HAI HELI-EXPO 2016

1Z4yyP0

1Z4yyP0

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

161 - MAR-APR <strong>2016</strong><br />

OUR 28th YEAR<br />

PREMIER TRANSATLANTIC<br />

BUSINESS AVIATION MAGAZINE<br />

GLOBAL CUSTOMER SUPPORT AND SPARE PARTS page 60<br />

CONNECTIVITY USERS FEEL A NEED FOR SPEED page 68<br />

SUPER-MEDIUM CLASS<br />

<strong>HELI</strong>COPTERS<br />

AN INSIGHTFUL PREVIEW OF<br />

<strong>HAI</strong> <strong>HELI</strong>-<strong>EXPO</strong> <strong>2016</strong> page 56

SOMEWHERE BELOW YOU,<br />

THERE’S A WORLD FULL OF SPEED LIMITS.<br />

Leave everything else behind. The HondaJet won’t just get you there<br />

faster; it will do it with a level of comfort that makes getting there as<br />

exciting as the destination. Escape the gridlock. hondajet.com

EDITORIAL<br />

PUBLISHER'S<br />

NOTES<br />

Although we are a new team,<br />

BART’s great traditions will<br />

always be with us. For<br />

example, the magazine’s first<br />

Editor-in-Chief Marc Grangier,<br />

now 73, is still among our<br />

active contributors.<br />

AS FRANK SINATRA MIGHT HAVE SUNG,<br />

it was a very good year. One of innovation<br />

for our industry. OEMs outdid themselves<br />

launching new programs, rolling out new<br />

aircraft and gaining certification for their<br />

latest models. Two clean-sheet aircraft, the<br />

Gulfstream G500 and G650, were launched<br />

in Georgia. In France, Dassault introduced<br />

two new business jets, the Falcon 8X and the<br />

5X. The Citation Latitude, Phenom 300 and<br />

Bombardier Global 7000 all also blossomed<br />

on our playing field.<br />

I would like to emphasize the "special class"<br />

HondaJet, with its original concept design.<br />

Also the Pilatus 24 Super Versatile Jet, and<br />

finally the AS2, a long awaited supersonic<br />

business jet, from Aerion in partnership with<br />

Airbus.<br />

Our mission at BART is to inform you of<br />

these latest developments. Six times a year<br />

we update you with the latest developments<br />

in our dynamic industry. In opposition to<br />

lifestyle magazines, our goal is to present our<br />

line of work as a business tool rather than a<br />

luxury gizmo.<br />

Do you know that BART stands for<br />

Business Aviation Real Tool? That's what<br />

Business Aviation is for trade and industry<br />

and that's what we want to be for you, a<br />

tool and a resource. I have been a<br />

publisher of aviation magazines for 44<br />

years and I know that if you want to keep<br />

your reader's attention, you have to have<br />

the best editors, journalists and<br />

photographers. You also need to get and<br />

deserve the confidence of advertisers in the<br />

industry. Last year, guided by our<br />

managing editor Paul Walsh, we celebrated<br />

our 27th anniversary with a recordbreaking<br />

readership.<br />

At a time when aviation magazines are<br />

becoming leaner or disappearing, making<br />

place for on-line substitutes, I gave a<br />

mandate to the BART's team to make your<br />

magazine even better, starting with a new<br />

layout and improved editorial page quality.<br />

One sign of that commitment is the arrival of<br />

Volker Thomalla as our new Editor-in-Chief.<br />

One of the premier talents among aviation<br />

journalists, Volker comes to us from Motor<br />

Press Stuttgart in Bonn, where he was at the<br />

helm of the entire Aerospace Division.<br />

Editor-in-Chief of Flug Revue and Aerokurier<br />

for 25 years, we are fortunate to benefit from<br />

the high reputation he acquired within our<br />

industry. We are proud of him, and proud to<br />

have him. Busra Ozturk is another recent<br />

addition to our editorial team. We hired the<br />

young Turkish journalist to support Volker<br />

with the management of our team of<br />

contributors.<br />

BART has always been a friend to the<br />

people in the aviation industry, and to its<br />

readers. Another new addition, Titi<br />

Kusumandari comes to us from Indonesia to<br />

support Associate Publisher Kathy Ann<br />

Francois in keeping up with our readers and<br />

industry players.<br />

BART exceedingly deserves its<br />

"International" adjective. It is a Business<br />

Aviation standard, one of too few authorities<br />

you can trust today. You can trust us now,<br />

and you can trust us to always be setting our<br />

standards even higher worldwide.<br />

“Transatlantic relations are in a good period. The patient is the rest of the world.<br />

Global problems would be in a better state if we co-operate.”<br />

Javier Solana

Volume XXVIII N° 2<br />

EDITOR AND PUBLISHER<br />

Fernand M. Francois<br />

ASSOCIATE PUBLISHER<br />

Kathy Ann Francois<br />

EDITOR-IN-CHIEF<br />

Volker K. Thomalla<br />

vthomalla@bartintl.com<br />

DEPUTY EDITOR<br />

Busra Ozturk<br />

ART DIRECTOR<br />

Tanguy Francois<br />

SAFETY EDITOR<br />

Michael Grüninger<br />

INSTRUCTION EDITOR<br />

Captain LeRoy Cook<br />

TECHNOLOGY EDITOR<br />

Steve Nichols<br />

ROTORCRAFT EDITOR<br />

Mark Huber<br />

NEW YORK EDITOR<br />

Kirby J. Harrison<br />

PREMIER TRANSATLANTIC<br />

BUSINESS AVIATION MAGAZINE<br />

MEMBER OF<br />

SECTIONS<br />

3<br />

EDITORIAL<br />

6<br />

POINTER<br />

8<br />

QUICK LANE<br />

22<br />

BUSINESS NEWS<br />

26<br />

TRANSATLANTIC UPDATE<br />

CONTRIBUTING EDITORS<br />

Louis Smyth, Giulia Mauri,<br />

Aofie O'Sullivan, Derek Bloom,<br />

Guy Visele, Richard Koe,<br />

Brian Foley<br />

ADVERTISING<br />

Kathy Ann Francois<br />

Marketing Director<br />

kafrancois@bartintl.com<br />

Titi Kusumandari<br />

Marketing Manager<br />

tkusumandari@bartintl.com<br />

BART International. Premier Transatlantic<br />

Business Aviation Magazine. ISSN 0776-7596.<br />

Printed in Belgium, published by SA F&L<br />

20 rue de l'Industrie at B1400 Nivelles,<br />

Phone +326 788 3603. Fax +326 788 3623.<br />

BART International is governed by<br />

the International copyright laws.<br />

Free Professional subscription available<br />

International distribution by ASENDIA<br />

USPS 016707 Periodical postage paid<br />

Call IMS 1 (800) 428 3003<br />

Responsible Publisher Fernand M. Francois<br />

EBACE OFFICIAL PUBLICATION<br />

30<br />

FLEET REPORT<br />

Despite a rough economic year in 2015,<br />

Business Aviation defied the odds<br />

reports Busra Ozturk<br />

in our annual fleet report.<br />

42<br />

THE BIG (CABIN) CHILL<br />

The BRIC countries are experiencing<br />

a slowdown in demand for big cabin<br />

business aircraft.<br />

45<br />

ANOTHER CHOPPY YEAR<br />

Flight activities disappointed in 2015,<br />

reports Richard Koe.<br />

48<br />

<strong>HELI</strong>COPTER DEMAND<br />

In almost every region, the helicopter<br />

market saw a stable growth.<br />

CONTENTS<br />

53<br />

TECHNOLOGY WINNING THE FIGHT<br />

Helicopter Cabin Noise reduction<br />

systems are making their way into<br />

modern helicopters.<br />

56<br />

<strong>HELI</strong>-<strong>EXPO</strong> <strong>2016</strong> PREVIEW<br />

The super-medium helicopter class is<br />

drawing customers from both medium<br />

to heavy class helicopter customers<br />

reports Mark Huber.<br />

68<br />

THE NEED FOR SPEED<br />

Steve Nichols evaluates the latest<br />

developments of in-flight<br />

connectivity services.<br />

74<br />

FROM THE COCKPIT<br />

LeRoy Cook reflects on the tough<br />

aspects of pilot judgement and decision<br />

making in unfamiliar situations.

