br />

Summary<br />

1 Briefly describe the org<strong>anization</strong> ' s mission or most significant activities<br />

Awarded over 2,200 grants during 2010 in support <strong>of</strong>firearm- related public interest activities <strong>of</strong> various constituencies<br />

throughout the United States including youth, women , men, physically disabled individuals , gun collectors , law enforcement<br />

<strong>of</strong>ficers, hunters and competitive shooters Awarded over 2,200 grants during 2010 in support <strong>of</strong>firearm- related public interest<br />

activities <strong>of</strong> various constituencies throughout the United States including youth, women , men, physically disabled individuals, gun<br />

collectors , law enforcement <strong>of</strong>ficers, hunters and competitive shooters<br />

2 Check this box if the org<strong>anization</strong> discontinued its operations or disposed <strong>of</strong> more than 25% <strong>of</strong> its net assets<br />

3 N umber <strong>of</strong> voting members <strong>of</strong> the governing body ( Part VI, line 1a) . 3 13<br />

4 Number <strong>of</strong> independent voting members <strong>of</strong> the governing body ( Part VI, line 1b) 4 12<br />

5 Total number <strong>of</strong> individuals employed in calendar year 2010 ( Part V, line 2a) . 5 0<br />

6 Total number <strong>of</strong> volunteers ( estimate if necessary) . 6 10,000<br />

7aTotal unrelated business revenue from Part VIII, column ( C), line 12 7a 0<br />

b Net unrelated business taxable income from Form 990-T, line 34 7b<br />

Prior Year<br />

Current Year<br />

8 Contributions and grants ( Part VIII , line 1h ) . 27,442,160 16,074,571<br />

9 Program service revenue (Part VIII , line 2g ) . 38,245 27,685<br />

13-<br />

10 Investment income ( Part VIII , column ( A), lines 3, 4, and 7d . -496,539 614,327<br />

11 Other revenue (Part VIII , column ( A), lines 5, 6d, 8c , 9c, 10c, and 11e) 7,496,646 6,645,519<br />

12 Total revenue - add lines 8 through 11 (must equal Part VIII , column ( A), line<br />

12) . . . . . . . . . . . . . . . . . . . 34,480,512 23,362,102<br />

13 Grants and similar amounts paid (Part IX , column (A), lines 1-3 . 17,725,773 21,241,222<br />

14 Benefits paid to or for members (Part IX, column (A), line 4) . 0<br />

15 Salaries , other compensation , employee benefits ( Part IX, column ( A), lines 5-<br />

10) 0<br />

i 16a Pr<strong>of</strong>essional fundraising fees ( Part IX, column (A), line l le) . 0<br />

b Total fundraising expenses (Part IX, column (D), line 25) 0-3,224,616<br />

17 Other expenses ( Part IX, column (A), lines 11a-11d, 11f-24f) . 4,148,119 5,298,436<br />

18 Total expenses Add lines 13 - 17 (must equal Part IX, column (A), line 25) 21,873,892 26,539,658<br />

19 Revenue less expenses Subtract line 18 from line 12 12,606,620 -3,177,556<br />

e ll<br />

'M<br />

ED<br />

Beginning <strong>of</strong> Current<br />

Year<br />

End <strong>of</strong> Year<br />

20 Total assets ( Part X, line 16 ) . 78,036,851 80,370,677<br />

21 Total liabilities (Part X, line 26 ) . . . . . . . . . . . 6,461,979 7,944,043<br />

ZLL 22 Net assets or fund balances Subtract line 21 from line 20 71 574 872 72 426 634<br />

lifij=<br />

Signature Block<br />

Under penalties <strong>of</strong> perjury , I declare that I have examined this return, including acco<br />

knowledge and belief, it is true , correct , and complete. Declaration <strong>of</strong> preparer (othe<br />

knowledge.<br />

Sign<br />

Signature <strong>of</strong> <strong>of</strong>ficer<br />

Here WILSON H PHILLIPS JR TREASURER<br />

Type or print name and title<br />

Print/Type<br />

Preparer' s signature<br />

preparer ' s name JAMES P SWEENEY JAMES P SW<br />

Paid Firm ' s name RSM MCGLADREY INC<br />

Preparer<br />

Use Only<br />

Firm ' s address 8000 TOWERS CRESCENT DR STE 500<br />

VIENNA, VA 22184<br />

May the IRS discuss this return with the preparer shown above (see instructio

Form 990 (2010)<br />

Form 990 (2010) Page 2<br />

1:M-600<br />

Statement <strong>of</strong> Program Service Accomplishments<br />

Check if Schedule 0 contains a response to any question in this Part III F<br />

1 Briefly describe the org<strong>anization</strong>'s mission<br />

Support firearm-related public interest activities to defend and foster the Second Amendment rights <strong>of</strong> law-abiding Americans Promote<br />

firearms and hunting safety, enhance marksmanship skills <strong>of</strong> shooting sports participants, and educate the general public about firearms in<br />

their historic, technological and artistic context<br />

2 Did the org<strong>anization</strong> undertake any significant program services during the year which were not listed on<br />

the prior Form 990 or 990-EZ'' . . . . . . . . . . . . . . . . . . . . fl Yes F No<br />

If "Yes," describe these new services on Schedule 0<br />

3 Did the org<strong>anization</strong> cease conducting, or make significant changes in how it conducts, any program<br />

services F Yes F No<br />

If "Yes," describe these changes on Schedule 0<br />

4 Describe the exempt purpose achievements for each <strong>of</strong> the org<strong>anization</strong>'s three largest program services by expenses<br />

Section 501(c)(3) and 501(c)(4) org<strong>anization</strong>s and section 4947(a)(1) trusts are required to report the amount <strong>of</strong> grants and<br />

allocations to others, the total expenses, and revenue, if any, for each program service reported<br />

4a (Code ) (Expenses $ 22,007,401 including grants <strong>of</strong> $ 21,241,222 ) (Revenue $<br />

The NRA <strong>Foundation</strong> financially supports programs that provide direct community support, including Eddie Eagle GunSafe program for children Partners in Shooting,<br />

working with individuals with physical disablilities in the shooting sports Refuse to be a Victim program training women on how to avoid being the victim <strong>of</strong> crime<br />

wildlife and natural resource conservation goals, such as Hunters for the Hungry Environment Conservation and Hunting Outreach ECHO Youth Hunter Education<br />

Challenge YHEC basic firearms training and safety courses marksmanship qualification programs instructor and range safety <strong>of</strong>ficer certifica- tions and law<br />

enforcement training Boy Scouts and 4-H groups are among the most frequent recipients <strong>of</strong> funding - for merit badge, hunter education and safety training<br />

Numerous programs benefit men, women and youth across the country<br />

4b (Code ) (Expenses $ 31,935 including grants <strong>of</strong> $ ) (Revenue $ 27,685<br />

The NRA <strong>Foundation</strong>s National Firearms Law Seminar is conducted annually and is an opportunity for attorneys who represent firearms owners and firearms- related<br />

businesses to meet and discuss legal issues and theories relevant to this expanding area <strong>of</strong> the law A nationally-renowned faculty is always on hand to address a<br />

broad range <strong>of</strong> firearms-related issues<br />

4c (Code ) (Expenses $ including grants <strong>of</strong> $ ) (Revenue $<br />

4d Other program services (Describe in Schedule 0<br />

(Expenses $ including grants <strong>of</strong> $ ) (Revenue $<br />

4e Total program service expenses $ 22,0 39,3 36

Form 990 (2010) Page 3<br />

Li^ Checklist <strong>of</strong> Required Schedules<br />

1 Is the org<strong>anization</strong> described in section 501(c)(3) or4947(a)(1) (other than a private foundation) If "Yes," Yes<br />

complete Schedule As . . . . . . . . . . . . . . . . . . . . . ^ 1<br />

2 Is the org<strong>anization</strong> required to complete Schedule B, Schedule <strong>of</strong> Contributors (see instruction) 2 Yes<br />

3 Did the org<strong>anization</strong> engage in direct or indirect political campaign activities on behalf <strong>of</strong> or in opposition to No<br />

candidates for public <strong>of</strong>fice If "Yes,"complete Schedule C, Part I . . . . . . . . . . 3<br />

4 Section 501 ( c)(3) org<strong>anization</strong>s . Did the org<strong>anization</strong> engage in lobbying activities, or have a section 501(h) No<br />

election in effect during the tax year If "Yes,"complete Schedule C, Part II . 4<br />

5 Is the org<strong>anization</strong> a section 501(c)(4), 501(c)(5), or 501(c)(6) org<strong>anization</strong> that receives membership dues,<br />

assessments, or similar amounts as defined in Revenue Procedure 98-19 If "Yes,"complete Schedule C, Part<br />