OUR ADVERTISERS and their Agencies<br />

81 AMSTAT<br />

13 Dassault Falcon Puck l’Agence<br />

27 Duncan Aviation<br />

25 EBACE <strong>2016</strong><br />

9 FlightSafety International Greteman Group<br />

67 GCS Safety Solution<br />

7 Gulfstream Aerospace Corporation<br />

2 HondaJet Milner Butcher Media Group<br />

11 Jet Aviation<br />

65 Jet Expo <strong>2016</strong><br />

43 JetNetLLC<br />

21 JSSI Jet Support Services Inc.<br />

39 NBAA-BACE <strong>2016</strong><br />

15 Pilatus Aircraft Ltd.<br />

69 Rockwell Collins ARINCDirect<br />

19 Rolls-Royce<br />

73 Satcom Direct<br />

84 Textron Aviation Customer Support Copp Media Services, Inc.<br />

83 Universal Avionics Systems, Corp.<br />

17 Universal Weather and Aviation, Inc.<br />

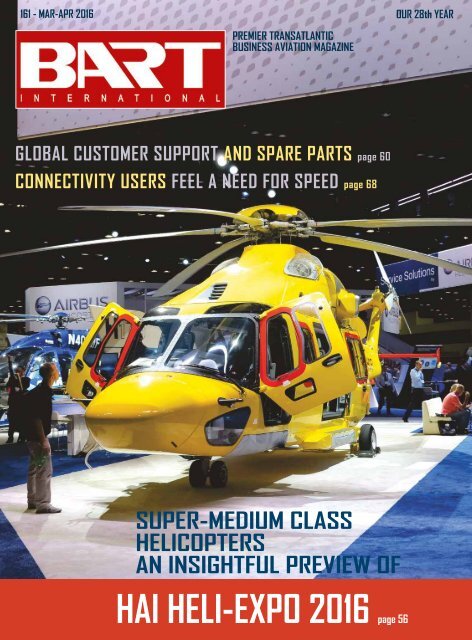

OUR COVER<br />

Helicopters in the super-midsize<br />

category are emerging on the<br />

market. The Airbus Helicopters<br />

H175 adorning our cover is an<br />

offering in the niche.<br />

Read the insightful preview<br />

of Heli-Expo <strong>2016</strong> on page 56

POINTER<br />

Events<br />

Agenda<br />

<strong>HAI</strong> <strong>HELI</strong>-<strong>EXPO</strong><br />

Feb. 29 – March 3, <strong>2016</strong><br />

Louisville KY, USA<br />

AERO Friedrichshafen<br />

April 20 – 23, <strong>2016</strong><br />

Friedrichshafen, Germany<br />

EBACE<br />

May 24 – 26, <strong>2016</strong><br />

Geneva, Switzerland<br />

IN SEQUENCE<br />

BRIEFING ROOM<br />

MORE TSA WAIVER CHANGES<br />

1. Recent changes<br />

Three NOTAMs were issued – 6/4260, 6/4256, and 6/4255 – and the only change is the reinclusion<br />

of “portal countries.” The purpose of this change was to alleviate some of the restrictions<br />

impacting operators registered in these portal countries regarding overflying the U.S. and<br />

its territories or possessions.<br />

2. Portal country considerations<br />

Aircraft no longer require TSA Waivers to transit U.S. territorial airspace if they’re departing<br />

from a portal country and arriving into a portal country, as long as they are also registered to<br />

“portal countries” – Canada, Mexico, Bahamas, Bermuda, British Virgin Islands, and Cayman<br />

Islands, and under 100,309 lbs. maximum takeoff weight. Therefore, an operator with an aircraft<br />

under 100,309 lbs. MTOW registered to one of the portal countries may fly direct from<br />

Mexico to Canada without a TSA Waiver. However, a direct flight from Canada to Guatemala<br />

still requires a TSA Waiver, as Guatemala is not a portal country.<br />

3. Non-portal country considerations<br />

Under current TSA Waiver regulations, operators of aircraft registered in non-portal countries<br />

that are less than 100,309 lbs. MTOW require TSA Waivers for all overflight of U.S. territorial<br />

airspace, but they do not require waivers when operating within the U.S., with the exception of<br />

“special interest countries.”<br />

4. Operating to, from, and within U.S. airspace<br />

As per the previous TSA-related NOTAMs issued December 11, 2015, operators of aircraft<br />

under 100,309 lbs. MTOW no longer require TSA Waivers when operating within the U.S.,<br />

unless their aircraft are registered to “special interest” countries. Special interest countries currently<br />

include China, Cuba, Iran, North Korea, Russia, Sudan, and Syria. Operators of aircraft<br />

registered to these countries require TSA Waivers for all flights over and within U.S. airspace,<br />

its territories and possessions, and they also require Special Routing Authorization from the<br />

FAA. Also, note that for your first stop into the U.S. and last point out of the country, you need<br />

to ensure that you have U.S. APIS filed.<br />

5. Obtaining TSA Waivers<br />

Normal lead time to obtain a TSA Waiver is five business days. Blanket TSA Waivers may be<br />

obtained for up to 90 days, and we recommend adding any aircraft, crew, and airport ICAOs<br />

you may travel to or from on the TSA Waiver application. Note that TSA is closed weekends<br />

and holidays and does not process waivers during these times. However, short notice waiver<br />

requests may be obtained with less than five business days lead time at TSA’s discretion. All<br />

TSA Waivers are applied for online. Note that a login/password is needed to check on the status<br />

of your TSA Waiver request. Once a waiver is confirmed TSA will update this on its site. If<br />

there are any issues with the waiver request they’ll send you an email. Some of the larger<br />

issues with TSA Waiver submissions include incorrect crew and passenger information and filling<br />

out the form incorrectly.<br />

Questions?<br />

If you have any questions about this article or would like assistance obtaining your next TSA<br />

Waiver, contact UNIVERSAL WEATHER & AVIATION at lukasmarrow@univ-wea.com or luisnambo@univ-wea.com.<br />

Follow us on Instagram<br />

@bart_intl<br />

LABACE<br />

Aug 23 – 25, <strong>2016</strong><br />

Sào Paulo, Brazil<br />

FARNBOROUGH INT’L AIRSHOW<br />

July 11 – 17, <strong>2016</strong><br />

Farnborough, UK<br />

BART MOURNS LOSS OF BERNARD FITZSIMONS<br />

It is with very deep sadness that we are informing you that our<br />

MRO editor Bernard Fitzsimons, one of our more respected<br />

journalists passed away on December 9 following catastrophic<br />

surgery to remove a lung.<br />

Bernard was a great editor, putting aerospace in writing for more<br />

than 25 years. He was writing in BART 158, September issue<br />

“There is always something new to learn.<br />

I look forward to seeing how Business Jets pan out for the next<br />

10 years – and whatever else the industry comes up with”. We<br />

lost him three months later!<br />

All of us at BART International are deeply saddened by “Ernie’s”<br />

passing and we express our deepest sympathy and condolences<br />

to his wife Jenny and his family.<br />

6 - BART: MARCH - APRIL <strong>2016</strong>

BOUNDLESS POSSIBILITIES<br />

Gulfstream gives travelers the ability to live without limits. By fusing exceptional<br />

engineering with a genuine obsession for superior style and product support,<br />

Gulfstream delivers unsurpassed aviation performance. Our fleet empowers<br />

people by expanding horizons. Create boundless possibilities. Fly Gulfstream.<br />

To contact a Gulfstream sales representative<br />

in your area, visit gulfstream.com/contacts.<br />

GULFSTREAM.COM<br />

G650ER, G650, G600, G500, G550, G450, G280 and G150 are trademarks or registered trademarks of Gulfstream Aerospace<br />

Corporation in the U.S. and other countries.

QUICK LANE<br />

FAA CERTIFIES RAISBECK SWEPT BLADE PROPELLERS FOR KING AIR 350S<br />

Raisbeck Engineering announced the FAA<br />

certification of its 4-Blade Swept Propellers<br />

for the King Air 350 family on Feb. 3. The<br />

backlog of orders for the newest version of<br />

Raisbeck/Hartzell Swept Blade Propellers<br />

began immediately, with first production<br />

shipset going to Raisbeck dealer Stevens<br />

Aviation in Dayton, Ohio for installation on<br />

Denison Aviation’s Indianapolis-based 350.<br />

The second shipset is headed to Elliott<br />

Aviation in Des Moines, Iowa for installation<br />

on Iowa State University’s 350.<br />

AAC REDELIVERS FIRST BOEING 787-8 VVIP<br />

FOR HEAD OF STATE CUSTOMER<br />

Associated Air Center (AAC), StandardAero’s Large Transport<br />

Category VIP Completions Center has redelivered the company’s<br />

and the industry’s first Boeing 787-8 Head of State aircraft<br />

completion. This project was AAC’s first Boeing 787-8 model aircraft<br />

completion and the company’s eighth wide-body completion<br />

project. The Head of State configuration features 2,404<br />

square feet of cabin space. This interior configuration can comfortably<br />

accommodate 82 VIP passengers.<br />

WEST STAR AVIATION<br />

RECEIVES ODA/STC<br />

CERTIFICATE FROM FAA<br />

JET AVIATION ST. LOUIS<br />

COMPLETES UPGRADES TO PAINT SHOP<br />

Jet Aviation St. Louis has<br />

completed the installation<br />

of a sophisticated system<br />

of controls for climate, air<br />

quality, and final finish in<br />

the Paint Shop. “Our new<br />

computerized and automated<br />

climate-control system,<br />

painter decontamination<br />

chambers, and paint<br />

delivery and quality-control<br />

devices provide the<br />

best quality control in the<br />

art of aircraft painting,”<br />

said Britt Julius, manager,<br />

Paint Shop.<br />

COMLUX EXTENDS VVIP FLEET<br />

WITH 3 ACQUISITIONS<br />

West Star Aviation has announced<br />

that they received an Organizational<br />

Design Authorization (ODA) allowing<br />

them to issue Supplemental<br />

Type Certification (STC) projects on<br />

behalf of the FAA. West Star<br />

Aviation is now authorized to show<br />

compliance on behalf of the FAA in<br />

regards to STCs, and recently<br />

issued an STC on the FAA’s behalf,<br />

for the installation and certification<br />

of the Honeywell CAS-100B TCAS<br />

7.1 upgrade.<br />

TEXTRON COMPLETES<br />

CERTIFICATION OF US COMPANY-<br />

OWNED SERVICE CENTERS<br />

Textron Aviation Inc. announced on Jan. 28 that it<br />

has attained new certifications allowing each U.S.<br />

company-owned service center to support the<br />

Beechcraft, Cessna and Hawker brands. “All 14<br />

Textron Aviation-operated service centers in North<br />

America have received expanded certifications in<br />

the past year, allowing us to deliver on our service<br />

commitments across our brands,” said Brad<br />

Thress, senior vice president, Customer Service.<br />

Comlux The Aviation Group has announced<br />

major developments to its VVIP fleet of aircraft,<br />

which consolidate its position as a key<br />

player in the ultra-large cabin / ultra-long<br />

range aircraft market, confirming the purchase<br />

of 3 brand new Airbus ACJ320 neo, all<br />

equipped with CFM Engines. In 2015, Fly<br />

Comlux has signed 5 new aircraft management<br />

contracts with undisclosed customers of<br />

heavy jets and bizjets: 1 Gulfstream 650, 2<br />

Bombardier Global 6000, 1 Airbus ACJ319<br />

and 1 Boeing 777BBJ.<br />

8 - BART: MARCH - APRIL <strong>2016</strong>

PROFESSIONAL TRAINING<br />

FOR PROFESSIONAL PILOTS<br />

FlightSafety delivers type-specific, specialty and advanced pilot courses – designed to help<br />

you operate your aircraft to the highest level of safety – while providing the outstanding service you<br />

expect and deserve. Our development experts design courses and our instructors deliver training<br />

with one overriding goal – to enhance safety. We offer the most complete range of professional<br />

programs for the majority of helicopters and fixed-wing business aircraft on the world’s largest fleet<br />

of advanced-technology simulators located throughout a global network of Learning Centers.<br />

Aviation professionals from around the world trust us to provide the highest quality training and outstanding service.<br />

More than 1,800 highly experienced professional instructors deliver aircraft- and mission-specific courses, using our<br />

comprehensive training systems and advanced-technology flight simulators designed to enhance safety. Trust your<br />

training to FlightSafety. You’ll see why so many aviation professionals make the same choice. And have since 1951.<br />

For information, please contact Steve Gross, Vice President, Sales • 314.785.7815<br />

sales@flightsafety.com • flightsafety.com • A Berkshire Hathaway company

QUICK LANE<br />

CESSNA ANNOUNCES <strong>2016</strong> TOP HAWK UNIVERSITY PARTNERS<br />

Cessna Aircraft Company, a subsidiary of<br />

Textron Aviation Inc., a Textron Inc. company,<br />

announced the partner universities<br />

selected for its <strong>2016</strong> Top Hawk program<br />

on Jan. 28. Kent State University,<br />

LeTourneau University, Purdue<br />

University and Westminster College will<br />

each take delivery of a new, custom<br />

branded Cessna Skyhawk 172 aircraft to<br />

support flight training, recruiting efforts<br />

and promotional activities at their respective<br />

universities throughout the year.<br />

DUNCAN RECEIVES STC FOR INTEGRATED CHALLENGER<br />

601 3A/3R CPDLC/FANS 1/A+ SOLUTION<br />

Duncan Aviation announced that it recently completed an industry-first Controller<br />

Pilot Data Link Communications/Future Air Navigation System (CPDLC/FANS)<br />

1/A+ installation. The Supplemental Type Certificate (STC) was recently issued by the<br />

FAA and covers the Challenger 601. The installation features the upgraded NZ-2000<br />

Honeywell Flight Management System (FMS), which integrates with current<br />

Challenger 601 Original Equipment Manager (OEM) flight decks. “Our installation is<br />

unique in the industry,” says Regional Avionics Sales Manager Mark Francetic.<br />

JET AVIATION COMPLETES 3 FANS<br />

INSTALLATIONS IN CHALLENGER 604S<br />

The industry’s first three installations of<br />

Future Aircraft Navigation Systems (FANS) in<br />

Bombardier Challenger 604s by Jet Aviation<br />

St. Louis are complete, with three more<br />

already scheduled. The installations are possible<br />

after Jet Aviation St. Louis received FAA<br />

approval for a Supplemental Type Certificate<br />

(STC). Jet Aviation St. Louis teamed with<br />

Rockwell Collins to develop the STC for the<br />

Challenger 604 FANS 1/A aftermarket solution.<br />

AIRBUS DELIVERS ACJ319 WITH<br />

HIGH-TECH SYSTEM ONBOARD<br />

Airbus Corporate Jet Centre (ACJC), the innovative<br />

provider of customized nose-to-tail solutions<br />

to VIP and airline customers under Airbus standards,<br />

has delivered a refurbished Airbus ACJ319<br />

for an undisclosed government, after a successful<br />

C-Check (10 years) and heavy work on the fuselage.<br />

This project presented a double challenge<br />

by requiring high-level communication and inflight<br />

entertainment (IFE) systems and a new<br />

cabin configuration in a record time.<br />

TEXTRON AVIATION LAUNCHES<br />

1CALL, COMPLETE AIRCRAFT<br />

SUPPORT TEAM<br />

FLIGHTSAFETY RECEIVES FAA LEVEL D QUALIFICATION FOR<br />

2 CESSNA CARAVAN SIMULATORS<br />

FlightSafety International has received Level<br />

D qualification from the United States Federal<br />

Aviation Administration for two Cessna<br />

Caravan aircraft simulators located at its<br />

Wichita East Learning Center. The simulators<br />

are equipped with Garmin G1000 and Garmin<br />

G600 avionics. “The Level D qualification of<br />

our Cessna Caravan simulators by the FAA<br />

demonstrates FlightSafety’s ongoing commitment<br />

to provide the highest quality training<br />

using advanced technology equipment that<br />

meets the highest standards,” said Daniel<br />

MacLellan, Senior Vice President,<br />

Operations.<br />

Textron Aviation Inc. has announced that it<br />

has bolstered its customer service offering<br />

with the launch of 1Call, which provides a single<br />

point of contact for Beechcraft, Citation<br />

and Hawker customers during unscheduled<br />

maintenance events. Customers can access<br />

the dedicated 1Call team by dialing +1-316-517-<br />

2090. The team oversees every step of a maintenance<br />

event using visual display boards that<br />

track all calls, air response aircraft and mobile<br />

service units through issue resolution.<br />

10 - BART: MARCH - APRIL <strong>2016</strong>

SAFETY FIRST<br />

Jet Aviation Maintenance and Refurbishment Services<br />

You can count on Jet Aviation’s 50-plus years of industry experience whether you need a routine inspection, heavy<br />

maintenance and repair, refurbishment, or the technical expertise of our round-the-clock AOG team. Strategically<br />

located around the world, our repair stations are staffed by technicians trained in all major airframes. Keeping<br />

your aircraft safe and operational is our No.1 priority at every Jet Aviation facility. You can count on us.<br />