III . . . . . . . . . . . . . . . . . . . . . . . . 5<br />

6 Did the org<strong>anization</strong> maintain any donor advised funds or any similar funds or accounts where donors have the<br />

right to provide advice on the distribution or investment <strong>of</strong> amounts in such funds or accounts If "Yes,"complete<br />

Schedule D, Part I . . . . . . . . . . . . . . . . . . . . . . 6 N o<br />

7 Did the org<strong>anization</strong> receive or hold a conservation easement, including easements to preserve open space,<br />

the environment, historic land areas or historic structures If "Yes,"complete Schedule D, Part II . . 7 No<br />

8 Did the org<strong>anization</strong> maintain collections <strong>of</strong> works <strong>of</strong> art, historical treasures, or other similar assets If "Yes,"<br />

complete Schedule D, Part III . . . . . . . . . . . . . . . . . . . .<br />

Yes<br />

8 Yes<br />

9 Did the org<strong>anization</strong> report an amount in Part X, line 21, serve as a custodian for amounts not listed in Part X, or<br />

provide credit counseling, debt management, credit repair, or debt negotiation services If "Yes,"<br />

complete Schedule D, Part IV . 9 N o<br />

10 Did the org<strong>anization</strong>, directly or through a related org<strong>anization</strong>, hold assets in term, permanent,or quasi- 10 Yes<br />

endowments If "Yes,"complete Schedule D, Part 15<br />

11 If the org<strong>anization</strong>'s answer to any <strong>of</strong> the following questions is 'Yes,' then complete Schedule D, Parts VI, VII,<br />

VIII, IX, or X as applicable<br />

No<br />

a Did the org<strong>anization</strong> report an amount for land, buildings, and equipment in Part X, linelO If "Yes,"complete<br />

Schedule D, Part VI.95<br />

b Did the org<strong>anization</strong> report an amount for investments-other securities in Part X, line 12 that is 5% or more <strong>of</strong><br />

its total assets reported in Part X, line 16 If "Yes,"complete Schedule D, Part VII. lib<br />

c Did the org<strong>anization</strong> report an amount for investments-program related in Part X, line 13 that is 5% or more <strong>of</strong><br />

its total assets reported in Part X, line 16 If "Yes,"complete Schedule D, Part VIII. 11c<br />

d Did the org<strong>anization</strong> report an amount for other assets in Part X, line 15 that is 5% or more <strong>of</strong> its total assets<br />

reported in Part X, line 16 If "Yes,"complete Schedule D, Part IXI^ lld<br />

11a<br />

Yes<br />

Yes<br />

No<br />

No<br />

12a<br />

e Did the org<strong>anization</strong> report an amount for other liabilities in Part X, line 25 If "Yes," complete Schedule D, Part X.95<br />

f Did the org<strong>anization</strong>'s separate or consolidated financial statements for the tax year include a footnote that<br />

addresses the org<strong>anization</strong>'s liability for uncertain tax positions under FIN 48 (ASC 740) If "Yes,"complete 11f Yes<br />

Schedule D, Part X.95<br />

Did the org<strong>anization</strong> obtain separate, independent audited financial statements for the tax year If "Yes,"<br />

complete Schedule D, Parts XI, XII, and XIII 12a Yes<br />

b Was the org<strong>anization</strong> included in consolidated, independent audited financial statements for the tax year If<br />

"Yes," and if the org<strong>anization</strong> answered 'No'to line 12a, then completing Schedule D, Parts XI, XII, and XIII is optional 12b Yes<br />

lie<br />

Yes<br />

13 Is the org<strong>anization</strong> a school described in section 170(b)(1)(A)(ii) If "Yes, "complete Schedule E<br />

13 No<br />

14a Did the org<strong>anization</strong> maintain an <strong>of</strong>fice, employees, or agents outside <strong>of</strong> the United States . 14a No<br />

b Did the org<strong>anization</strong> have aggregate revenues or expenses <strong>of</strong> more than $10,000 from grantmaking, fundraising, business, and program<br />

service activities outside the United States If "Yes," complete Schedule F, Parts I and IV . 14b<br />

N o<br />

15 Did the org<strong>anization</strong> report on Part IX, column (A), line 3, more than $5,000 <strong>of</strong> grants or assistance to any<br />

org<strong>anization</strong> or entity located outside the U S If "Yes, "complete Schedule F, Parts II and IV . . 15 No<br />

16 Did the org<strong>anization</strong> report on Part IX, column (A), line 3, more than $5,000 <strong>of</strong> aggregate grants or assistance to<br />

individuals located outside the U S If "Yes,"complete Schedule F, Parts III and IV .<br />

16 No<br />

17 Did the org<strong>anization</strong> report a total <strong>of</strong> more than $15,000, <strong>of</strong> expenses for pr<strong>of</strong>essional fundraising services on 17 No<br />

Part IX, column (A), lines 6 and 11e If "Yes,"complete Schedule G, Part I (see instructions)<br />

18 Did the org<strong>anization</strong> report more than $15,000 total <strong>of</strong>fundraising event gross income and contributions on Part<br />

VIII, lines 1c and 8a If "Yes, "complete Schedule G, Part II .<br />

18 Yes<br />

19 Did the org<strong>anization</strong> report more than $15,000 <strong>of</strong> gross income from gaming activities on Part VIII, line 9a If 19 Yes<br />

"Yes," complete Schedule G, Part III . . . . . . . . . . . . . . . . . . . S<br />

20a Did the org<strong>anization</strong> operate one or more hospitals If "Yes,"complete ScheduleH .<br />

b If "Yes" to line 20a, did the org<strong>anization</strong> attach its audited financial statement to this return Note . Some Form<br />

990 filers that operate one or more hospitals must attach audited financial statements (see instructions)<br />

20a<br />

20b<br />

No<br />

Form 990 (2010)

Form 990 (2010) Page 4<br />

Li^ Checklist <strong>of</strong> Required Schedules (continued)<br />

21 Did the org<strong>anization</strong> report more than $5,000 <strong>of</strong> grants and other assistance to governments and org<strong>anization</strong>s in 21 Yes<br />

the United States on Part IX, column (A), line 1'' If "Yes,"complete Schedule I, Parts I and II .<br />

22 Did the org<strong>anization</strong> report more than $5,000 <strong>of</strong> grants and other assistance to individuals in the United States<br />

on Part IX, column (A), line 2'' If "Yes,"complete Schedule I, Parts I and III .<br />

23 Did the org<strong>anization</strong> answer "Yes" to Part VII, Section A, questions 3, 4, or 5, about compensation <strong>of</strong> the<br />

org<strong>anization</strong>'s current and former <strong>of</strong>ficers, directors, trustees, key employees, and highest compensated 23 Yes<br />

employees If "Yes,"complete Schedule J . . . . . . . . . . . . . . . Q9<br />

24a Did the org<strong>anization</strong> have a tax-exempt bond issue with an outstanding principal amount <strong>of</strong> more than $100,000<br />

as <strong>of</strong> the last day <strong>of</strong> the year, that was issued after December 31, 2002' If "Yes," answer lines 24b-24d and<br />

complete Schedule K. If "No,"go to line 25 . . . . . . . . . . . . . . . 24a<br />

22<br />

No<br />

N o<br />

b Did the org<strong>anization</strong> invest any proceeds <strong>of</strong> tax-exempt bonds beyond a temporary period exception .<br />

c Did the org<strong>anization</strong> maintain an escrow account other than a refunding escrow at any time during the year<br />

to defease any tax-exempt bonds . 24c<br />

d Did the org<strong>anization</strong> act as an "on behalf <strong>of</strong>" issuer for bonds outstanding at any time during the year • 24d<br />

25a Section 501(c )( 3) and 501 ( c)(4) org<strong>anization</strong>s . Did the org<strong>anization</strong> engage in an excess benefit transaction with<br />

a disqualified person during the year If "Yes,"complete Schedule L, Part I 25a No<br />

b Is the org<strong>anization</strong> aware that it engaged in an excess benefit transaction with a disqualified person in a prior<br />

year, and that the transaction has not been reported on any <strong>of</strong> the org<strong>anization</strong>'s prior Forms 990 or 990-EZ7 If 25b No<br />

"Yes," complete Schedule L, Part I .<br />

26 Was a loan to or by a current or former <strong>of</strong>ficer, director, trustee, key employee, highly compensated employee, or<br />

disqualified person outstanding as <strong>of</strong> the end <strong>of</strong> the org<strong>anization</strong>'s tax year If "Yes," complete Schedule L, 26<br />

Part II .<br />

27 Did the org<strong>anization</strong> provide a grant or other assistance to an <strong>of</strong>ficer, director, trustee, key employee, substantial<br />

contributor, or a grant selection committee member, or to a person related to such an individual If "Yes," 27 No<br />

complete Schedule L, Part III .<br />

28 Was the org<strong>anization</strong> a party to a business transaction with one <strong>of</strong> the following parties (see Schedule L, Part IV<br />

instructions for applicable filing thresholds, conditions, and exceptions)<br />

24b<br />

No<br />

a A current or former <strong>of</strong>ficer, director, trustee, or key employee If "Yes,"complete Schedule L, Part<br />