Visit our global MRO locations:<br />

Basel, Boston/Bedford, Dubai, Geneva<br />

Hong Kong, Jeddah, Moscow Vnukovo<br />

Singapore, St. Louis, Teterboro, Vienna<br />

www.jetaviation.com/maintenance

QUICK LANE<br />

OSLO AIRPORT FIRST LOCATION TO SUPPLY<br />

AIR BP BIOJET VIA FUEL HYDRANT SYSTEM<br />

In a first for commercial aviation, Air<br />

BP, together with Norwegian airport<br />

operator Avinor, and sustainable biofuel<br />

specialist SkyNRG, announced the<br />

results of a successful collaboration for<br />

commercial supply of jet biofuel at<br />

Oslo Airport Gardermoen on Jan. 22.<br />

From this date, all airlines landing at<br />

Oslo Airport can have jet biofuel delivered<br />

from the airport’s main fuel farm,<br />

via the existing hydrant mechanism.<br />

JET AVIATION ZURICH SIGNS<br />

DISPENSER FUELING AGREEMENT<br />

WITH LUFTHANSA GROUP<br />

Jet Aviation Zurich has signed an agreement with<br />

the Lufthansa Group to provide high-volume fuel<br />

uplifts through docked dispenser fueling. The<br />

company successfully fueled its first Lufthansa<br />

Group aircraft with dispenser fueling on Jan. 1.<br />

As part of its agreement, Jet Aviation Zurich purchased<br />

two new dispenser trucks and hired five<br />

new truck operators, thereby expanding its fueling<br />

team to 18, and sent three refueling operators<br />

to Frankfurt, Germany, for dispenser training.<br />

COMLUX LAUNCHES NEW VIP SERVICE CENTER IN MIDDLE EAST WITH TEXEL AIR<br />

Comlux The Aviation Group has announced the<br />

signing of a cooperation agreement with Texel<br />

Air, in order to provide its Middle East customers<br />

with dedicated MRO line Maintenance and cabin<br />

upgrades & refurbishments on their VIP aircraft.<br />

While Texel Air will provide hangar, maintenance<br />

and certification services through its 3,200 m2<br />

facility at Bahrain International airport, Comlux<br />

will take care of system upgrades and cabin modification<br />

services by hiring high-skilled local<br />

craftsmen and engineers, managed and assisted<br />

by Comlux America experts on-site.<br />

GLOBAL CERTIFICATION PROGRAM<br />

FOR GROUND HANDLERS BY UNIVERSAL AVIATION<br />

Universal Aviation has announced a new global certification program<br />

designed to recognize and distinguish ground handlers<br />

around the world. “When our clients operate to a Universal<br />

Aviation Certified location, even in remote locales, they can have<br />

confidence that they will receive the same level of service and commitment<br />

that they would at a Universal Aviation location,” said<br />

Jonathan Howells, Senior Vice President, International, Universal.<br />

LONDON OXFORD AIRPORT<br />

OBTAINS TWO NEW ACCREDITATIONS<br />

London Oxford Airport is ringing in the New Year with two new<br />

accreditations. Its OxfordJet FBO has become one of only a few<br />

FBO’s in the UK to receive the International Standard for Business<br />

Aircraft Handling (IS-BAH). London Oxford has also achieved formal<br />

recognition from Gulfstream Aerospace for approved ground<br />

handling. This news follows an increasing number of Gulfstream<br />

business jets utilizing the OxfordJet FBO on a regular basis.<br />

12 - BART: MARCH - APRIL <strong>2016</strong>

TWO WAYS<br />

TO CONQUER THE WORLD.<br />

Now you have two choices for superior, ultra-long-range capability. The 5,950 nm Falcon 7X—the fastest selling Falcon ever (and with<br />

good reason). Or the new, 6,450 nm Falcon 8X, destined to become a favorite of world travelers. Both have the awe-inspiring ability<br />

to fl y long distances from short and challenging runways such as Aspen and London City. The 8X is more than three feet longer, with<br />

over 30 cabin layouts. Fly far. Fly in comfort. Achieve more.<br />

WWW.DASSAULTFALCON.COM I FRANCE: +33 1 47 11 88 68 I USA: +1 201 541 4600

QUICK LANE<br />

BELL <strong>HELI</strong>COPTER,<br />

AIR METHODS CELEBRATE HISTORIC BELL 407GXP DELIVERY<br />

Bell Helicopter, a Textron Inc. company, has announced the delivery of the Bell<br />

407GXP configured for Helicopter Emergency Medical Services to Air Methods.<br />

This is the first of many Bell 407GXPs expected over the next ten years. “Air<br />

Methods is celebrating this historic milestone that supports our mission of giving<br />

more tomorrows,” said Aaron Todd, chief executive officer, Air Methods. “As our<br />

launch customer for this aircraft, we take great pride in their ongoing trust in Bell<br />

Helicopter,” said Bell Helicopter’s President and CEO Mitch Snyder.<br />

JET AVIATION ZURICH FBO<br />

HANDLES VAST MAJORITY OF<br />

HEAD-OF-STATE WEF <strong>2016</strong> FLIGHTS<br />

Jet Aviation Zurich spent months preparing<br />

for the surge of VIP customers that arrived in<br />

Zurich to attend the 46th annual World<br />

Economic Forum (WEF) meeting, held Jan.<br />

20-23, in Davos, Switzerland. The company<br />

served the majority of aircraft and passengers<br />

attending WEF, handling 612 movements<br />

and 1,830 passengers while supporting<br />

fuel sales of 1.5 million liters. The WEF drew<br />

business aviation traffic from around the<br />

world.<br />

PARAGON NETWORK ADDS<br />

LUX AIR JET CENTERS<br />

AT PHOENIX-GOODYEAR AIRPORT<br />

Lux Air Jet Centers, located at Phoenix-<br />

Goodyear Airport (KGYR), became an official<br />

member of the Paragon Network on Jan 1,<br />

<strong>2016</strong>. Lux Air Jet Centers has been the<br />

Phoenix-Goodyear Airport full service FBO<br />

since 2007. Lux Air Goodyear offers a full<br />

range of ground support assistance for all types<br />

of aircraft, including heavy transports. Their<br />

highly trained line staff is known for providing<br />

the highest level of customer service.<br />

EPIC ADDS KONECT AVIATION<br />

TO THEIR FBO NETWORK<br />

EPIC welcomes Konect Aviation (MMV) as the<br />

newest EPIC FBO Network location. As an<br />

EPIC branded location Konect Aviation will be<br />

accepting the globally accepted EPIC Card and<br />

will award Bravo Rewards points on all fueling<br />

purchases. Konect Aviation was awarded the<br />

Fixed Base Operator/Airport Manager contract<br />

for the McMinnville Municipal Airport,<br />

granting Konect Aviation the authority to provide<br />

general aviation support services to visitors.<br />

FLIGHTSAFETY INT’L ADDS GULFSTREAM G650 CPDLC<br />

TO ITS eLEARNING COURSES<br />

FlightSafety International adds Gulfstream G650 Controller Pilot<br />

Data Link Communication to its extensive series of eLearning<br />

courses and CPDLC iFlightDECK subscription-based application.<br />

The three-hour eLearning CPDLC scenario-based course is<br />

designed to familiarize pilots with CPDLC/ADS-C operations in normal<br />

and abnormal situations. The course will take them through a<br />

flight planning phase, as well as flights over the Atlantic and Pacific<br />

oceans.<br />

14 - BART: MARCH - APRIL <strong>2016</strong>

1200 HORSEPOWER AT YOUR FINGERTIPS<br />

The PC-12 NG is part pacemaker, part insider tip. Its short-field performance lets you<br />

say yes to trips that used to give you headaches. Its operating costs come in much,<br />

much lower than competing aircraft. The large cabin makes it a joy for riders. And its<br />

renowned safety and reliability are backed by the industry’s top-rated support. All in<br />

all, a workhorse that looks good, any way you look at it.<br />

Pilatus Aircraft Ltd • Switzerland • Phone +41 41 619 61 11 • www.pilatus-aircraft.com

QUICK LANE<br />

TAG FARNBOROUGH AIRPORT<br />

OPENS NEW TERMINAL FACILITIES<br />

AMAC AEROSPACE OPENS 4th HANGAR<br />

AT EUROAIRPORT IN BASEL<br />

TAG Farnborough Airport has invested<br />

an additional £1 million to create more<br />

space for passengers and crew at its terminal<br />

building in order to meet growing<br />

demand. In 2015, air traffic movement<br />

(ATM) growth was 2%. This includes a<br />

6% increase in the number of airlinerderived<br />

(50-80 tons maximum take-off<br />

weight) business jets, which represents<br />

the highest number in this category for<br />

any year.<br />

DAHER DELIVERS<br />

55 TBM 900 AIRCRAFT IN 2015<br />

AMAC Aerospace AG opens its fourth hangar at their facilities at<br />

EuroAirport in Basel after only 11 months construction time.<br />

The additional hangar area of 7,280 m2 and the additional apron<br />

area of 6,038 m2 allow AMAC Aerospace to further expand their<br />

capacity for wide-body maintenance work. Unlike the already<br />

existing three hangars, the fourth one is purely dedicated to<br />

maintenance projects and wide-body aircrafts.<br />

Daher’s Airplane Business Unit delivered a total of 55 TBM 900s<br />

in 2015 – a 10 percent increase compared to 2014, and the second<br />

best year since the first TBM single-engine very fast turboprop<br />

aircraft was provided to a customer in 1991. The 2015 geographic<br />

distribution reflected global economic trends in 2015, as<br />

TBM 900 deliveries were led by the United States. Latin America<br />

ranked second, while Europe was third.<br />

ASSOCIATED AIR CENTER<br />

COMPLETES<br />

FAA STC CERTIFICATION<br />

Associated Air Center (AAC) has<br />

obtained a Federal Aviation<br />

Administration (FAA) Supplemental<br />

Type Certificate (STC) for the<br />

installation of a Controller-Pilot<br />

Data Link Communication<br />

(CPDLC) System — as part of the<br />

requirements for Future Air<br />

Navigation System (FANS) — on<br />

a Boeing Business Jet VIP model<br />

aircraft. The STC was completed<br />

at AAC’s FAR-145 FAA Repair<br />

Station at Dallas Love Field and<br />

delivered to the customer on Dec.<br />

23, 2015.<br />

AEROSERVICIO APPOINTED EXCLUSIVE KODIAK SALES REPRESENTATIVE<br />

Quest Aircraft Company has<br />

named Aeroservicio as its<br />

authorized KODIAK sales<br />

representative for Chile.<br />

Based in Santiago, Chile,<br />

Aeroservicio has over 50<br />

years of experience in the<br />

aviation industry. “The<br />

KODIAK is well-suited for a<br />

wide variety of operators in<br />

Chile and the surrounding<br />

countries, and the addition of<br />

Aeroservicio will enhance<br />

our marketing efforts in this<br />

market,” said John Hunt,<br />

Vice President of Sales for<br />

North, Central and South<br />

America.<br />

16 - BART: MARCH - APRIL <strong>2016</strong>

Introducing uvGO.<br />

Trip management made easy.<br />

Planning and executing successful missions is a 24/7 operation.<br />

What if you had a simple, more intuitive way to manage your trips<br />

from beginning to end – no matter where you are? Now you do.<br />

Get started at universalweather.com/uvGO.<br />

Apple and iPad are trademarks of Apple Inc., registered in the U.S. and other countries.<br />

Universal Weather and Aviation, Inc. is not endorsed, sponsored, affiliated with or otherwise authorized by Apple Inc.

QUICK LANE<br />

LEGACY 450<br />

SPREADS ITS WINGS OVER EUROPEAN SKIES<br />

JET AVIATION VIENNA<br />

RECEIVES EASA APPROVAL<br />

FOR GULFSTREAM GV-SP<br />

Jet Aviation Vienna received authorization<br />

from the European Aviation Safety Agency<br />

(EASA) to provide line maintenance to the<br />

series of GV-SP aircraft which includes the<br />

Gulfstream G550. The company also provides<br />

line and base maintenance and AOG services<br />

to the Cessna Citation series and Bombardier<br />

Challenger 300 aircraft, as well as line maintenance<br />

services to Bombardier Learjet and<br />

Global 5000 aircraft.<br />

WEST STAR AVIATION<br />

ANNOUNCES APPROVAL BY CAAC<br />

West Star Aviation announced that their Grand Junction, CO<br />

location has been approved by the Civil Aviation Administration<br />

of China (CAAC). West Star’s Grand Junction location is now in<br />

compliance with the China Civil Aviation Regulation (CCAR)-<br />

Part 145 Maintenance Organization. The purpose of the approval<br />

includes repairing landing gear for business aircraft and also<br />

specialized service of Ultrasonic, Eddy Current X-Ray, Liquid<br />

Penetrate and Magnetic Particle Inspection.<br />

Embraer Executive Jets’ Legacy 450 is spreading its wings over<br />

European skies. The first EASA-registered aircraft is based in<br />

Brussels, Belgium, under the management of Smart Air SA. The<br />

new mid-light business jet is available for charter and will be<br />

operated by ASL. The Legacy 450 has received certification from<br />

the aeronautical authorities of Brazil, the United States and the<br />

European Union.<br />

EMBRAER DELIVERS FIRST LEGACY 500 TO<br />

CHINA'S LAUNCH CUSTOMER JACKIE CHAN<br />

Embraer has announced that Jackie Chan, a worldrenowned<br />

movie star, became the first customer in China<br />

to take delivery of a Legacy 500. "The Legacy 500 features<br />

our best-to-date technologies and it incorporates designs<br />

that maximize passenger comfort and fuel efficiency," said<br />

Marco Tulio Pellegrini, President & CEO, Embraer<br />

Executive Jets. "I'm so thrilled to receive this Legacy 500, a<br />

state-of-art executive jet," said Jackie Chan. Jackie Chan's<br />

connection with Embraer Executive Jets dates to 2012,<br />

when he received an Embraer Legacy 650 as China's<br />

launch customer and became Embraer's brand ambassador.<br />

18 - BART: MARCH - APRIL <strong>2016</strong>

olls-royce.com<br />

Nobody does it<br />

like CorporateCare ®<br />

Bringing you the most comprehensive and sought after<br />

business jet engine maintenance program in the world,<br />

with industry leading service and expertise provided by<br />

the original manufacturer. Regardless of where you<br />

travel, CorporateCare will be there to support you. To<br />

help maximize your assets availability, value and<br />

liquidity, Rolls-Royce is proud to offer CorporateCare.<br />

To find out more contact Steve Friedrich, Vice President<br />

– Sales and Marketing, at +1 (703) 834-1700, or email<br />

corporate.care@rolls-royce.com.<br />

Trusted to deliver excellence.

QUICK LANE<br />

TAG AVIATION LE BOURGET<br />

MAINTENANCE CENTER NOW AN AUTHORIZED<br />

ROCKWELL COLLINS DEALER<br />

TAG Aviation’s Maintenance Service Center located at Le Bourget<br />

Airport in Paris has announced it has become an Authorized<br />

Business and Regional Systems (BRS) Dealer following a new<br />

cooperation with Rockwell Collins. TAG Aviation Le Bourget is<br />

now authorized to promote and sell a wide range of the leading<br />

US manufacturer’s products including Venue cabin management<br />

and entertainment solution, an interactive Airshow® moving map<br />

and Tailwind® airborne satellite TV as well as other avionics system<br />

solutions.<br />

StandardAero LAUNCHES PT6A FASTLANE<br />

“TM” ENGINE MAINTENANCE PROGRAM<br />

HONDA AIRCRAFT COMPANY BEGINS<br />

HONDAJET DELIVERIES<br />

Honda Aircraft Company announced on Dec. 23 that<br />

it has begun deliveries of the HondaJet, the world's<br />

most advanced light jet. The company has delivered<br />

the first aircraft at its world headquarters in<br />

Greensboro, North Carolina. This milestone follows<br />

final type certification from the Federal Aviation<br />

Administration (FAA), which the HondaJet received<br />

on Dec. 8. Honda Aircraft Company CEO<br />

Michimasa Fujino said: "We are very excited to commence<br />

deliveries of the HondaJet, fulfilling Honda's<br />

commitment to advancing human mobility through<br />

innovation."<br />

StandardAero CERTIFIES ROCKWELL COLLINS<br />

TCAS 7.1 - TTR-4100 SYSTEM<br />

Working in conjunction with Rockwell Collins, StandardAero’s<br />

Springfield, Illinois business aviation MRO facility, has completed<br />

its first Rockwell Collins TTR-4100 TCAS 7.1 Supplemental<br />

Type Certificate (STC) for a Falcon 50EX aircraft. This new<br />

TTR-4100 TCAS processor incorporates new 7.1 logic that<br />

enhances crew awareness of traffic situations and allows either<br />

aircraft to issue resolution advisory reversals in the event an<br />

approaching aircraft does not follow ATC or TCAS instructions<br />

to avoid a conflict.<br />

JET AVIATION<br />

DEVELOPS COMPETITIVE MANUFACTURING<br />

CAPABILITIES TO SUPPORT PRO LINE 21<br />

Jet Aviation Basel has installed two Rockwell Collins Pro Line<br />

21 Avionic upgrades: one on a Dassault Falcon 2000, the other<br />

on a Dassault Falcon 2000EX. The company has also developed<br />

a Pro Line 21 support kit to reduce expected downtime of such<br />

installations to six weeks. The Pro Line 21 support kit is based<br />

on modern instrument panels and cable looms that can be customized<br />

to the various aircraft types supported by Jet Aviation<br />

Basel’s in-house shops.<br />

StandardAero has launched a<br />

new, customized accelerated<br />

response program to support<br />

PT6A turboprop engine operators<br />

with hot section inspections,<br />

repairs and on-site field services.<br />

This new program titled “PT6A<br />

FASTLANE” includes but is<br />

not limited to, on-wing inspections<br />

by a certified StandardAero<br />

Field Service Representative<br />

(FSR), Service Center support<br />

and OEM approved repairs.<br />

Primary engine models for the<br />

FASTLANE program include<br />

PT6A-41/-42/-60A/-114A/-135A.<br />

20 - BART: MARCH - APRIL <strong>2016</strong>

All of these names<br />

have one name in common.<br />

AgustaWestland • Airbus • Airbus Helicopters • Bell • Boeing • Bombardier • Cessna<br />