IV<br />

b A family member <strong>of</strong> a current or former <strong>of</strong>ficer, director, trustee, or key employee If "Yes,"<br />

complete Schedule L, Part IV . . . . . . . . . . . . . . . . . . 28b<br />

c A n entity <strong>of</strong> which a current or former <strong>of</strong>ficer, director, trustee, or key employee (or a family member there<strong>of</strong>) was<br />

an <strong>of</strong>ficer, director, trustee, or direct or indirect owner If "Yes,"complete Schedule L, Part IV . . 28c<br />

28a<br />

N o<br />

N o<br />

No<br />

29 Did the org<strong>anization</strong> receive more than $25 , 000 in non-cash contributions If "Yes , " complete Schedule MS 29 Yes<br />

30 Did the org<strong>anization</strong> receive contributions <strong>of</strong> art, historical treasures, or other similar assets, or qualified<br />

conservation contributions If "Yes,"complete Schedule M . . . . . . . . . . . 30 No<br />

31 Did the org<strong>anization</strong> liquidate, terminate, or dissolve and cease operations If "Yes,"complete Schedule N,<br />

PartI . 31 No<br />

32 Did the org<strong>anization</strong> sell, exchange, dispose <strong>of</strong>, or transfer more than 25% <strong>of</strong> its net assets If "Yes,"complete<br />

Schedule N, Part II . 32 N o<br />

33 Did the org<strong>anization</strong> own 100% <strong>of</strong> an entity disregarded as separate from the org<strong>anization</strong> under Regulations<br />

sections 301 7701-2 and3017701-3'' If"Yes,"complete Schedule R, PartI . 33 No<br />

34 Was the org<strong>anization</strong> related to any tax-exempt or taxable entity If "Yes,"complete Schedule R, Parts II, III, IV,<br />

and V, line 1 . .<br />

35 Is any related org<strong>anization</strong> a controlled entity within the meaning <strong>of</strong> section 512(b)(13)7 .<br />

a Did the org<strong>anization</strong> receive any payment from or engage in any transaction with a controlled entity within the<br />

meaning <strong>of</strong> section 512 (b)(13 )'' If "Yes,"complete Schedule R, Part V, line 2 . . . F-Yes F7No<br />

36 Section 501(c )( 3) org<strong>anization</strong>s . Did the org<strong>anization</strong> make any transfers to an exempt non-charitable related<br />

org<strong>anization</strong> If "Yes,"complete Schedule R, Part V, line 2 . 36<br />

37 Did the org<strong>anization</strong> conduct more than 5% <strong>of</strong> its activities through an entity that is not a related org<strong>anization</strong><br />

and that is treated as a partnership for federal income tax purposes If "Yes,"complete Schedule R, Part VI 37<br />

38 Did the org<strong>anization</strong> complete Schedule 0 and provide explanations in Schedule 0 for Part VI, lines 11 and 197<br />

Note . All Form 990 filers are required to complete Schedule 0 38<br />

34 Yes<br />

35 N o<br />

Yes<br />

Yes<br />

No<br />

Form 990 (2010)

Form 990 (2010)<br />

Form 990 ( 2010) Page 5<br />

Statements Regarding Other IRS Filings and <strong>Tax</strong> Compliance<br />

Check if Schedule 0 contains a response to any question in this Part V<br />

Yes<br />

No<br />

la Enter the number reported in Box 3 <strong>of</strong> Form 1096 Enter -0- if not applicable<br />

b Enter the number <strong>of</strong> Forms W-2G included in line la Enter -0- if not applicable<br />

la 1,578<br />

lb 0<br />

c Did the org<strong>anization</strong> comply with backup withholding rules for reportable payments to vendors and reportable<br />

gaming (gambling) winnings to prize winners 1c Yes<br />

2a Enter the number <strong>of</strong> employees reported on Form W-3, Transmittal <strong>of</strong> Wage and <strong>Tax</strong><br />

Statements filed for the calendar year ending with or within the year covered by this<br />

return . . . . . . . . . . . . . . . . . . . . 2a 0<br />

b If at least one is reported on line 2a, did the org<strong>anization</strong> file all required federal employment tax returns<br />

Note . If the sum <strong>of</strong> lines la and 2a is greater than 250, you may be required to e-file (see instructions)<br />

2b<br />

3a<br />

Did the org<strong>anization</strong> have unrelated business gross income <strong>of</strong> $1,000 or more during the<br />

year . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3a N o<br />

b If "Yes," has it filed a Form 990-T for this year If "No,"provide an explanation in Schedule O . . . . 3b<br />

4a At any time during the calendar year, did the org<strong>anization</strong> have an interest in, or a signature or other authority<br />

over, a financial account in a foreign country (such as a bank account, securities account, or other financial<br />

account) . 4a No<br />

b If "Yes," enter the name <strong>of</strong> the foreign country 0-<br />

See instructions for filing requirements for Form TD F 90-22 1, Report <strong>of</strong> Foreign Bank and Financial Accounts<br />

5a Was the org<strong>anization</strong> a party to a prohibited tax shelter transaction at any time during the tax year . . 5a No<br />

b Did any taxable party notify the org<strong>anization</strong> that it was or is a party to a prohibited tax shelter transaction<br />

c If "Yes" to line 5a or 5b, did the org<strong>anization</strong> file Form 8886-T''<br />

6a Does the org<strong>anization</strong> have annual gross receipts that are normally greater than $100,000, and did the 6a No<br />

org<strong>anization</strong> solicit any contributions that were not tax deductible<br />

b<br />

If "Yes," did the org<strong>anization</strong> include with every solicitation an express statement that such contributions or gifts<br />

were not tax deductible . 6b<br />

7 <strong>Or</strong>g<strong>anization</strong>s that may receive deductible contributions under section 170(c).<br />

a Did the org<strong>anization</strong> receive a payment in excess <strong>of</strong> $75 made partly as a contribution and partly for goods and 7a Yes<br />

services provided to the payor7 .<br />

b If "Yes," did the org<strong>anization</strong> notify the donor <strong>of</strong> the value <strong>of</strong> the goods or services provided . 7b Yes<br />

c Did the org<strong>anization</strong> sell, exchange, or otherwise dispose <strong>of</strong> tangible personal property for which it was required to<br />

file Form 82827 . 7c No<br />

d If "Yes," indicate the number <strong>of</strong> Forms 8282 filed during the year 7d<br />

5b<br />

Sc<br />

No<br />

e Did the org<strong>anization</strong> receive any funds, directly or indirectly, to pay premiums on a personal benefit<br />

contract . 7e No<br />

f Did the org<strong>anization</strong>, during the year, pay premiums, directly or indirectly, on a personal benefit contract 7f No<br />

g If the org<strong>anization</strong> received a contribution <strong>of</strong> qualified intellectual property, did the org<strong>anization</strong> file Form 8899 as<br />

required . 7g<br />

h If the org<strong>anization</strong> received a contribution <strong>of</strong> cars, boats, airplanes, or other vehicles, did the org<strong>anization</strong> file a<br />

Form 1098-C7<br />

8 Sponsoring org<strong>anization</strong>s maintaining donor advised funds and section 509(a)(3) supporting org<strong>anization</strong>s. Did<br />

the supporting org<strong>anization</strong>, or a donor advised fund maintained by a sponsoring org<strong>anization</strong>, have excess<br />

business holdings at any time during the year .<br />

9 Sponsoring org<strong>anization</strong>s maintaining donor advised funds.<br />

a Did the org<strong>anization</strong> make any taxable distributions under section 49667 .<br />

b Did the org<strong>anization</strong> make a distribution to a donor, donor advisor, or related person<br />

10 Section 501(c )( 7) org<strong>anization</strong>s. Enter<br />

7h<br />

8<br />

9a<br />

9b<br />

a Initiation fees and capital contributions included on Part VIII, line 12<br />

b Gross receipts, included on Form 990, Part VIII, line 12, for public use <strong>of</strong> club<br />

facilities<br />

10a<br />

10b<br />

11 Section 501(c )( 12) org<strong>anization</strong>s. Enter<br />

a<br />

b<br />

Gross income from members or shareholders<br />

Gross income from other sources (Do not net amounts due or paid to other sources<br />

against amounts due or received from them ) . . . . . . 11b<br />

11a<br />

12a Section 4947( a)(1) non -exempt charitable trusts. Is the org<strong>anization</strong> filing Form 990 in lieu <strong>of</strong> Form 1041'<br />

b<br />

If "Yes," enter the amount <strong>of</strong> tax-exempt interest received or accrued during the<br />

year<br />

13 Section 501(c )( 29) qualified nonpr<strong>of</strong>it health insurance issuers.<br />

a Is the org<strong>anization</strong> licensed to issue qualified health plans in more than one state<br />