Dassault • Embraer • GE • Gulfstream • Hawker Beechcraft • Honeywell<br />

MD Helicopters • Pratt & Whitney • Robinson<br />

Rolls Royce • Sikorsky • Williams<br />

Lower Maintenance Costs • Higher Residual Value • Global Support<br />

JSSI ® is the leading provider of hourly cost maintenance programs covering virtually<br />

all makes and models of business aircraft, engines and APUs, including helicopters.<br />

jetsupport.com/gettoknowus • +1.312.644.8810 • +44.1252.52.6588

TEXTRON REPORTS FOURTH QUARTER 2015 INCOME<br />

GENERAL DYNAMICS<br />

REPORTS<br />

FOURTH-QUARTER,<br />

FULL-YEAR 2015 RESULTS<br />

Textron Inc. (NYSE: TXT) has reported fourth<br />

quarter 2015 income from continuing operations<br />

of $0.81 per share, up 6.6 percent from<br />

$0.76 per share in the fourth quarter of 2014.<br />

Revenues in the quarter were $3.9 billion,<br />

down 4.2 percent compared to $4.1 billion in<br />

the fourth quarter of 2014. Textron segment<br />

profit in the quarter was $378 million, down<br />

$20 million from the fourth quarter of 2014.<br />

Fourth quarter manufacturing cash flow<br />

before pension contributions was $534 million<br />

compared to $449 million during last<br />

year's fourth quarter.<br />

"We had good execution in the quarter with<br />

margin improvements at Aviation, Systems<br />

and Industrial and solid double digit margins<br />

at Bell," said Textron Chairman and<br />

CEO Scott C. Donnelly. "While overall revenues<br />

were down in the quarter, we were<br />

encouraged by continued strong demand at<br />

Industrial, the ramp-up of our new Latitude<br />

business jet and the positive customer<br />

reception to our new Longitude and<br />

Hemisphere jets announced during<br />

November's National Business Aviation<br />

Association Exhibition."<br />

Full-year income from continuing operations<br />

was $2.50 per share, compared to $2.15 in<br />

2014. Full-year 2015 manufacturing cash flow<br />

before pension contributions was $631 million<br />

compared to $753 million in 2014.<br />

Outlook<br />

Textron is forecasting <strong>2016</strong> revenues of<br />

approximately $14.3 billion, up six percent,<br />

and earnings per share from continuing<br />

operations in the range of $2.60 to $2.80.<br />

The company is estimating cash flow from<br />

continuing operations of the manufacturing<br />

group before pension contributions will be<br />

between $600 and $700 million with planned<br />

pension contributions of about $60 million.<br />

Donnelly continued, "Our outlook for <strong>2016</strong><br />

reflects the success of our strategy of investing<br />

in both new product development and<br />

acquisitions. As we look to the future, we<br />

remain committed to making investments to<br />

drive growth and shareholder value."<br />

Fourth Quarter Segment Results<br />

Textron Aviation<br />

Revenues at Textron Aviation were down<br />

$32 million, primarily reflecting lower King<br />

Air and used pre-owned aircraft volumes<br />

partially offset by higher jet volume.<br />

Textron Aviation delivered 60 new jets and<br />

33 King Airs in the quarter, compared to 55<br />

jets and 41 King Airs in last year's fourth<br />

quarter.<br />

Textron Aviation recorded a segment profit<br />

of $138 million in the fourth quarter compared<br />

to $130 million a year ago. The<br />

increase is primarily due to improved performance,<br />

which included lower amortization<br />

of $8 million related to fair value step-up<br />

adjustments, partially offset by the impact of<br />

lower volumes.<br />

Textron Aviation backlog at the end of the<br />

fourth quarter was $1.1 billion, down $308<br />

million from the end of the third quarter.<br />

Bell<br />

Bell revenues decreased $36 million, primarily<br />

the result of lower commercial aftermarket<br />

volume and a change in mix of commercial<br />

aircraft delivered in the quarter partially<br />

offset by higher military deliveries.<br />

Bell delivered 8 V-22's and 9 H-1's in the<br />

quarter compared to 7 V-22's and 7 H-1's in<br />

last year's fourth quarter and 56 commercial<br />

helicopters compared to 57 units last year.<br />

Segment profit decreased $22 million, primarily<br />

due to unfavorable impact from the<br />

change in the mix of commercial aircraft<br />

delivered in the quarter and the lower commercial<br />

aftermarket volume partially offset<br />

by favorable performance.<br />

Bell backlog at the end of the fourth quarter<br />

was $5.2 billion, up $76 million from the end<br />

of the third quarter.<br />

$<br />

General Dynamics (NYSE: GD) has<br />

reported fourth-quarter 2015 earnings<br />

from continuing operations of $764 million,<br />

a 3.7 percent increase over fourthquarter<br />

2014, on revenue of $7.8 billion.<br />

Diluted earnings per share from continuing<br />

operations were $2.40 compared to<br />

$2.19 in the year-ago quarter, a 9.6 percent<br />

increase.<br />

Full-year Results<br />

Full-year earnings from continuing operations<br />

rose to $3 billion from $2.7 billion in<br />

2014, a 10.9 percent increase. Diluted<br />

earnings per share from continuing operations<br />

were up 16 percent at $9.08 compared<br />

to $7.83 in 2014. Revenue for 2015<br />

was up 2 percent, to $31.5 billion.<br />

“General Dynamics had another recordsetting<br />

year of financial performance, with<br />

operating earnings, margins, earnings<br />

22 - BART: MARCH - APRIL <strong>2016</strong>

from continuing operations, EPS and<br />

return on sales at the highest levels in the<br />

company’s history,” said Phebe<br />

Novakovic, chairman and chief executive<br />

officer. “We have a healthy and stable<br />

backlog with the defense businesses executing<br />

on recent program wins, and<br />

Aerospace’s backlog is growing year-overyear<br />

reflecting strong order activity<br />

throughout 2015.<br />

“Over the past 36 months, this management<br />

team has demonstrated the value of<br />

focusing on operations, managing the<br />

business for cash and earnings, and growing<br />

return on invested capital. The company’s<br />

accomplishments in 2015 illustrate<br />

the strength of our approach and support<br />

our commitment to disciplined growth.”<br />

Revenue<br />

Revenue for the fourth quarter of 2015<br />

was $7.8 billion. For the full year of 2015,<br />

revenue was $31.5 billion, a 2 percent<br />

increase compared to 2014. The<br />

Aerospace and Marine Systems groups<br />

increased revenue in 2015, with Marine<br />

Systems growing by more than 9 percent.<br />

Margin<br />

Company-wide operating margin for<br />

fourth-quarter and full-year 2015 was 13.3<br />

percent. Margins grew 50 basis points<br />

over the fourth quarter of 2014 and 70<br />

basis points for the full year, with expansion<br />

in Aerospace, Combat Systems and<br />

Information Systems and Technology during<br />

the year.<br />

Cash<br />

Net cash provided by operating activities<br />

for the full year totaled $2.5 billion. Free<br />

cash flow from operations, defined as net<br />

cash provided by operating activities less<br />

capital expenditures, was $1.9 billion for<br />

the year.<br />

Backlog<br />

General Dynamics’ total backlog at the<br />

end of 2015 was $66.1 billion. It was<br />

another strong quarter for the Aerospace<br />

group, with order activity in each of the<br />

Gulfstream products and across their<br />

global market. The estimated potential<br />

contract value, representing management’s<br />

estimate of value in unfunded<br />

indefinite delivery, indefinite quantity<br />

(IDIQ) contracts and unexercised<br />

options, was $24.5 billion. Total potential<br />

contract value, the sum of all backlog<br />

components, was $90.6 billion at the end<br />

of the year.<br />

$<br />

JSSI SEES BUSINESS AVIATION SOARING IN 2015<br />

JSSI Business Aviation Index Suggests<br />

Small Cabin Aircraft Use Spearheads<br />

Growth<br />

JSSI has released its Q3 2015 Business<br />

Aviation Index, which tracks flight hours<br />

for business aircraft by region, industry<br />

and cabin type. According to JSSI’s Q3<br />

2015 Business Aviation Index, global<br />

flight hours grew 4.3% Quarter-over-<br />

Quarter (QoQ). By percentage of peak<br />

usage – JSSI concluded business aviation<br />

is now operating at 80.7% of the sector’s<br />

2008 peak levels.<br />

“Q2 2015’s flight activity is, on the whole,<br />

indicative of volatility in the global business<br />

aviation markets,” said Neil Book,<br />

JSSI’s President and Chief Executive<br />

Officer. “The decline in oil prices has had<br />

a negative impact on the helicopter sector<br />

which supports offshore operations<br />

and flight hours in the Middle East.<br />

Stable economic conditions in North<br />

America and Europe are reflected in both<br />

QoQ and YoY flight hour growth.<br />

Despite this growth, third quarter business<br />

aviation is still well behind -2008 levels.”<br />

JSSI Index: By Aircraft Type<br />

Segmenting flight hour data by aircraft<br />

type reveals medium and small cabin aircraft,<br />

the primary choice of aircraft by<br />

midsize companies, were this quarter’s<br />

biggest growth areas, as both maintained<br />

positive YoY gains in flight hours.<br />

“As the U.S. economy remains strong and<br />

fuel prices remain low, owner/operators<br />

are flying small cabin aircraft more, as<br />

are midsize companies looking for both<br />

access and flexibility,” continued Mr.<br />

Book.<br />

JSSI Index: By Region<br />

From Q2 2015 to Q3 2015, business aviation<br />

grew across nearly every market.<br />

Africa outpaced expectations as it experienced<br />

the largest QoQ increase in over<br />

one year.<br />

Noting the African rebound, Book stated,<br />

“Many foreign investors remain bullish<br />

on growth prospects for the region and<br />

continue to utilize business aviation to<br />

Aircraft Type Helicopter Large Cabin Medium Cabin Small Cabin<br />

QoQ Change -0.3% 0.9% 2.2% 8.8%<br />

YoY Change -15.0% -5.0% 3.7% 8.2%<br />

Region Africa Asia-Pacific C. America Europe Mid. East N. America S. America<br />