Note . See the instructions for additional information the org<strong>anization</strong> must report on Schedule 0<br />

12b<br />

12a<br />

13a<br />

b Enter the amount <strong>of</strong> reserves the org<strong>anization</strong> is required to maintain by the states<br />

in which the org<strong>anization</strong> is licensed to issue qualified health plans 13b<br />

c<br />

Enter the amount <strong>of</strong> reserves on hand<br />

14a Did the org<strong>anization</strong> receive any payments for indoor tanning services during the tax year . 14a No<br />

b If "Yes," has it filed a Form 720 to report these payments If "No,"provide an explanation in Schedule 0 . 14b<br />

13c

Form 990 ( 2010) Page 6<br />

Lamm<br />

Section A .<br />

Governance , Management, and Disclosure For each "Yes" response to lines 2 through 7b below, and for<br />

a "No" response to lines 8a, 8b, or 10b below, describe the circumstances, processes, or changes in Schedule<br />

0. See instructions.<br />

Check if Schedule 0 contains a response to any question in this Part VI .F<br />

Governin g Bod y and Mana g ement<br />

Yes<br />

No<br />

la<br />

Enter the number <strong>of</strong> voting members <strong>of</strong> the governing body at the end <strong>of</strong> the tax<br />

year . . . . . . . . . . . . . la 13<br />

b Enter the number <strong>of</strong> voting members included in line la, above, who are<br />

independent . . . . . . . . . . . . . . . . lb 12<br />

2 Did any <strong>of</strong>ficer, director, trustee, or key employee have a family relationship or a business relationship with any<br />

other <strong>of</strong>ficer, director, trustee, or key employee 2 No<br />

3 Did the org<strong>anization</strong> delegate control over management duties customarily performed by or under the direct<br />

supervision <strong>of</strong> <strong>of</strong>ficers, directors or trustees, or key employees to a management company or other person 3 No<br />

4 Did the org<strong>anization</strong> make any significant changes to its governing documents since the prior Form 990 was<br />

filed 4 No<br />

5 Did the org<strong>anization</strong> become aware during the year <strong>of</strong> a significant diversion <strong>of</strong> the org<strong>anization</strong>'s assets 5 No<br />

6 Does the org<strong>anization</strong> have members or stockholders 6 No<br />

7a<br />

Does the org<strong>anization</strong> have members, stockholders, or other persons who may elect one or more members <strong>of</strong> the<br />

governing body . . . . . . . . . . . . . . . . . . . . . . . . 7a No<br />

b Are any decisions <strong>of</strong> the governing body subject to approval by members, stockholders, or other persons 7b No<br />

8 Did the org<strong>anization</strong> contemporaneously document the meetings held or written actions undertaken during the<br />

year by the following<br />

a The governing body . . . . . . . . . . . . . . . . . . . . . . . . 8a Yes<br />

b Each committee with authority to act on behalf <strong>of</strong> the governing body 8b Yes<br />

9 Is there any <strong>of</strong>ficer, director, trustee, or key employee listed in Part VII, Section A, who cannot be reached at the<br />

org<strong>anization</strong>'s mailing address If"Yes," provide the names and addresses in Schedule 0 9 No<br />

Section B. Policies (This Section B requests information about policies not required by the Internal<br />

Revenue Code. )<br />

10a Does the org<strong>anization</strong> have local chapters, branches, or affiliates 10a No<br />

b If "Yes," does the org<strong>anization</strong> have written policies and procedures governing the activities <strong>of</strong> such chapters,<br />

affiliates, and branches to ensure their operations are consistent with those <strong>of</strong> the org<strong>anization</strong> . 10b<br />

11a Has the org<strong>anization</strong> provided a copy <strong>of</strong> this Form 990 to all members <strong>of</strong> its governing body before filing the form<br />

b Describe in Schedule 0 the process, if any, used by the org<strong>anization</strong> to review this Form 990<br />

11a<br />

Yes<br />

Yes<br />

No<br />

12a Does the org<strong>anization</strong> have a written conflict <strong>of</strong> interest policy If "No,"go to line 13 . 12a Yes<br />

b Are <strong>of</strong>ficers, directors or trustees, and key employees required to disclose annually interests that could give rise<br />

to conflicts 12b Yes<br />

c Does the org<strong>anization</strong> regularly and consistently monitor and enforce compliance with the policy If "Yes,"<br />

describe in Schedule 0 how this is done 12c Yes<br />

13 Does the org<strong>anization</strong> have a written whistleblower policy 13 Yes<br />

14 Does the org<strong>anization</strong> have a written document retention and destruction policy 14 Yes<br />

15 Did the process for determining compensation <strong>of</strong> the following persons include a review and approval by<br />

independent persons, comparability data, and contemporaneous substantiation <strong>of</strong> the deliberation and decision<br />

a The org<strong>anization</strong>'s CEO, Executive Director, or top management <strong>of</strong>ficial 15a Yes<br />

b Other <strong>of</strong>ficers or key employees <strong>of</strong> the org<strong>anization</strong> 15b Yes<br />

If "Yes" to line 15a or 15b, describe the process in Schedule 0 (See instructions<br />

16a Did the org<strong>anization</strong> invest in, contribute assets to , or participate in a joint venture or similar arrangement with a<br />

taxable entity during the year 16a No<br />

b If "Yes, " has the org<strong>anization</strong> adopted a written policy or procedure requiring the org<strong>anization</strong> to evaluate its<br />

participation in joint venture arrangements under applicable federal tax law, and taken steps to safeguard the<br />

org<strong>anization</strong> ' s exempt status with respect to such arrangements<br />

Section C.<br />

Disclosure<br />

17 List the States with which a copy <strong>of</strong> this Form 990 i s required to be filed-WV , WI , WA , VA , UT , TN , SC , RI , PA , O R , O K , O H<br />

NY,NM,NJ,NH,ND,NC,MS,MN , MI,ME,MD,MA<br />

KY , KS , I L , H I , GA , FL , DC , CT , CA , A Z , A R , A L , A K<br />

18 Section 6104 requires an org<strong>anization</strong> to make its Form 1023 (or 1024 if applicable), 990, and 990 -T (501(c)<br />

(3)s only) available for public inspection Indicate how you make these available Check all that apply<br />

fl Own website fi Another' s website F Upon request<br />

19 Describe in Schedule 0 whether (and if so, how ), the org<strong>anization</strong> makes its governing documents , conflict <strong>of</strong><br />

interest policy , and financial statements available to the public See Additional Data Table<br />

20 State the name, physical address, and telephone number <strong>of</strong> the person who possesses the books and records <strong>of</strong> the org<strong>anization</strong> 0-<br />

THE NRA FOUNDATION INC<br />

11250 WAPLES MILL ROAD<br />

FAIRFAX,VA 220307400<br />

(703) 267-1000<br />

16b<br />

Form 990 (2010)

Form 990 (2010)<br />

Form 990 (2010) Page 7<br />

1:M.lkvh$ Compensation <strong>of</strong> Officers , Directors,Trustees , Key Employees , Highest Compensated<br />

Employees , and Independent Contractors<br />

Check if Schedule 0 contains a response to any question in this Part VII .F<br />

Section A. Officers, Directors, Trustees, Kev Employees, and Highest Compensated Employees<br />

la Complete this table for all persons required to be listed Report compensation for the calendar year ending with or within the org<strong>anization</strong>'s<br />

tax year<br />

* List all <strong>of</strong> the org<strong>anization</strong>' s current <strong>of</strong>ficers, directors, trustees (whether individuals or org<strong>anization</strong>s), regardless <strong>of</strong> amount<br />

<strong>of</strong> compensation, and current key employees Enter -0- in columns (D), (E), and (F) if no compensation was paid<br />

* List all <strong>of</strong> the org<strong>anization</strong> ' s current key employees, if any See instructions for definition <strong>of</strong> "key employee "<br />

* List the org<strong>anization</strong>'s five current highest compensated employees (other than an <strong>of</strong>ficer, director, trustee or key employee)<br />

who received reportable compensation (Box 5 <strong>of</strong> Form W-2 and/or Box 7 <strong>of</strong> Form 1099-MISC) <strong>of</strong> more than $100,000 from the<br />

org<strong>anization</strong> and any related org<strong>anization</strong>s<br />

6 List all <strong>of</strong> the org<strong>anization</strong>'s former <strong>of</strong>ficers, key employees, and highest compensated employees who received more than $100,000<br />

<strong>of</strong> reportable compensation from the org<strong>anization</strong> and any related org<strong>anization</strong>s<br />

6 List all <strong>of</strong> the org<strong>anization</strong>' s former directors or trustees that received, in the capacity as a former director or trustee <strong>of</strong> the<br />

org<strong>anization</strong>, more than $10,000 <strong>of</strong> reportable compensation from the org<strong>anization</strong> and any related org<strong>anization</strong>s<br />