QoQ Change 24.5% -0.2% 3.0% 9.3% 4.6% 2.3% 9.1%<br />

YoY Change 12.5% 0.7% 12.9% 0.5% -12.1% 1.7% -9.7%<br />

access areas difficult to reach using the<br />

airlines. The strong growth also represents<br />

a rebound from a historically tough<br />

2014, due to the unprecedented 2014<br />

Ebola outbreak.”<br />

“South America’s -9.7% decline in YOY<br />

flight activity reflects the weak overall<br />

state of the region’s principle economies,<br />

which the IMF predicts will enter a<br />

recession later this year,” remarked<br />

Book.<br />

$<br />

BART: MARCH - APRIL <strong>2016</strong> - 23

ON THE MOVE<br />

PEOPLE<br />

Duncan Aviation recently<br />

named Lee Bowes the company’s<br />

Central United States<br />

Regional Manager. In this new<br />

Lee Bowes<br />

position, Bowes will help business<br />

aircraft operators in the<br />

central part of the United States,<br />

including Colorado, Iowa,<br />

Kansas, Minnesota, Montana,<br />

Nebraska, North Dakota, South<br />

Dakota and Wyoming and<br />

become more familiar with the<br />

comprehensive service capabilities<br />

offered by Duncan Aviation.<br />

These services include airframe<br />

and engine maintenance, paint<br />

and interior refurbishment,<br />

avionics installations, repair,<br />

engine and airframe AOG assistance,<br />

aircraft sales and acquisition,<br />

and parts support.<br />

Puja Mahajan has been<br />

appointed as CEO of Elit’Avia,<br />

succeeding Michel Coulomb.<br />

Puja Mahajan<br />

David Opalach<br />

As CEO, Puja will lead<br />

Elit’Avia’s continued success as<br />

one of the world’s foremost aircraft<br />

charter, management and<br />

travel services providers.<br />

Michel Coulomb, Chairman of<br />

the Board now, said, “In just<br />

over two years as Chief<br />

Operating Officer with Elit’Avia,<br />

Puja has made tremendous<br />

contributions to the company’s<br />

growth. We are delighted that<br />

she has accepted her new role<br />

to lead the company onto even<br />

greater successes.”<br />

FlightSafety International has<br />

also announced that Luiz<br />

Hamilton Lima has joined the<br />

company as airline training<br />

Sales Manager for Europe, the<br />

Middle East and Africa. Luiz<br />

joins FlightSafety from<br />

Embraer after more than 35<br />

years with the company. “Our<br />

current and prospective airline<br />

Customers in Europe, the<br />

Middle East and Africa will benefit<br />

from Luiz’s knowledge,<br />

experience and commitment to<br />

provide the very best service<br />

and training solutions that meet<br />

their individual needs,” said<br />

Steve Gross, Vice President,<br />

Sales.<br />

Another news from<br />

FlightSafety International is<br />

the promotion of Steve Gross<br />

to the position of Senior Vice<br />

President, Commercial. He is<br />

now responsible for<br />

FlightSafety’s business aviation<br />

and regional airline training<br />

sales activities worldwide. He<br />

was most recently Vice<br />

President, Sales. “Steve is most<br />

deserving of this promotion to<br />

Senior Vice President,<br />

Commercial. Our Customers<br />

around the world appreciate<br />

and value Steve’s ability to<br />

develop and tailor solutions that<br />

meet their specific needs,” said<br />

Bruce Whitman, Chairman,<br />

President & CEO.<br />

David Opalach has also been<br />

named Assistant Manager of<br />

the FlightSafety International’s<br />

Learning Center in<br />

Wilmington, Delaware. The<br />

Wilmington Learning Center<br />

offers a wide variety of training<br />

programs for pilots, maintenance<br />

technicians, and flight<br />

attendants and Opalach will be<br />

responsible for the training<br />

operations and simulations that<br />

are carried out in the center.<br />

David most recently served as<br />

the Director of Quality<br />

Management Systems and as<br />

the point of contact for all<br />

courseware development at the<br />

Wilmington Learning Center.<br />

Gama Aviation has appointed<br />

Lorrissa Lippi as Marketing<br />

and Media Coordinator to help<br />

further develop its marketing<br />

efforts in the US. Lorrissa will<br />

report to Duncan Daines,<br />

Group Chief Marketing Officer,<br />

and Johnny Griggs, Brand<br />

Manager, and will be responsible<br />

for new business and event<br />

support, as well as developing<br />

digital content for each US location<br />

and assisting in the expansion<br />

of marketing strategies.<br />

Speaking on her appointment,<br />

Lorrissa commented: “I hope<br />

to make a valuable contribution<br />

to the continued success of<br />

Gama Aviation.”<br />

Gulfstream Aerospace Corp.<br />

recently promoted Nicolas<br />

Robinson to the position of<br />

regional vice president of new<br />

aircraft Sales for Africa.<br />

Robinson, previously the company’s<br />

director of Product<br />

Support Sales for Asia Pacific,<br />

reports to Trevor Esling,<br />

Gulfstream regional senior vice<br />

president, International Sales<br />

for Europe, the Middle East and<br />

Africa. Robinson is based at the<br />

Gulfstream Sales and Design<br />

Nicolas Robinson<br />

Center in Mayfair, London. A<br />

19-year veteran of the aviation<br />

industry, Robinson most recently<br />

oversaw Gulfstream’s<br />

Product Support Sales activities<br />

in Asia Pacific.<br />

TAG Aviation Europe has<br />

announced the appointment of<br />

Daniel Christe as Chief<br />

Executive Officer of TAG<br />

Aviation Europe. Welcoming<br />

his promotion, Mr Christe said:<br />

“I am very enthusiastic to take<br />

the lead of TAG Aviation<br />

Europe which enjoys an unrivalled<br />

reputation in the business<br />

aviation industry. I remain<br />

mindful about the challenges<br />

ahead in the current difficult<br />

economic environment but am<br />

privileged to have beside me<br />

the dedication and support of a<br />

very experienced management<br />

team.”<br />

West Star Aviation has<br />

announced that Thomas<br />

Hilboldt will be the General<br />

Manager for their newest location<br />

in Chattanooga,<br />

Tennessee. Having over 40<br />

years of experience in aviation,<br />

Tom will be responsible for<br />

overseeing all operations of the<br />

new 40,000-sq.-ft. heated hangar<br />

and will oversee all maintenance,<br />

interior, avionics and<br />

mobile response team services.<br />

“Tom is respected throughout<br />

the aviation industry and has<br />

proven skills that will continue<br />

to add positive growth for our<br />

new location,” says, Rodger<br />

Renaud, Chief Operating<br />

Officer.<br />

24 - BART: MARCH - APRIL <strong>2016</strong>

Join European business leaders, government<br />

officials, manufacturers, corporate aviation<br />

department personnel and all those<br />

involved in business aviation for the<br />

European Business Aviation Convention<br />

& Exhibition (EBACE<strong>2016</strong>). Visit the<br />

EBACE website to learn more and<br />

register today.<br />

REGISTER TODAY:<br />

www.ebace.aero/bart

TRANSATLANTIC<br />

EUROPE ON OUR RADAR THIS MONTH<br />

From the Desk of<br />

Fabio Gamba CEO EBAA<br />

EUROPEAN AVIATION SUMMIT SHEDS LIGHT ON<br />

THE CHALLENGES FACING THE AVIATION INDUSTRY<br />

THERE IS NO DOUBT THAT <strong>2016</strong> will be a<br />

year where air transport gets the<br />

attention it needs. The year kicked off<br />

with the much anticipated European<br />

Aviation Summit where EU<br />

Commissioner Violeta Bulc formally<br />

presented her Aviation Strategy to the<br />

most influential personalities in the<br />

industry. While industry leaders<br />

universally agree that European<br />

transport needs legislative support to<br />

boost its competitiveness, the specific<br />

measures outlined in the Aviation<br />

Strategy have fostered far less<br />

confidence on the outcomes that the<br />

strategy is expected to achieve.<br />

Admittedly, the EU Commissioner<br />

recognizes that the Aviation Strategy may<br />

not provide the right tools to help the<br />

industry moving forward and has called<br />

upon aviation thought leaders to actively<br />

engage in conversations with her cabinet<br />

to find the right balance. The challenge,<br />

of course, will be for the various<br />

segments in air transport to align their<br />

interests and needs so that any<br />

recommended amendments to the<br />

Aviation Strategy is reflective of the<br />

entire value chain.<br />

More diversity in the dialogue<br />

on aviation needs<br />

So with the diversity of interests within<br />

the air transport industry being the<br />

potential barrier, what does it mean for<br />

smaller segments such as Business<br />

Aviation? Notably, it means that the<br />

European Commission must ensure that<br />

there is a fairer representation of voices<br />

at the table. Surprisingly, the three<br />

panels that were offered at the<br />

European Aviation Summit only included<br />

the likes of mainstream airlines and<br />

larger commercial organisations – such<br />

as Lufthansa, Ryanair, EasyJet, and the<br />

Aeroports de Paris. But the absence of<br />

other players in the industry could not<br />

be more obvious. If we are to<br />