List persons in the following order individual trustees or directors , institutional trustees , <strong>of</strong>ficers, key employees , highest<br />

compensated employees , and former such persons<br />

1 Check this box if neither the org<strong>anization</strong> nor any related org<strong>anization</strong> compensated any current <strong>of</strong>ficer , director , or trustee<br />

(1) Frank R Brownell III<br />

President<br />

(2) Bill K Brewster<br />

Vice President<br />

(3) Wilson H Phillips Jr<br />

Treasurer<br />

(4) Sandy S Elkin<br />

Secretary<br />

(5) Joe M Allbaugh<br />

Trustee<br />

(6) William A Bachenberg<br />

Trustee<br />

(7) Allan D Cors<br />

Trustee<br />

(8) Sandra S <strong>From</strong>an<br />

Trustee<br />

(9) P X Kelley<br />

Trustee<br />

(10) Owen P Mills<br />

Trustee<br />

(11) James WPorter II<br />

Trustee<br />

(12) Dennis J Reese<br />

Trustee<br />

(13) Ronald L Schmeits<br />

Trustee<br />

(14) John C Sigler<br />

Trustee<br />

(15) Wayne L LaPierre<br />

Ex Officio<br />

(A) (B) (C) (D ) ( E) (F)<br />

Name and Title Average Position (check all Reportable Reportable Estimated<br />

hours that apply) compensation compensation amount <strong>of</strong> other<br />

per from the from related compensation<br />

fD =<br />

week -<br />

(5 org<strong>anization</strong> (W- org<strong>anization</strong>s from the<br />

(describe M D 2/1099-MISC) (W- 2/1099- org<strong>anization</strong> and<br />

hours Q1 < 5<br />

T<br />

MISC) related<br />

for c 2 +0 4 0 org<strong>anization</strong>s<br />

c<br />

related 6 r' ca -<br />

org<strong>anization</strong>s<br />

m<br />

in<br />

Schedule<br />

0)<br />

m<br />

.`<br />

a<br />

1 00 X X 0 0 0<br />

1 00 X X 0 0 0<br />

1 00 X 0 519,338 124,168<br />

1 00 X 0 100,351 34,084<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 0 0<br />

100 X 0 0 0<br />

1 00 X 0 0 0<br />

1 00 X 0 835,469 125,615

Form 990 (2010) Page 8<br />

Ugj= Section A. Officers , Directors , Trustees , Key Employees , and Highest Compensated Employees (continued)<br />

(A)<br />

Name and Title<br />

(B)<br />

Average<br />

hours<br />

per<br />

week<br />

(describe<br />

hours<br />

for<br />

related<br />

org<strong>anization</strong>s<br />

in<br />

Schedule<br />

0)<br />

(C)<br />

Position (check all<br />

that apply)<br />

2_ Q- <<br />

0 C<br />

6 r'<br />

m<br />

-<br />

2<br />

ca<br />

-<br />

`<br />

a,<br />

5<br />

m<br />

-<br />

-D =<br />

(5<br />

M 0<br />

- `+<br />

+0 4<br />

- 0<br />

-0 m<br />

V<br />

T<br />

0<br />

¢,<br />

(D)<br />

Reportable<br />

compensation<br />

from the<br />

org<strong>anization</strong> (W-<br />

2/1099-MISC)<br />

(E)<br />

Reportable<br />

compensation<br />

from related<br />

org<strong>anization</strong>s<br />

(W- 2/1099-<br />

MISC)<br />

(F)<br />

Estimated<br />

amount <strong>of</strong> other<br />

compensation<br />

from the<br />

org<strong>anization</strong> and<br />

related<br />

org<strong>anization</strong>s<br />

lb Sub -Total . . . . . . . . . . . . . . . . . . 0-<br />

c Total from continuation sheets to Part VII , Section A . . . .<br />

d Total ( add lines lb and 1c ) . 1,455,158 283,867<br />

Total number <strong>of</strong> individuals (including but not limited to those listed above) who received more than<br />

$100,000 in reportable compensation from the org<strong>anization</strong>-3<br />

Did the org<strong>anization</strong> list any former <strong>of</strong>ficer, director or trustee, key employee, or highest compensated employee<br />

on line la's If "Yes,"complete Schedule] forsuch individual . . . . . . . . . . . . 3 No<br />

For any individual listed on line la, is the sum <strong>of</strong> reportable compensation and other compensation from the<br />

org<strong>anization</strong> and related org<strong>anization</strong>s greater than $150,000' If"Yes,"complete Schedule] forsuch<br />

individual . . . . . . . . . . . . . . . . . . . . . . . . . . .<br />

No<br />

Did any person listed on line la receive or accrue compensation from any unrelated org<strong>anization</strong> or individual for<br />

services rendered to the org<strong>anization</strong> If "Yes, "complete ScheduleI for such person<br />

5 No<br />

Section B.<br />

Independent Contractors<br />

1 Complete this table for your five highest compensated independent contractors that received more than<br />

$100,000 <strong>of</strong> compensation from the org<strong>anization</strong><br />

(A) (B) (C)<br />

Name and business address Description <strong>of</strong> services Compensation<br />

2 Total number <strong>of</strong> independent contractors (including but not limited to those listed above) who received more than<br />

$100.000 in compensation from the org<strong>anization</strong> -<br />

Form 990 (2010)

Form 990 (2010) Page 9<br />

1:M.&TJO04<br />

Statement <strong>of</strong> Revenue<br />

(A) (B) (C) (D)<br />

Total revenue Related Unrelated Revenue<br />

or business<br />

exempt revenue excluded<br />

function<br />

from<br />

tax<br />

revenue<br />

under<br />

sections<br />

la Federated campaigns . la 365,869<br />

512,<br />

513, or<br />

514<br />

E<br />

b Membership dues . . . . lb<br />

c Fundraising events . 1c 12,238,250<br />

d Related org<strong>anization</strong>s . ld<br />

e Government grants (contributions) le<br />

f All other contributions, gifts, grants, and if 3,470,452<br />

similar amounts not included above<br />

g Noncash contributions included in lines la-If $ 121,073<br />

h Total. Add lines la-1f . 16,074,571<br />

a, Business Code<br />

2a Firearms Law Seminar registration fees 611710 27,685 27,685<br />

b<br />

c<br />

U7<br />

O<br />

d<br />

e<br />

f All other program service revenue<br />

g Total. Add lines 2a-2f . 27,685<br />

3 Investment income (including dividends, interest<br />

and other similar amounts) 10- 1,006,198 1,006,198<br />

4 <strong>Income</strong> from investment <strong>of</strong> tax-exempt bond proceeds<br />

5 Royalties<br />

6a<br />

Gross Rents<br />

b Less rental<br />

expenses<br />

c Rental income<br />

or (loss)<br />

d Net rental income or (loss) . .<br />

7a Gross amount 10,658,437<br />

from sales <strong>of</strong><br />

assets other<br />

than inventory<br />

b Less cost or 11,050,308<br />

other basis and<br />

sales expenses<br />

c Gain or (loss) -391,871<br />

(i) Real (ii) Personal<br />

(i) Securities (ii) Other<br />

d Net gain or (loss) -391,871 -391,871<br />

q^ 8a Gross income from fundraising events<br />

(not including<br />

$ 12,238,250<br />

Qo <strong>of</strong> contributions reported on line 1c)<br />

See Part IV, line 18 .<br />

s<br />

a 11,696,746<br />

b Less direct expenses b 13,470,545<br />

c Net income or (loss) from fundraising events . -1,773,799 -<br />

1,773,799<br />

9a Gross income from gaming activities See Part IV, line 19 . a 18,808,357<br />

b Less direct expenses b 10,393,259<br />

c Net income or (loss) from gaming activities 8,415,098 8,415,098<br />

10aGross sales <strong>of</strong> inventory, less<br />

returns and allowances .<br />

a 15,643<br />

b Less cost <strong>of</strong> goods sold . b 19,089<br />

c Net income or (loss) from sales <strong>of</strong> inventory -3,446 -3,446<br />

Miscellaneous Revenue<br />

11a M i s c e l l a n e o u s<br />

Business Code<br />

900099 7,666 7,666<br />

b<br />

c<br />

dAll other revenue . .<br />

e Total . A dd l i n e s h a-11 d<br />

7,666<br />

12 Total revenue . See Instructions<br />

23,362,102 24,239 1 1 7,263,292<br />

Form 990 (2010)

Form 990 (2010)<br />

Form 990 (2010) Page 10<br />

Statement <strong>of</strong> Functional Expenses<br />

Section 501 ( c)(3) and 501(c)(4) org<strong>anization</strong>s must complete all columns.<br />

All other org<strong>anization</strong>s must complete column (A) but are not required to complete columns ( B), (C), and ( D).<br />

Do not include amounts reported on lines 6b,<br />

7b , 8b , 9b , and 10b <strong>of</strong> Part VIII .<br />

(A)<br />

Total expenses<br />

(B)<br />

Program service<br />

expenses<br />

(C)<br />

Management and<br />

general expenses<br />

(D)<br />

Fundraising<br />

expenses<br />

1 Grants and other assistance to governments and org<strong>anization</strong>s<br />

in the U S See Part IV, line 21<br />

21,241,222 21,241,222<br />

2 Grants and other assistance to individuals in the<br />

U S See Part IV, line 22 0<br />

3 Grants and other assistance to governments,<br />

org<strong>anization</strong>s , and individuals outside the U S See<br />

Part IV, lines 15 and 16 0<br />

4 Benefits paid to or for members 0<br />

5 Compensation <strong>of</strong> current <strong>of</strong>ficers, directors, trustees, and<br />

key employees 0<br />

6 Compensation not included above, to disqualified persons<br />

(as defined under section 4958 ( f)(1)) and persons<br />

described in section 4958 ( c)(3)(B) 0<br />

7 Other salaries and wages 0<br />

8 Pension plan contributions (include section 401(k) and section<br />

40 3(b) employer contributions) 0<br />

9 Other employee benefits 0<br />

10 Payroll taxes 0<br />

a<br />

Fees for services ( non-employees)<br />

Management . 0<br />

b Legal 40,000 32,004 7,996<br />

c Accounting 38,200 38,200<br />

d Lobbying 0<br />

e Pr<strong>of</strong>essional fundraising services See Part IV, line 17<br />

f Investment management fees 127,743 127,743<br />

g Other 40 ,159 35,044 5,115<br />

12 Advertising and promotion 230,809 7,158 3,573 220,078<br />

13 Office expenses 238,160 220,413 15,375 2,372<br />

14 Information technology 86,649 39,033 6,967 40,649<br />

15 Royalties 0<br />

16 Occupancy 0<br />

17 Travel 0<br />

18 Payments <strong>of</strong> travel or entertainment expenses for any federal,<br />

state, or local public <strong>of</strong>ficials 0<br />

19 Conferences , conventions , and meetings 112,155 70,307 41,848<br />

20 Interest 0<br />

21 Payments to affiliates 0<br />

22 Depreciation , depletion, and amortization 7,600 7,414 186<br />

23 Insurance 0<br />

24 Other expenses Itemize expenses not covered above (List<br />

miscellaneous expenses in line 24f If line 24f amount exceeds 10% <strong>of</strong><br />

line 25, column ( A) amount, list line 24f expenses on Schedule 0<br />

a Management fees 3,665 ,399 340,704 889,413 2,435,282<br />

b Printing and publications 630,970 20,482 84,253 526,235<br />

c Miscellaneous 80,592 25,555 55,037<br />

d<br />

e<br />

f All other expenses 0<br />

25 Total functional expenses . Add lines 1 through 24f 26,539,658 22,039,336 1,275,706 3,224,616<br />

26 Joint costs. Check here - F iffollowing<br />

SOP 98-2 (ASC 958-720) Complete this line only if the<br />

org<strong>anization</strong> reported in column (B) joint costs from a<br />

combined educational campaign and fundraising solicitation 2,173 0,482 6,359 ,332

Form 990 (2010)<br />

Form 990 (2010) Page 11<br />

IMEM Balance Sheet<br />

(A)<br />

Beginning <strong>of</strong> year<br />

(B)<br />

End <strong>of</strong> year<br />

1 Cash-non-interest-bearing 1,855 1 55<br />

2 Savings and temporary cash investments 6,760,200 2 2,449,045<br />

3 Pledges and grants receivable, net 3,343,340 3 2,233,321<br />

4 Accounts receivable, net 1,495,922 4 2,401,200<br />

5 Receivables from current and former <strong>of</strong>ficers, directors, trustees, key employees, and<br />

highest compensated employees Complete Part II <strong>of</strong><br />

Schedule L 5<br />

6 Receivables from other disqualified persons (as defined under section 4958(f)(1)),<br />

persons described in section 4958(c)(3)(B), and contributing employers, and<br />

sponsoring org<strong>anization</strong>s <strong>of</strong> section 501(c)(9) voluntary employees' beneficiary<br />

org<strong>anization</strong>s (see instructions)<br />

Schedule L 6<br />

0 7 Notes and loans receivable, net 8,259 7 7,624<br />

8 Inventories for sale or use 6,509,876 8 7,193,551<br />

9 Prepaid expenses and deferred charges 56,254 9 325,752<br />

10a Land, buildings, and equipment cost or other basis Complete 757,605<br />

Part VI <strong>of</strong> Schedule D<br />

10a<br />

b Less accumulated depreciation 10b 70,662 698,137 10c 686,943<br />

11 Investments-publicly traded securities 38,306,540 11 43,709,519<br />

12 Investments-other securities See Part IV, line 11 12<br />

13 Investments-program-related See Part IV, line 11 13<br />

14 Intangible assets 14<br />

15 Other assets See Part IV, line 11 20,856,468 15 21,363,667<br />

16 Total assets . Add lines 1 through 15 (must equal line 34) . . 78,036,851 16 80,370,677<br />

17 Accounts payable and accrued expenses 1,326,861 17 906,523<br />

18 Grants payable 585,736 18 1,255,286<br />

19 Deferred revenue 50,550 19 52,040<br />

20 <strong>Tax</strong>-exempt bond liabilities 20<br />

} 21 Escrow or custodial account liability Complete Part IV<strong>of</strong> Schedule D 21<br />

22 Payables to current and former <strong>of</strong>ficers, directors, trustees, key<br />

employees, highest compensated employees, and disqualified<br />

persons Complete Part II <strong>of</strong> Schedule L . 22<br />

23 Secured mortgages and notes payable to unrelated third parties 23<br />

24 Unsecured notes and loans payable to unrelated third parties 24<br />

25 Other liabilities Complete Part X <strong>of</strong> Schedule D 4,498,832 25 5,730,194<br />

26 Total liabilities . Add lines 17 through 25 . 6,461,979 26 7,944,043<br />

<strong>Or</strong>g<strong>anization</strong>s that follow SFAS 117 , check here - 7 and complete lines 27<br />

through 29, and lines 33 and 34.<br />

27 Unrestricted net assets 4,209,055 27 694,619<br />

M 28 Temporarily restricted net assets 19,430,152 28 22,638,801<br />

W_<br />

29 Permanently restricted net assets 47,935,665 29 49,093,214<br />

<strong>Or</strong>g<strong>anization</strong>s that do not follow SFAS 117 , check here F- and complete<br />

lines 30 through 34.<br />

30 Capital stock or trust principal, or current funds 30<br />

31 Paid-in or capital surplus, or land, building or equipment fund 31<br />

32 Retained earnings, endowment, accumulated income, or other funds 32<br />

33 Total net assets or fund balances 71,574,872 33 72,426,634<br />

z<br />

34 Total liabilities and net assets/fund balances 78,036,851 34 80,370,677

Form 990 (2010) Page 12<br />

1 :M. WO Reconcilliation <strong>of</strong> Net Assets<br />

Check if Schedule 0 contains a response to any question in this Part XI F<br />

1 Total revenue (must equal Part VIII, column (A), line 12)<br />

2 Total expenses (must equal Part IX, column (A), line 25)<br />

3 Revenue less expenses Subtract line 2 from line 1 .<br />

1 23,362,102<br />

2 26,539,658<br />

3 -3,177,556<br />

4 Net assets or fund balances at beginning <strong>of</strong> year (must equal Part X, line 33, column (A))<br />

5 Other changes in net assets or fund balances (explain in Schedule 0) .<br />

4 71,574,872<br />

5 4,029,318<br />

6 Net assets or fund balances at end <strong>of</strong> year Combine lines 3, 4, and 5 (must equal Part X, line 33, column<br />

(B))<br />

6 72,426,634<br />

Financial Statements and Reporting<br />

Eff-<br />

Check if Schedule 0 contains a response to any question in this Part XII .F<br />

GM<br />

Yes<br />

No<br />

1 Accounting method used to prepare the Form 990 p Cash F Accrual F-Other<br />

If the org<strong>anization</strong> changed its method <strong>of</strong> accounting from a prior year or checked "Other," explain in<br />

Schedule 0<br />

2a Were the org<strong>anization</strong>'s financial statements compiled or reviewed by an independent accountant's 2a No<br />

b Were the org<strong>anization</strong>'s financial statements audited by an independent accountant . 2b Yes<br />

c If "Yes,"to 2a or 2b, does the org<strong>anization</strong> have a committee that assumes responsibility for oversight <strong>of</strong> the<br />

audit, review, or compilation <strong>of</strong> its financial statements and selection <strong>of</strong> an independent accountant<br />

If the org<strong>anization</strong> changed either its oversight process or selection process during the tax year, explain in<br />