successfully implement an Aviation<br />

Strategy that truly delivers on the needs<br />

of the industry, we must open the<br />

dialogue to a wider net of actors to<br />

ensure that we do not marginalize any<br />

of the air transport’s sectors, one that is<br />

an important provider of internal<br />

connectivity such as Business Aviation at<br />

that.<br />

Promoting greater awareness<br />

of the value of Business Aviation<br />

In preparation of the continuing debate<br />

on the Aviation Strategy, the EBAA is<br />

proud to announce the release of an<br />

independent study on the impact of<br />

Business Aviation to the European<br />

economy. The study provides the hard<br />

facts that helps policymakers to<br />

understand the broader value of<br />

Business Aviation in terms of its<br />

contribution to Europe’s gross value add<br />

(GVA) and the number of jobs that it has<br />

created.<br />

26 - BART: MARCH - APRIL <strong>2016</strong>

EUROPE<br />

Interestingly, the study not only reveals<br />

that Business Aviation accounts for<br />

nearly half a million jobs but also<br />

generates close to EUR 100 billion in<br />

revenues. Equally important is the<br />

sector’s added benefit of connectivity –<br />

serving more than 25 000 airport pairs<br />

that are not connected by non-stop<br />

commercial flights. By offering seamless<br />

service to distant and remote regions<br />

across Europe, Business Aviation offers<br />

greater access to destinations that do<br />

not have the benefit of a commercial<br />

hub to sustain local business activity.<br />

With this in mind, it is now up to the<br />

European Commission to ensure that it<br />

also includes measures in its Aviation<br />

Strategy that help the sector to continue<br />

its positive contributions to regional<br />

economies.<br />

Advancing the perception<br />

of Business Aviation<br />

Alongside the Secretariat’s efforts to<br />

raise awareness of the economic<br />

benefits of Business Aviation, EBAA will<br />

also continue to tackle the issue of<br />

perception. It is no secret that public<br />

opinion of Business Aviation has also<br />

proved to be a challenge for the sector –<br />

often being associated with high costs<br />

and elitism. In 2015, the EBAA decided<br />

to conduct a formal study that helped<br />

the Secretariat to get behind the core<br />

issues influencing public perception and<br />

to identify opportunities to advance<br />

those perceptions. The findings of the<br />

study have shown that:<br />

❍ The more educated stakeholders are<br />

about Business Aviation, the better their<br />

perception of the sector<br />

❍ Stakeholders value Bizav as a<br />

necessary and useful tool but struggle<br />

with its perceived elitism and high costs<br />

❍ Stakeholders attribute a low<br />

performance to the sector on the<br />

environmental and economic fronts<br />

Over the course of <strong>2016</strong>, EBAA will work<br />

with partners in the industry to carve<br />

out specific programs and initiatives that<br />

address these three fronts.<br />

In summary, <strong>2016</strong> will be an exciting<br />

year for the air transport industry, and<br />

Business Aviation in particular.<br />

Fortunately, we have the tools in place<br />

to help us make a real difference. That is<br />

the aim.<br />

ALT<br />

You asked. We acted.<br />

Business aircraft operators have always wanted<br />

the best in safety and efficiency. It was no different<br />

in the 1960s. As new cockpit and system technology<br />

emerged, those who had purchased Bonanzas,<br />

King Airs, Barons and even Learjets without it were<br />

interested in having their aircraft upgraded. Donald<br />

Duncan operated Duncan Aviation, an aircraft sales<br />

and support facility in Lincoln, Nebraska. He listened<br />

to their wishes. And in 1966, he acted by hiring Don<br />

Fiedler, an electronics engineer, as the company’s 17th<br />

employee. His job was to install and repair avionics<br />

equipment for a variety of business aircraft.<br />

Decades later, Duncan Aviation is still providing<br />

operators with the best in avionics and instrument repair<br />

and avionics upgrades. And we still take our founder’s<br />

cue. We listen to customer wishes and respond by<br />

developing and providing experience, unlike any other.<br />

www.DuncanAviation.aero/60<br />

✈<br />

Experience. Unlike any other.

TRANSATLANTIC<br />

U.S.A. ON OUR RADAR THIS MONTH<br />

NBAA HELPS REPRESENT<br />

INDUSTRY CONCERNS AS EASA WORKS<br />

TO HARMONIZE PROCESSES<br />

From the Desk of<br />

Ed Bolen NBAA<br />

President and CEO<br />

28 - BART: MARCH - APRIL <strong>2016</strong><br />

THROUGHOUT <strong>2016</strong>, NBAA will<br />

continue working, alongside the<br />

European Business Aviation Association<br />

(EBAA) and other stakeholder groups,<br />

before the European Aviation Safety<br />

Agency (EASA) and other regulatory<br />

agencies to ensure that business<br />

aviation operators continue to operate<br />

safely and efficiently – and under a<br />

regulatory regime that is as workable<br />

as possible – when traveling in the<br />

European Union (EU). As always, part<br />

of our work in this area also includes<br />

educating member companies with<br />

NBAA and other associations about the<br />

latest European operating<br />

requirements and procedures.<br />

For example, beginning in late<br />

November of this year, Part 135 air<br />

carrier operators planning to fly into the<br />

EU and its related territories will need<br />

prior authorization through the new<br />

EASA Third-Country Operator (TCO)<br />

program intended to enhance safety,<br />

and reduce foreign operators'<br />

administrative requirements when flying<br />

to multiple European countries.<br />

A couple of issues that initially<br />

concerned business aircraft operators<br />

about TCO have been resolved. One<br />

potential issue involved requirements<br />

issued by the U.S. Federal Aviation<br />

Administration (FAA) for flight data<br />

recorders (FDR), which are different<br />

from EASA's requirements. NBAA also<br />

expressed concern that EASA safety<br />

management system (SMS) stipulations<br />

in that process were more restrictive,<br />

perhaps unduly so, than the FAA's<br />

requirement, which only applies to Part<br />

121 air carriers and not to business<br />

aircraft.<br />

Already in effect, as of Dec. 1, 2015, is<br />

an EASA requirement that all aircraft<br />

above 5,700 kilograms (12,500 pounds)<br />

maximum certified takeoff mass<br />

(MCTM) be equipped with Airborne<br />

Collision Avoidance System II (ACAS)<br />

version 7.1.<br />

Understandably, these issues raised<br />

concerns that non-European operators<br />

could be flagged for noncompliance with<br />

these dictates during Safety Assessment<br />

of Foreign Aircraft (SAFA) inspections.<br />

Because the TCO requirements are<br />

based on International Civil Aviation<br />

Organization (ICAO) standards – and<br />

there are some key differences between<br />

ICAO and FAA regulations, such as SMS<br />

implementation – some U.S. operators<br />

have raised concerns that are being<br />

addressed by NBAA.<br />

These discussions have already resulted<br />

in reasonable compromises. For<br />

example, EASA told TCO applicants in<br />

December 2015, "after analysis of the

prevailing FDR equipage situation<br />

worldwide, taking due<br />

consideration of corresponding EU<br />

regulations, the problem size, the<br />

direct effects on the safe conduct<br />

of flight, as well as technical<br />

feasibility and economic impact of<br />

retrofit, for the purpose of TCO<br />

authorization EASA will not require<br />

third-country operators to change<br />

their existing FDR equipment in<br />

order to establish compliance ...<br />

and will accept already-installed<br />

FDR equipment on aircraft with an<br />

individual certificate of<br />

airworthiness first issued before 26<br />

November <strong>2016</strong>."<br />

That said, compliance with EASA's<br />

application of ICAO Annex 6 flight<br />

data analysis program<br />

requirements, "remains fully<br />

applicable for the purpose of TCO<br />

authorization" for all aircraft in<br />

excess of 27,000 kilograms (60,000<br />

pounds) MCTM, which has been a<br />

requirement for EU-registered<br />

aircraft since October 2014.<br />

Commercial and non-commercial<br />

business aircraft operators should<br />

also be prepared for random ramp<br />

inspections, which may include a<br />

check to make sure their traffic<br />

alert and collision avoidance<br />

system (TCAS) meets the new 7.1<br />

standard.<br />

As EASA works to better harmonize<br />

safety regulations across Europe,<br />

the agency aims to replace<br />

sometimes-inconsistent schemes of<br />

individual states with a more<br />

centralized and ideally<br />

performance- and risk-based<br />

approach.<br />

New requirements for TCO, ACAS<br />

7.1, SMS, and other rules for noncommercial<br />

operators are just a few<br />

of the effects on business aviation<br />

from Europe's evolving aviation<br />

regulations. NBAA will remain<br />

actively engaged in this process to<br />