Schedule 0 2c Yes<br />

d If "Yes" to line 2a or 2b, check a box below to indicate whether the financial statements for the year were issued<br />

on a separate basis, consolidated basis, or both<br />

fl Separate basis fl Consolidated basis F Both consolidated and separated basis<br />

3a As a result <strong>of</strong> a federal award, was the org<strong>anization</strong> required to undergo an audit or audits as set forth in the<br />

Single Audit Act and 0MB Circular A-133 . . . . . . . . . . . . . . . 3a<br />

b If "Yes," did the org<strong>anization</strong> undergo the required audit or audits If the org<strong>anization</strong> did not undergo the required 3b<br />

audit or audits, explain why in Schedule 0 and describe any steps taken to undergo such audits .<br />

Form 990 (2010)

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93493270004111<br />

OMB No 1545-0047<br />

SCHEDULE A<br />

Public Charity Status and Public Support<br />

(Form 990 or 990EZ) 201 0<br />

Complete if the org<strong>anization</strong> is a section 501(c)(3) org<strong>anization</strong> or a section<br />

Department <strong>of</strong> the Treasury<br />

4947( a) (1) nonexempt charitable trust.<br />

Internal Revenue Service<br />

Name <strong>of</strong> the org<strong>anization</strong><br />

NRA FOUNDATION INC<br />

► Attach to Form 990 or Form 990 - EZ. ► See separate instructions.<br />

Employer identification number<br />

52-1710886<br />

Reason for Public Charity Status (All org<strong>anization</strong>s must complete this part.) See Instructions<br />

The org<strong>anization</strong> is not a private foundation because it is (For lines 1 through 11, check only one box )<br />

1 1 A church, convention <strong>of</strong> churches, or association <strong>of</strong> churches described in section 170 ( b)(1)(A)(i).<br />

2 1 A school described in section 170 (b)(1)(A)(ii). (Attach Schedule E )<br />

3 1 A hospital or a cooperative hospital service org<strong>anization</strong> described in section 170(b)(1)(A)(iii).<br />

4 1 A medical research org<strong>anization</strong> operated in conjunction with a hospital described in section 170 (b)(1)(A)(iii). Enter the<br />

hospital's name, city, and state<br />

5 1 A n org<strong>anization</strong> operated for the benefit <strong>of</strong> a college or university owned or operated by a governmental unit described in<br />

section 170 ( b)(1)(A)(iv ). (Complete Part II )<br />

6 1 A federal, state, or local government or governmental unit described in section 170 ( b)(1)(A)(v).<br />

7 F An org<strong>anization</strong> that normally receives a substantial part <strong>of</strong> its support from a governmental unit or from the general public<br />

described in<br />

section 170 ( b)(1)(A)(vi ) (Complete Part II )<br />

8 1 A community trust described in section 170 ( b)(1)(A)(vi ) (Complete Part II )<br />

9 1 An org<strong>anization</strong> that normally receives (1) more than 331/3% <strong>of</strong> its support from contributions, membership fees, and gross<br />

receipts from activities related to its exempt functions-subject to certain exceptions, and (2) no more than 331/3% <strong>of</strong><br />

its<br />

support from gross investment income and unrelated business taxable income (less section 511 tax) from businesses<br />

acquired by the org<strong>anization</strong> after June 30, 1975 See section 509 (a)(2). (Complete Part III )<br />

10 1 An org<strong>anization</strong> organized and operated exclusively to test for public safety Seesection 509(a)(4).<br />

11 1 An org<strong>anization</strong> organized and operated exclusively for the benefit <strong>of</strong>, to perform the functions <strong>of</strong>, or to carry out the purposes <strong>of</strong><br />

one or more publicly supported org<strong>anization</strong>s described in section 509(a)(1) or section 509(a)(2) See section 509 (a)(3). Check<br />

the box that describes the type <strong>of</strong> supporting org<strong>anization</strong> and complete lines 11e through 11h<br />

a 1 Type I b 1 Type II c 1 Type III - Functionally integrated d 1 Type III - Other<br />

e F By checking this box, I certify that the org<strong>anization</strong> is not controlled directly or indirectly by one or more disqualified persons<br />

other than foundation managers and other than one or more publicly supported org<strong>anization</strong>s described in section 509(a)(1) or<br />

section 509(a)(2)<br />

f If the org<strong>anization</strong> received a written determination from the IRS that it is a Type I, Type II or Type III supporting org<strong>anization</strong>,<br />

check this box F<br />

g Since August 17, 2006, has the org<strong>anization</strong> accepted any gift or contribution from any <strong>of</strong> the<br />

following persons<br />

(i) a person who directly or indirectly controls, either alone or together with persons described in (ii) Yes No<br />

and (iii) below, the governing body <strong>of</strong> the the supported org<strong>anization</strong> 11g(i)<br />

(ii) a family member <strong>of</strong> a person described in (i) above 11g(ii)<br />

(iii) a 35% controlled entity <strong>of</strong> a person described in (i) or (ii) above <br />

h Provide the following information about the supported org<strong>anization</strong>(s)<br />

11 g(g(iii)<br />

M<br />

Name <strong>of</strong><br />

supported<br />

org<strong>anization</strong><br />

ii)<br />

EIN<br />

(iii)<br />

Type <strong>of</strong><br />

org<strong>anization</strong><br />

(described on<br />

lines 1- 9 above<br />

or IRC section<br />

(see<br />

Is<br />

(n th e<br />

org<strong>anization</strong> in<br />

col (i) listed in<br />

your governing<br />

document<br />

(v)<br />

Did ou noti fy the<br />

y<br />

org<strong>anization</strong> in<br />

col (i) <strong>of</strong> your<br />

su pp ort<br />

(vi)<br />

Is the<br />

org<strong>anization</strong> in<br />

col (i) organized<br />

in the U S 7<br />

instructions )) Yes No Yes No Yes No<br />

ii<br />

Amount <strong>of</strong><br />

support<br />

Total<br />

For Paperwork Red uchonAct Notice , seethe In structons for Form 990 Cat No 11285F Schedule A (Form 990 or 990-EZ) 2010

Schedule A (Form 990 or 990-EZ) 2010<br />

Schedule A (Form 990 or 990-EZ) 2010 Page 2<br />

Support Schedule for <strong>Or</strong>g<strong>anization</strong>s Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)<br />

(A)(vi)<br />

(Complete only if you checked the box on line 5, 7, or 8 <strong>of</strong> Part I or if the org<strong>anization</strong> failed to qualify<br />

under Part III. If the org<strong>anization</strong> fails to qualify under the tests listed below, please complete Part III.)<br />

Section A . Public Su pp ort<br />

'<br />

Calendar year ( or fiscal year beginning<br />

in) ►<br />

(a) 2006 ( b) 2007 ( c) 2008 ( d) 2009 ( e) 2010 (f) Total<br />

1 Gifts, grants , contributions, and<br />

membership fees received (Do<br />

not include any "unusual<br />

17,804,167 16,105,698 21,410,780 27,492,758 16,074,571 98,887,974<br />

grants ")<br />

2 <strong>Tax</strong> revenues levied for the<br />

org<strong>anization</strong> s benefit and either<br />

paid to or expended on its<br />

behalf<br />

3 The value <strong>of</strong> services or facilities<br />

furnished by a governmental unit<br />

to the org<strong>anization</strong> without<br />

charge<br />

4 Total . Add lines 1 through 3 17,804,167 16,105,698 21,410,780 27,492,758 16,074,571 98,887,974<br />

5 The portion <strong>of</strong> total contributions<br />

by each person ( other than a<br />

governmental unit or publicly<br />

supported org<strong>anization</strong> ) included 10 ,245,037<br />

on line 1 that exceeds 2% <strong>of</strong> the<br />

amount shown on line 11, column<br />

(f)<br />

6 Public Support . Subtract line 5<br />

from line 4<br />

88,642,937<br />

Section B. Total Support<br />

Calendar year (or fiscal year<br />

beginning in) 111111<br />

7 Amounts from line 4<br />

8 Gross income from interest,<br />

dividends, payments received<br />

on securities loans, rents,<br />

royalties and income from<br />

similar sources<br />

9 Net income from unrelated<br />

business activities, whether or<br />

not the business is regularly<br />

carried on<br />

10 Other income Do not include<br />

gain or loss from the sale <strong>of</strong><br />

capital assets (Explain in Part<br />

IV )<br />

11 Total support (Add lines 7<br />

through 10)<br />

12 Gross receipts from related activ<br />

(a) 2006 (b) 2007 ( c) 2008 ( d) 2009 (e) 2010 ( f) Total<br />

17,804,167 16,105,698 21,410,780 27,492,758 16,074,571 98,887,974<br />

502,769 1,257,201 1,299,222 959,747 1,006,198 5,025,137<br />

11,957 6,375 5,902 9,386 7,666 41,286<br />

103, 954, 397<br />

sties, etc ( See instructions 12 179,964<br />

13 First Five Years If the Form 990 is for the org<strong>anization</strong>'s first, second, third, fourth, or fifth tax year as a 501(c)(3) org<strong>anization</strong>,<br />

check this box and stop here<br />

Section C. Com p utation <strong>of</strong> Public Su pp ort Percenta g e<br />

14 Public Support Percentage for 2010 (line 6 column (f) divided by line 11 column (f)) 14 85 270 %<br />

15 Public Support Percentage for 2009 Schedule A, Part II, line 14 15 82 560 %<br />

16a 33 1 / 3% support test - 2010 . If the org<strong>anization</strong> did not check the box on line 13, and line 14 is 33 1/3% or more, check this box<br />

and stop here . The org<strong>anization</strong> qualifies as a publicly supported org<strong>anization</strong> lik^F<br />

b 33 1 / 3% support test - 2009 . If the org<strong>anization</strong> did not check the box on line 13 or 16a, and line 15 is 33 1/3% or more, check this<br />

box and stop here . The org<strong>anization</strong> qualifies as a publicly supported org<strong>anization</strong> F-<br />

17a 10%-facts-and -circumstances test - 2010 . If the org<strong>anization</strong> did not check a box on line 13, 16a, or 16b and line 14<br />

is 10% or more, and if the org<strong>anization</strong> meets the "facts and circumstances" test, check this box and stop here . Explain<br />

in Part IV how the org<strong>anization</strong> meets the "facts and circumstances" test The org<strong>anization</strong> qualifies as a publicly supported<br />

org<strong>anization</strong><br />

lik^Fb<br />

10%-facts -and-circumstances test-2009 . If the org<strong>anization</strong> did not check a box on line 13, 16a, 16b, or 17a and line<br />

15 is 10% or more, and if the org<strong>anization</strong> meets the "facts and circumstances" test, check this box and stop here.<br />

Explain in Part IV how the org<strong>anization</strong> meets the "facts and circumstances" test The org<strong>anization</strong> qualifies as a publicly<br />

supported org<strong>anization</strong> F-<br />

18 Private <strong>Foundation</strong> If the org<strong>anization</strong> did not check a box on line 13, 16a, 16b, 17a or 17b, check this box and see<br />

instructions<br />

lik^F-

Schedule A (Form 990 or 990-EZ) 2010<br />

Schedule A (Form 990 or 990-EZ) 2010 Page 3<br />

IMMOTM Support Schedule for <strong>Or</strong>g<strong>anization</strong>s Described in Section 509(a)(2)<br />

(Complete only if you checked the box on line 9 <strong>of</strong> Part I or if the org<strong>anization</strong> failed to qualify under<br />

Part II. If the org<strong>anization</strong> fails to qualify under the tests listed below, please complete Part II.)<br />

Section A . Public Support<br />

Calendar year (or fiscal year beginning<br />

in) lik^<br />

1 Gifts, grants, contributions, and<br />

membership fees received (Do not<br />

include any "unusual grants ")<br />

2 Gross receipts from admissions,<br />

merchandise sold or services<br />

performed, or facilities furnished in<br />

any activity that is related to the<br />

org<strong>anization</strong>'s tax-exempt<br />

purpose<br />

3 Gross receipts from activities that<br />

are not an unrelated trade or<br />

business under section 513<br />

4 <strong>Tax</strong> revenues levied for the<br />

org<strong>anization</strong>'s benefit and either<br />

paid to or expended on its<br />

behalf<br />

5 The value <strong>of</strong> services or facilities<br />

furnished by a governmental unit to<br />

the org<strong>anization</strong> without charge<br />

6 Total . Add lines 1 through 5<br />

7a Amounts included on lines 1, 2,<br />

and 3 received from disqualified<br />

persons<br />

b Amounts included on lines 2 and 3<br />

received from other than<br />

disqualified persons that exceed<br />

the greater <strong>of</strong> $5,000 or 1% <strong>of</strong> the<br />

amount on line 13 for the year<br />

c Add lines 7a and 7b<br />

8 Public Support (Subtract line 7c<br />

from line 6 )<br />

Section B. Total Support<br />

Calendar year (or fiscal year beginning<br />

in)<br />

9 Amounts from line 6<br />

(a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) 2010 (f) Total<br />

(a) 2006 (b) 2007 (c) 2008 (d) 2009 (e) 2010 (f) Total<br />

'<br />

10a Gross income from interest,<br />

dividends, payments received on<br />

securities loans, rents, royalties<br />

and income from similar<br />

sources<br />

b Unrelated business taxable<br />

income (less section 511 taxes)<br />

from businesses acquired after<br />

June 30, 1975<br />

c Add lines 10a and 10b<br />

11 Net income from unrelated<br />

business activities not included<br />

in line 10b, whether or not the<br />

business is regularly carried on<br />

12 Other income Do not include<br />

gain or loss from the sale <strong>of</strong><br />

capital assets (Explain in Part<br />

IV )<br />

13 Total support (Add lines 9, 10c,<br />

11 and 12 )<br />

14 First Five Years If the Form 990 is for the org<strong>anization</strong> s first, second , third, fourth, or fifth tax year as a section501(c)(3) org<strong>anization</strong>,<br />

check this box and stop here<br />

Section C. Com p utation <strong>of</strong> Public Su pp ort Percenta g e<br />

15 Public Support Percentage for 2010 (line 8 column (f) divided by line 13 column (f)) 15 0 %<br />

16 Public support percentage from 2009 Schedule A, Part III, line 15 16<br />

Section D .<br />

Com p utation <strong>of</strong> Investment <strong>Income</strong> Percenta g e<br />

17 Investment income percentage for 2010 (line 10c column (f) divided by line 13 column (f)) 17 0 %<br />

18 Investment income percentage from 2009 Schedule A, Part III, line 17 18<br />

19a 33 1 / 3% support tests-2010 . If the org<strong>anization</strong> did not check the box on line 14, and line 15 is more than 33 1/3% and line 17 is not<br />

more than 33 1/3%, check this box and stop here . The org<strong>anization</strong> qualifies as a publicly supported<br />

org<strong>anization</strong><br />

b 33 1 / 3%support tests-2009 . If the org<strong>anization</strong> did not check a box on line 14 or line 19a, and line 16 is more than 33 1/3% and line<br />

18 is not more than 33 1/3%, check this box and stop here . The org<strong>anization</strong> qualifies as a publicly supported org<strong>anization</strong><br />

20 Private <strong>Foundation</strong> If the org<strong>anization</strong> did not check a box on line 14, 19a or 19b, check this box and see instructions

Schedule A (Form 990 or 990-EZ) 2010 Page 4<br />

Supplemental Information . Supplemental Information. Complete this part to provide the explanations<br />

required by Part II, line 10; Part II, line 17a or 17b; and Part III, line 12. Also complete this part for any<br />

additional information. (See instructions).<br />

Facts And Circumstances Test<br />

Part II Line 10 Includes sales tax discounts, net increase in cash surrender value <strong>of</strong> life<br />

insurance and other miscellaneous receipts received in the normal course <strong>of</strong> business<br />

operations.<br />

Part II Line 10 Includes sales tax discounts, net increase in cash surrender value <strong>of</strong> life<br />

insurance and other miscellaneous receipts received in the normal course <strong>of</strong> business<br />

operations.<br />

Schedule A (Form 990 or 990-EZ) 2010

l efile GRAPHIC p rint - DO NOT PROCESS As Filed Data - DLN: 93493270004111<br />

SCHEDULE D<br />

OMB No 1545-0047<br />

(Form 990)<br />

Supplemental Financial Statements 2010<br />

- Complete if the org<strong>anization</strong> answered " Yes," to Form 990,<br />

Department <strong>of</strong> the Treasury Part IV, line 6, 7, 8, 9, 10 , 11, or 12. • ' ' '<br />

Internal Revenue Service Attach to Form 990 . 1- See separate instructions.<br />

Name <strong>of</strong> the org<strong>anization</strong><br />

NRA FOUNDATION INC<br />

Employer identification number<br />

1 52-1710886<br />

<strong>Or</strong>g<strong>anization</strong>s Maintaining Donor Advised Funds or Other Similar Funds or Accounts . Complete if the<br />

or g <strong>anization</strong> answered "Yes" to Form 990 Part IV , line 6.<br />

(a) Donor advised funds<br />

(b) Funds and other accounts<br />

1 Total number at end <strong>of</strong> year<br />

2 Aggregate contributions to (during year)<br />

3 Aggregate grants from (during year)<br />

4 Aggregate value at end <strong>of</strong> year<br />

5 Did the org<strong>anization</strong> inform all donors and donor advisors in writing that the assets held in donor advised<br />

funds are the org<strong>anization</strong>'s property, subject to the org<strong>anization</strong>'s exclusive legal control 1 Yes 1 No<br />